BP 2009 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

t

A

BP Annual Report and Accounts 2009

Business review

Business review

Business review

We continually seek to access resources and in 2009 this included Iraq,

where, together with China National Petroleum Corporation (CNPC), we

entered into a contract with the state-owned South Oil Company (SOC)

to expand production from the Rumaila field; Jordan, where on 3 January

2010, we received approval from the Government of Jordan to join the

state-owned National Petroleum Company (NPC) to exploit the onshore

Risha concession in the north east of the country; further access in

Egypt, where we were awarded two blocks in an offshore area of the

Nile Delta; Indonesia, where we signed a production-sharing agreement

(PSA) for the exploration and development of coalbed methane in the

Sanga-Sanga block, supplying gas to Indonesia’s largest LNG export

facility and, subject to Government of Indonesia approval, farmed into

Chevron’s West Papua I & III blocks; and the Gulf of Mexico, where we

were awarded 61 blocks through the Outer Continental Shelf Lease Sales

208 and 210.

In 2009, we were involved in a number of discoveries. The most

significant of these were in the deepwater Gulf of Mexico with the Tiber

well; Angola, where we made three further discoveries in the ultra

deepwater Block 31; and Canada, where we discovered natural gas with

the Ellice J27 well.

Seven major projects came onstream. We continue to grow our

position and leverage our experience as the largest producer in the Gulf

of Mexico, starting up three projects ahead of schedule, including the

second phase of Atlantis. In addition, production commenced at our

Savonette field in Trinidad, at our Tangguh LNG project in Indonesia and,

through TNK-BP, we saw the start-up of a further two projects, in the

northern hub of Kamennoye, and the Urna and Ust-Tegus fields in the

Uvat area.

Production from our established centres – including the North

Sea, Alaska, North America Gas and Trinidad – was on plan, with

improved operating efficiency for the segment as a whole, and we had

strong production growth in the Gulf of Mexico, including excellent

performance from Thunder Horse. Production from Egypt and TNK-BP

also made a strong contribution to our growth.

Production for the year was up more than 4% from last year. After

adjusting for the effect of entitlement changes in our PSAs and the effect

of OPEC quota restrictions, underlying production growthawas 5%

higher than 2008.

aUnderlying production growth excludes the effect of entitlement changes in our PSAs (driven by

changes in oil and gas prices) and the effect of OPEC quota restrictions.

We also reduced unit production costs through a combination of high-

grading activity, improving execution efficiency, capturing the benefits

of the deflationary cost environment at the beginning of the year and

favourable foreign exchange effects. During 2009 we improved the

quality of our procurement and supply chain management organization,

systems and processes, which we expect will help deliver sustained cos

efficiency in the future.

The replacement cost profit before interest and tax was

$24.8 billion, a 35% decrease compared with the record level in 2008.

This result was primarily driven by lower oil and gas realizations, lower

income from equity-accounted entities and higher depreciation, partly

offset by strong underlying production growth and improved cost

management, which contributed to a 12% reduction in unit production

costs. Our financial results are discussed in more detail on pages 55-56.

Total capital expenditure including acquisitions and asset

exchanges in 2009 was $14.9 billion (2008 $22.2 billion and 2007

$14.2 billion). In 2009, capital expenditure included $306 million relating

to the award of the contract to redevelop the Rumaila field in Iraq.

Development expenditure of subsidiaries incurred in 2009,

excluding midstream activities, was $10,396 million, compared with

$11,767 million in 2008 and $10,153 million in 2007.

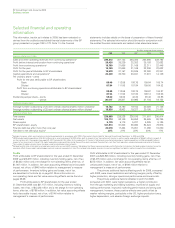

Key statistics

$ million

2009 2008 2007

Sales and other operating revenuesa57,626 86,170 65,740

Replacement cost profit before

interest and taxb24,800 38,308 27,602

Total assets 140,149 136,665 125,736

Capital expenditure and acquisitions 14,896 22,227 14,207

$ per barrel

Average BP liquids realizationsc d 56.26 90.20 67.45

$ per thousand cubic feet

verage BP natural gas realizationsc3.25 6.00 4.53

aIncludes sales between businesses.

bIncludes profit after interest and tax of equity-accounted entities.

cRealizations are based on sales of consolidated subsidiaries only, which excludes equity-accounted

entities.

dCrude oil and natural gas liquids.

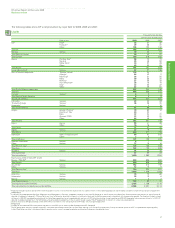

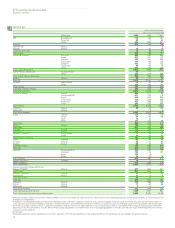

The table below presents our average sales price per unit of production.

$ per unit of productiona

Europe North South Africa Asia Australasia Total group

America America average

Rest of

Rest of North Rest of

UK Europe US America Russia Asia

Average sales priceb

2009

Liquidsc62.19 60.73 53.68 30.77 52.48 57.40 – 61.27 57.22 56.26

Gas 4.68 7.62 3.07 3.53 2.50 3.61 – 3.30 5.25 3.25

2008

Liquidsc89.82 93.77 89.22 64.42 91.61 89.44 – 97.20 86.33 90.20

Gas 8.41 6.96 6.77 7.87 4.90 4.46 – 3.63 9.22 6.00

2007

Liquidsc69.17 70.41 64.18 48.24 65.54 67.81 – 73.00 70.56 67.45

Gas 6.40 5.84 5.43 6.24 3.25 3.93 – 3.05 5.96 4.53

aUnits of production are barrels for liquids and thousands of cubic feet for gas.

bRealizations are based on sales of consolidated subsidiaries only (including transfers between businesses), which excludes equity-accounted entities.

cCrude oil and natural gas liquids.

23