BP 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212

|

|

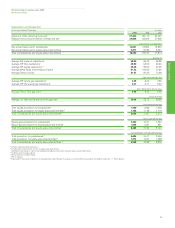

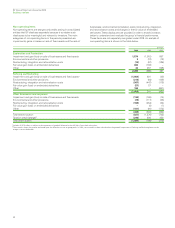

Non-operating items

Non-operating items are charges and credits arising in consolidated

entities that BP discloses separately because it considers such

disclosures to be meaningful and relevant to investors. The main

categories of non-operating items in the periods presented are:

impairments; gains or losses on sale of fixed assets and the sale of

businesses; environmental remediation costs; restructuring, integration

and rationalization costs; and changes in the fair value of embedded

derivatives. These disclosures are provided in order to enable investors

better to understand and evaluate the group’s financial performance.

These items are not separately recognized under IFRS. An analysis of

non-operating items is shown in the table below.

BP Annual Report and Accounts 2009

Business review

$ million

2009 2008 2007

Exploration and Production

Impairment and gain (loss) on sale of businesses and fixed assets 1,574 (1,015) 857

Environmental and other provisions 3(12) (12)

Restructuring, integration and rationalization costs (10) (57) (186)

Fair value gain (loss) on embedded derivatives 664 (163) –

Other 34 257 (168)

2,265 (990) 491

Refining and Marketing

Impairment and gain (loss) on sale of businesses and fixed assetsa(1,604) 801 (35)

Environmental and other provisions (219) (64) (138)

Restructuring, integration and rationalization costs (907) (447) (118)

Fair value gain (loss) on embedded derivatives (57) 57 –

Other 184 – (661)

(2,603) 347 (952)

Other businesses and corporate

Impairment and gain (loss) on sale of businesses and fixed assets (130) (166) (14)

Environmental and other provisions (75) (117) (35)

Restructuring, integration and rationalization costs (183) (254) (34)

Fair value gain (loss) on embedded derivatives –(5) (7)

Other (101) (91) (172)

(489) (633) (262)

Total before taxation (827) (1,276) (723)

Taxation credit (charge)b(240) 480 350

Total after taxation (1,067) (796) (373)

aIncludes $1,579 million in relation to the impairment of goodwill allocated to the US West Coast fuels value chain.

bThe amounts shown for taxation are based upon the effective tax rate on group profit. In 2009, no tax credit has been calculated on the goodwill impairment in Refining and Marketing because the

charge is not tax deductible.

58