BP 2009 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2009

Notes on financial statements

Financial statements

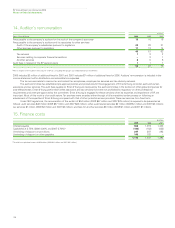

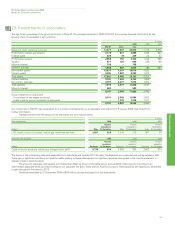

23. Investments in associates

–

143

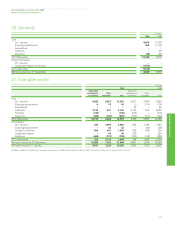

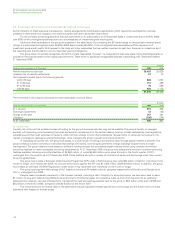

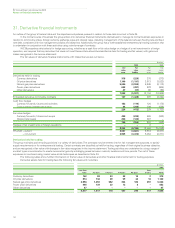

The significant associates of the group are shown in Note 43. The principal associate in 2009 is TNK-BP. Summarized financial information for the

group’s share of associates is set out below.

$ million

2009 2008 2007

TNK-BP Other Total

Sales and other operating revenues 17,377 8,301 25,678 11,709 9,855

Profit before interest and taxation 3,178 811 3,989 1,065 947

Finance costs 220 19 239 33 57

Profit before taxation 2,958 792 3,750 1,032 890

Taxation 871 125 996 234 193

Minority interest 139 – 139 –

Profit for the year 1,948 667 2,615 798 697

Non-current assets 13,437 4,573 18,010 4,292

Current assets 4,205 1,887 6,092 1,912

Total assets 17,642 6,460 24,102 6,204

Current liabilities 3,122 1,640 4,762 1,669

Non-current liabilities 4,797 2,277 7,074 1,852

Total liabilities 7,919 3,917 11,836 3,521

Minority interest 582 – 582 –

9,141 2,543 11,684 2,683

Group investment in associates

Group share of net assets (as above) 9,141 2,543 11,684 2,683

Loans made by group companies to associates – 1,279 1,279 1,317

9,141 3,822 12,963 4,000

Our investment in TNK-BP was reclassified from a jointly controlled entity to an associate with effect from 9 January 2009. See Note 22 for

further information.

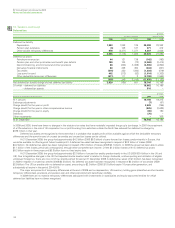

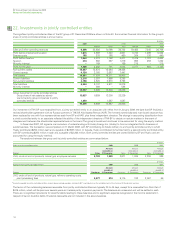

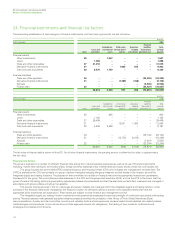

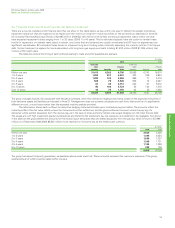

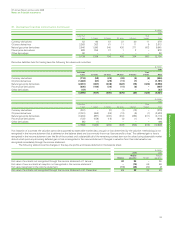

Transactions between the group and its associates are summarized below.

$ million

Sales to associates 2009 2008 2007

Amount Amount Amount

receivable at receivable at receivable at

Product Sales 31 December Sales 31 December Sales 31 December

LNG, crude oil and oil products, natural gas, employee services 2,801 320 3,248 219 697 60

Purchases from associates 2009 2008 2007

Amount Amount Amount

payable at payable at payable at

Product Purchases 31 December Purchases 31 December Purchases 31 December

Crude oil and oil products, natural gas, transportation tariff 5,110 614 4,635 295 2,905 574

The terms of the outstanding balances receivable from associates are typically 30 to 45 days. The balances are unsecured and will be settled in cash.

There are no significant provisions for doubtful debts relating to these balances and no significant expense recognized in the income statement in

respect of bad or doubtful debts.

The amounts receivable and payable at 31 December 2009, as shown in the table above, exclude $376 million due from and due to an

intermediate associate which provides funding for our associate The Baku-Tbilisi-Ceyhan Pipeline Company. These balances are expected to be settled

in cash throughout the period to 2015.

Dividends receivable at 31 December 2009 of $19 million are also excluded from the table above.