BP 2009 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2009

Notes on financial statements

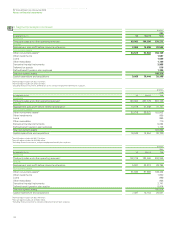

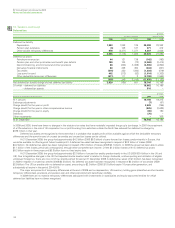

4. Segmental analysis continued

128

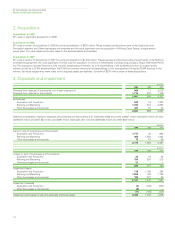

$ million

2008

Other Consolidation

Exploration Refining businesses adjustment

and and and and Total

By business Production Marketing corporate eliminations group

Segment revenues

Sales and other operating revenues 86,170 320,039 4,634 (49,700) 361,143

Less: sales between businesses (45,931) (1,918) (1,851) 49,700 –

Third party sales and other operating revenues 40,239 318,121 2,783 – 361,143

Equity-accounted earnings 3,565 131 125 – 3,821

Interest revenues 114 35 220 – 369

Segment results

Replacement cost profit (loss) before interest and taxation 38,308 4,176 (1,223) 466 41,727

Inventory holding lossesa(393) (6,060) (35) – (6,488)

Profit (loss) before interest and taxation 37,915 (1,884) (1,258) 466 35,239

Finance costs (1,547)

Net finance income relating to pensions and other post-retirement benefits 591

Profit before taxation 34,283

Other income statement items

Depreciation, depletion and amortization 8,440 2,208 337 – 10,985

Impairment losses 1,186 159 227 – 1,572

Impairment reversals 155 – – – 155

Fair value (gain) loss on embedded derivatives 163 (57) 5 – 111

Charges for provisions, net of write-back of unused provisions 573 479 657 – 1,709

Segment assets

Segment assets 136,665 75,329 19,079 (3,212) 227,861

Current tax receivable 377

Total assets 228,238

Includes

Equity-accounted investments 20,131 6,622 1,073 – 27,826

Additions to non-current assets 21,584 6,636 1,802 – 30,022

Additions to other investments 52

Element of acquisitions not related to non-current assets 11

Additions to decommissioning asset 615

Capital expenditure and acquisitions 22,227 6,634 1,839 – 30,700

aInventory holding gains and losses represent the difference between the cost of sales calculated using the average cost to BP of supplies incurred during the period and the cost of sales calculated on

the first-in first-out (FIFO) method including any changes in provisions where the net realizable value of the inventory is lower than its cost. Under the FIFO method, which we use for IFRS reporting, the

cost of inventory charged to the income statement is based on the historic cost of acquisition or manufacture rather than the current replacement cost. In volatile energy markets, this can have a

significant distorting effect on reported income. The amounts disclosed represent the difference between the charge to the income statement on a FIFO basis (and any related movements in net

realizable value provisions) and the charge that would arise using average cost of supplies incurred during the period. For this purpose, average cost of supplies incurred during the period is calculated by

dividing the total cost of inventory purchased in the period by the number of barrels acquired. The amounts disclosed are not separately reflected in the financial statements as a gain or loss. No

adjustment is made in respect of the cost of inventories held as part of a trading position and certain other temporary inventory positions.