BP 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

BP Annual Report and Accounts 2009

Business review

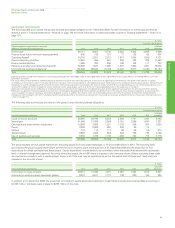

Environmental expenditure

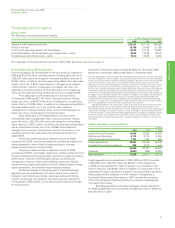

$ million

2009 2008 2007

Operating expenditure 701 755 662

Clean-ups 70 64 62

Capital expenditure 955 1,104 1,033

Additions to environmental remediation provision 588 270 373

Additions to decommissioning provision 169 327 1,163

Operating and capital expenditure on the prevention, control, abatement

or elimination of air, water and solid waste pollution is often not incurred

as a separately identifiable transaction. Instead, it may form part of a

larger transaction that includes, for example, normal maintenance

expenditure. The figures for environmental operating and capital

expenditure in the table are therefore estimates, based on the definitions

and guidelines of the American Petroleum Institute.

Environmental operating expenditure of $701 million in 2009

was lower than in 2008, due to a reduction in new projects undertaken.

In addition, there was a significant reduction in the sulphur oil premium

paid due to a greater use of low-sulphur fuel.

Environmental operating expenditure of $755 million in 2008 was

higher than in 2007 and reflected continuing integrity management

activity. There were no individually significant factors driving the increase.

Similar levels of operating and capital expenditures are expected

in the foreseeable future. In addition to operating and capital

expenditures, we also create provisions for future environmental

remediation. Expenditure against such provisions normally occurs in

subsequent periods and is not included in environmental operating

expenditure reported for such periods. The charge for environmental

remediation provisions in 2009 included $582 million resulting from a

reassessment of existing site obligations and $6 million in respect of

provisions for new sites.

Provisions for environmental remediation are recognized when

a clean-up is probable and the amount of the obligation can be reliably

estimated. Generally, this coincides with the commitment to a formal

plan of action or, if earlier, on divestment or on closure of inactive sites.

The extent and cost of future environmental restoration, remediation and

abatement programmes are inherently difficult to estimate. They often

depend on the extent of contamination, and the associated impact and

timing of the corrective actions required, technological feasibility and

BP’s share of liability. Though the costs of future programmes could be

significant and may be material to the results of operations in the period

in which they are recognized, it is not expected that such costs will be

material to the group’s overall results of operations or financial position.

In addition, we recognize provisions on installation of our oil- and

gas-producing assets and related pipelines to meet the cost of eventual

decommissioning. On installation of an oil or natural gas production

facility a provision is established that represents the discounted value of

the expected future cost of decommissioning the asset. Additionally, we

undertake periodic reviews of existing provisions. These reviews take

account of revised cost assumptions, changes in decommissioning

requirements and any technological developments. The level of increase

in the decommissioning provision varies with the number of new fields

coming onstream in a particular year and the outcome of the periodic

reviews.

Provisions for environmental remediation and decommissioning

are usually recognized on a discounted basis, as required by IAS 37

‘Provisions, Contingent Liabilities and Contingent Assets’.

Further details of decommissioning and environmental provisions

appear in Financial statements – Note 34 on page 160. See also

Environment on pages 47-49.