BP 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

BP Annual Report and Accounts 2009

Business review

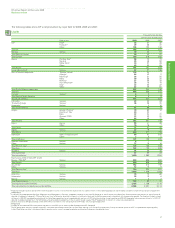

Refining and Marketing

Our Refining and Marketing business is responsible for the supply and

trading, refining, manufacturing, marketing and transportation of crude

oil, petroleum, petrochemicals products and related services to

wholesale and retail customers. BP markets its products in more than

80 countries. We have significant operations in Europe and North

America and also manufacture and market our products across

Australasia, in China and other parts of Asia, Africa and Central and

South America.

Our organization is managed through two main business

groupings: fuels value chains (FVCs) and international businesses (IBs).

The FVCs integrate the activities of refining, logistics, marketing, supply

and trading, on a regional basis, recognizing the geographic nature of the

markets in which we compete. This provides the opportunity to optimize

our activities from crude oil purchases to end-consumer sales through our

physical assets (refineries, terminals, pipelines and retail stations). The

IBs include the manufacturing, supply and marketing of lubricants,

petrochemicals, aviation fuels and liquefied petroleum gas (LPG).

Our market

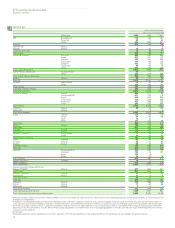

The 2009 operating environment was again challenging. Global oil

demand contracted by approximately 1.3 million barrels per day with

demand in the OECD falling for the fourth consecutive year. Crude oil

prices more than doubled during the course of the year, from a dated

Brent price of $36.55 per barrel on 1 January 2009 to $77.67 per barrel at

the end of 2009, contributing to margin volatility.

Refining margins fell sharply in 2009 as demand for oil products

reduced in the wake of the global economic recession and new refining

capacity came onstream, mostly in Asia. During 2009, distillate

inventories were consistently above the top of the range of the past five

years. Gasoline inventories grew steadily and were generally at or slightly

above the average level of the past five years. As a result, the BP global

indicator refining margin (GIM) averaged $4 per barrel in 2009, down

$2.50 per barrel compared with 2008, with the average for the fourth-

quarter of 2009 at only $1.49 per barrel, the lowest for almost 15 years.

This margin decline had a significant adverse impact on the financial

performance of the segment.

In Europe, where diesel accounts for a large proportion of regional

demand, refining margins were hit by reduced demand from commercial

transport because of the economic recession. In the US, where refining is

more highly upgraded and the transport market is more gasoline oriented,

margins deteriorated less. Refining margins in Asia Pacific were the

hardest hit due to substantial additions to refining capacity in the region.

During 2009, upgrading margins were particularly poor due to

stronger relative fuel oil prices and narrow light-heavy crude spreads. This

adversely impacted our highly upgraded refineries and had an adverse

impact on our financial performance in 2009 compared with 2008.

The end of 2008 and the first quarter of 2009 saw unprecedented

levels of market volatility, driven by turmoil in the financial sector and

disruptions in the supply chain resulting from the economic downturn.

This high level of volatility, combined with our proprietary asset base and

trading skills, enabled us to deliver a particularly strong supply and trading

result in the first quarter of 2009. Subsequent to the first quarter,

volatility returned to more normal levels.

In our IBs, we saw a decline in demand for lubricants due to the

financial crisis. During the year we saw a partial recovery in the demand

for our petrochemicals products.

Our strategy

Our purpose is to be the product- and service-led arm of BP, focused on

fuels, lubricants, petrochemicals products and related services. We aim

to be excellent in the markets we choose to be in – those that allow BP

to serve the major energy markets of the world. We are in pursuit of

competitive returns and enduring growth, as we serve customers and

promote BP and our brands through quality products.

We believe that key to our continued success in Refining and

Marketing is holding a portfolio of quality, integrated, efficient positions

and accessing available market growth in emerging markets. We intend

to do this through holding positions in advantaged integrated FVCs where

we will invest to strengthen our established positions. We also intend to

retain and grow our IBs.

In 2007, we identified that the segment’s financial performance

lagged that of our competitors, based on our analysis of our position

compared with our supermajor peers, and we launched a programme to

restore our financial performance. Our objective was to restore our

performance over a period of three to four years by focusing on achieving

safe, reliable and compliant operations, restoring missing revenues and

delivering sustainable competitive returns and cash flows.

We believe our overall performance has now returned to being

competitive with our supermajor peers, but that there is significant

potential for further performance improvements. In the future, we intend

to build on this by focusing on further improvements in operations, asset

quality and overall efficiency, in order to be a leading player in each of the

markets in which we choose to participate.

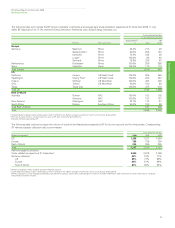

Our performance

Our 2009 performance has benefited from the fundamental

improvements we have been making across the business, including the

measures we have taken to restore the availability of our refining system,

reduce costs and simplify the organization. The replacement cost profit

before interest and tax was $0.7 billion for 2009, compared with

$4.2 billion in 2008. The result was heavily impacted by non-operating

items, which included a significant level of restructuring charges and a

$1.6 billion one-off charge to write off all the segment’s goodwill in the

US West Coast FVC relating to our 2000 ARCO acquisition. This resulted

from our annual review of goodwill as required under IFRS and reflects

the prevailing weak refining environment that, together with a review of

future margin expectations in the FVC, has led to a reduction in the

expected future cash flows. The decrease in profit was also driven by the

very significantly weaker environment, where refining margins fell by

almost 40%. This was partly offset by significantly stronger operational

performance in the fuels value chains, with 93.6% Solomon refining

availability, lower costs and improved performance in the international

businesses. Our financial results are discussed in more detail on

pages 56-57.

Safety, both process and personal, remains our top priority. During

2009, we continued the migration to the BP operating management

system (OMS) with a continuing focus on process safety. The OMS is

described in further detail in Safety (see page 46). At the end of 2009, all

our operated refineries and petrochemicals plants were using the OMS.

Within our US refineries, we continued to implement the

recommendations of the BP US Refineries Independent Safety Review

Panel and regulatory bodies (further information can be found in Safety

on page 46 and in Legal proceedings on page 99). The focus on

operational integrity continues to yield positive results across the

segment. Since 2005, when we started identifying incidents by type, we

have reduced the overall number of major incidents by 90%. None of the

major incidents reported in 2009 was integrity-management related. We

have also reduced the number of reported oil spills and the recordable

injury frequency in our workforce to the lowest level for 10 years. In

2009, there were no reported workforce fatalities associated with our

refining and marketing operations.