BP 2009 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review

Performance

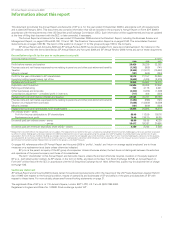

Production (thousand barrels of oil equivalent per day)

We report crude oil, natural gas liquids

(NGLs) and natural gas produced from

subsidiaries and equity-accounted

entities. These are converted to barrels

of oil equivalent (boe) at 1 barrel of

NGL = 1boe and 5,800 standard

cubic feet of natural gas = 1boe.

Reported production increased

by 4% compared with 2008. This

refl ected strong performance from

our existing assets, the continued

ramp-up of production following the

start-up of major projects in 2008 and

the start-up of a further seven major

projects in 2009.

4,250

4,000

3,750

3,500

3,818

2007

3,838

2008

3,998

2009

3,250

Reserves replacement ratioa b (%)

Proved reserves replacement ratio (also

known as the production replacement

ratio) is the extent to which production

is replaced by proved reserves additions.

The ratio is expressed in oil equivalent

terms and includes changes resulting

from revisions to previous estimates,

improved recovery and extensions,

and discoveries.

In 2009 we extended our track

record for reported reserves

replacement of more than 100% to

17 consecutive years. We continue

to drive renewal through new access,

exploration, targeted acquisitions and a

strategic focus on increasing resources

from fi elds we currently operate.

30

112

2007

121

2008

129

2009

150

120

90

60

a Combined basis of subsidiaries and

equity-accounted entities, excluding

acquisitions and disposals.

b See footnote f on page 27.

Refi ning availability (%)

Refi ning availability represents Solomon

Associates’ operational availability, which

is defi ned as the percentage of the year

that a unit is available for processing after

subtracting the annualized time lost due

to turnaround activity and all planned

mechanical, process and regulatory

maintenance downtime.

Refi ning availability has increased

signifi cantly each year from 2007 to

2009 and is now at the highest level

since 2005. This has been a key

element in our drive to restore missing

revenues in our operations, with the

biggest contributor being the restoration

of our Texas City refi nery.

20

82.9

2007

88.8

2008

93.6

2009

100

80

60

40

Operating cash fl ow ($ billion)

Operating cash fl ow is net cash

fl ow provided by operating activities,

from the group cash fl ow statement.

Operating activities are the principal

revenue-generating activities of the

group and other activities that are

not investing or fi nancing activities.

Lower operating cash fl ow in

2009 primarily refl ected lower group

profi ts, movements in working capital

and a decrease in dividends from jointly

controlled entities and associates.

These effects were partly offset by

decreases in income taxes paid.

10

24.7

2007

38.1

2008

27.7

2009

50

40

30

20

Replacement cost profi t per ordinary share (cents)

Replacement cost profi t refl ects the

replacement cost of supplies. It is

arrived at by excluding from profi t

inventory holding gains and losses

and their associated tax effect.

(See footnote a on page 1.)

Our 2009 results were impacted

by lower oil and gas realizations and

lower refi ning margins, partly offset by

higher production, stronger operational

performance and lower costs.

40

95.85

2007

136.20

2008

74.49

2009

200

160

120

80

Dividends paid per ordinary share

This measure shows the total dividend

per share paid to ordinary shareholders

in the year.

The total dividend paid per share in

2009 increased by 2% compared with

2008. We determine the dividend in US

dollars as it is the economic currency of

BP. In sterling terms, our 2009 dividend

was 24% higher than in 2008 due to

the strengthening of the dollar relative

to sterling.

9

Cents

Pence

15

42.30

2007

20.995

2007

55.05

2008

29.387

2008

56.00

2009

36.417

2009

75

60

45

30

Total shareholder return represents

the change in value of a shareholding

over a calendar year, assuming that

dividends are re-invested to purchase

additional shares at the closing price

applicable on the ex-dividend date.

Total shareholder return scores

in 2009 refl ect BP’s improving

competitive performance as well

as a general recovery of global stock

markets compared with the low

levels seen at the end of 2008.

Total shareholder returna (%)

-20

2007 2007

2008

-34.6

2008

-15.1

2009 2009

40

20

60

0

ADS basis

Ordinary share basis

6.8 33.0 27.6

14.1

a

There is a small change in comparative data

due to the exclusion of non-trading days from

the average TSR calculation.