BP 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

BP Annual Report and Accounts 2009

Board performance and biographies

Delegation

Ernst & Young

Internal audit

Finance function

General counsel

External market

and reputation

research

Independent expert

Accountability

• BP goal

• Governance process

• Delegation model

• Executive limitations

Delegation

Accountability

GCE’s delegations

Group chief executive

Monitoring,

Information and

Assurance

Safety & Operations

function

Delegation of authority

Group compliance through policy with

offi cer monitoring

Assurance through

Independent advice monitoring and reporting

Executive management

(if requested)

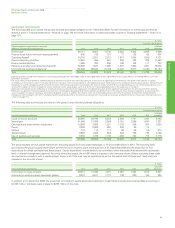

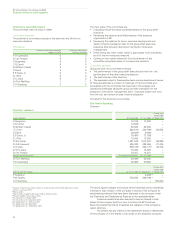

BP Board Governance

Principles

RCM GPC GDC GFRC GORC

Resource Group people Group Group Group

commitments committee disclosures financial risk operations risk

meeting committee committee committee

Owners/shareholders

Board

Chairman’s Audit

Nomination Remuneration committee committee

committee committee

BP governance framework

Nomination Remuneration Chairman’s SEEAC Audit

committee committee committee committee

Annual plan / Group risks / Strategy

GCE update and business reviews

The group chief executive provides a written report to each meeting of

the board which gives an update on key issues relating to safety and

integrity, operations, financial performance and the market in which

BP’s businesses operate. These are complemented by verbal updates

given by executive directors on material matters which have arisen in

their business.

Periodic reviews of the business are scheduled throughout the

year. During 2009, reviews were held with both segments (Exploration

and Production and Refining and Marketing) and with Alternative Energy.

Country specific reports

Separate to the business specific reports, the board discussed the

performance, political landscape and market outlook relating to BP’s

operations, particularly in the US and Russia.

Functional reviews

The work of the group technology function was reviewed and discussions

were held on issues relating to information technology and services.

Financial and corporate reporting

The board considered the group’s statutory reports and the broader

aspects of corporate reporting. It also received regular updates on the

group’s financial outlook as well as discussing the financial results.

An annual review of the group’s process for sanctioning capital

investment is undertaken by the board. This includes examining case

studies of BP projects with different levels of complexity and

understanding the effectiveness of project delivery against original

sanction.

Other matters

Other matters discussed by the board included the BP brand and

corporate advertising, the results of the group-wide employee

satisfaction survey and an annual report evaluating BP’s external

reputation in the UK and US.

The board also received a presentation from the independent expert

appointed to provide an objective assessment of the BP US Refineries

Independent Safety Review Panel (the panel). Further details on the

activities of the independent expert are outlined in the report of the

safety, ethics and environment assurance committee below.

Risk management and internal control

The board and its committees monitor the identification and

management of the group’s risks and the board reviews how group-level

risks and their mitigations are embedded in the c ompany’s annual plan.

Geopolitical and reputational risks are considered by all the board which

also receives reports from the committees to whom specific risk

oversight has been allocated. The audit committee monitors financial risk

whilst the safety, ethics and environment assurance committee (SEEAC)

monitors non-financial risk; the audit committee and SEEAC hold an

annual joint meeting to assess the effectiveness of the company’s

internal controls and risk management. Like BP’s other board

committees, the audit committee and SEEAC are composed entirely

of independent non-executive directors.

The audit committee and SEEAC maintain a forward-looking

approach to risk exposure. A high level work programme for the board

and its committees is set on the basis of an agenda that reflects the

board’s core tasks and the key group risks.

The group chief executive and his senior team are supported by

executive-level sub-committees which monitor specific group risks: these

committees comprise the group operations risk committee (GORC), the

group financial risk committee (GFRC), the group people committee

(GPC), the resource commitments meeting (RCM) and the group

disclosures committee (GDC). They provide input and data to the risk

oversight process by the executive, as well as external and internal audit,

the group’s compliance and ethics officer, safety and operations audit

and group controls.

Further information about our internal control systems is set out

on pages 20, 74 and 105.