BP 2009 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2009

Parent company financial statements of BP p.l.c.

Financial statements

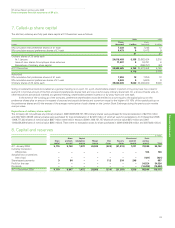

11. Share-based payments

205

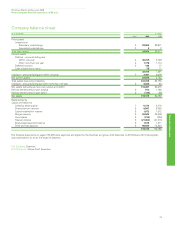

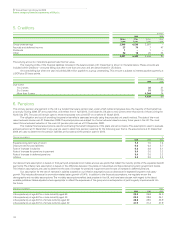

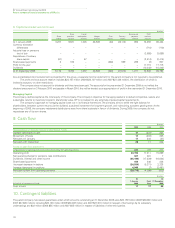

Effect of share-based payment transactions on the company’s result and financial position

$ million

2009 2008 2007

Total expense recognized for equity-settled share-based payment transactions 506 524 412

Total expense (credit) recognized for cash-settled share-based payment transactions 15 (16) 16

Total expense recognized for share-based payment transactions 521 508 428

Closing balance of liability for cash-settled share-based payment transactions 32 21 40

Total intrinsic value for vested cash-settled share-based payments 72 22

For ease of presentation, option and share holdings detailed in the tables within this note are stated as UK ordinary share equivalents in US dollars.

US employees are granted American Depositary Shares (ADSs) or options over the company’s ADSs (one ADS is equivalent to six ordinary shares).

The share-based payment plans that existed during the year are detailed below. All plans are ongoing unless otherwise stated.

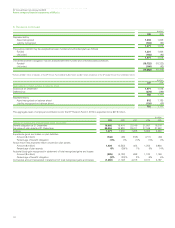

Plans for executive directors

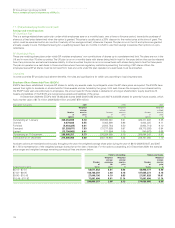

Executive Directors’ Incentive Plan (EDIP) – share element

An equity-settled incentive plan for executive directors with a three-year performance period. For share plan performance periods 2007-2009 and

2008-2010 the award of shares is determined by comparing BP’s total shareholder return (TSR) against the other oil majors (ExxonMobil, Shell, Total

and Chevron). For the performance period 2009-2011 the award of shares is determined 50% on TSR versus a competitor group of oil majors (which in

this period also included ConocoPhillips) and 50% on a balanced scorecard (BSC) of three underlying performance measures versus the same

competitor group. After the performance period, the shares that vest (net of tax) are then subject to a three-year retention period. The directors’

remuneration report on pages 81 to 92 includes full details of the plan.

Executive Directors’ Incentive Plan (EDIP) – share option element

An equity-settled share option plan for executive directors that permits options to be granted at an exercise price no lower than the market price of a

share on the date that the option is granted. The options are exercisable up to the seventh anniversary of the grant date and the last grants were made

in 2004. From 2005 onwards the remuneration committee’s policy is not to make further grants of share options to executive directors.

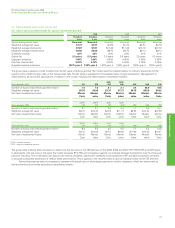

Plans for senior employees

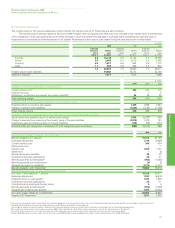

The group operates a number of equity-settled share plans under which share units are granted to its senior leaders and certain employees. These

plans typically have a three-year performance or restricted period during which the units accrue net notional dividends which are treated as having

been reinvested. Leaving employment during the three-year period will normally preclude the conversion of units into shares, but special arrangements

apply where the participant leaves for a qualifying reason.

Grants are settled in cash where participants are located in a country whose regulatory environment prohibits the holding of BP shares.

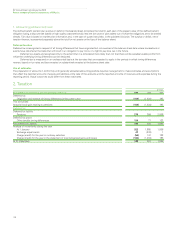

Performance unit plans

The number of units granted is made by reference to level of seniority of the employees. The number of units converted to shares is determined by

reference to performance measures over the three-year performance period. The main performance measure used is BP’s TSR compared against the

other oil majors. In addition, free cash flow (FCF) is used as a performance measure for one of the performance plans. Plans included in this category

are the Competitive Performance Plan (CPP), the Medium Term Performance Plan (MTPP) and, in part, the Performance Share Plan (PSP).

Restricted share unit plans

Share unit grants under BP’s restricted plans typically take into account the employee’s performance in either the current or the prior year, track record

of delivery, business and leadership skills and long-term potential. One restricted share unit plan used in special circumstances for senior employees,

such as recruitment and retention, normally has no performance conditions. Plans included in this category are the Executive Performance Plan (EPP),

the Restricted Share Plan (RSP), the Deferred Annual Bonus Plan (DAB) and, in part, the Performance Share Plan (PSP).

BP Share Option Plan (BPSOP)

Share options with an exercise price equivalent to the market price of a share immediately preceding the date of grant were granted to participants

annually until 2006. There were no performance conditions and the options are exercisable between the third and tenth anniversaries of the grant date.