BP 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2009

Business review

Our O&D business has operations in both China and Malaysia. In China,

our SECCO joint venture between BP, Sinopec and its subsidiary,

Shanghai Petrochemical Company, is the largest olefins cracker in China.

SECCO is BP’s single largest investment in China. This naphtha cracker

produces ethylene and propylene plus derivatives acrylonitrile,

polyethylene, polypropylene, styrene, polystyrene, butadiene and other

products. In Malaysia, BP participates in two joint ventures: Ethylene

Malaysia Sdn. Bhd. (EMSB), which produces ethylene from gas feedstock

in a joint venture between BP, Petronas and Idemitsu; while Polyethylene

Malaysia Sdn. Bhd. (PEMSB) produces polyethylene in a joint venture

between BP and Petronas. BP also owns one other naphtha cracker

site outside of Asia, which is integrated with our Gelsenkirchen

refinery in Germany.

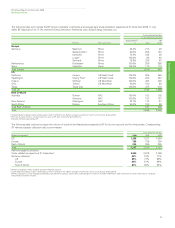

The following table shows BP’s petrochemicals production

capacity at 31 December 2009. This production capacity is based on the

original design capacity of the plants plus expansions.

BP share of petrochemicals production capacitya b

thousand tonnes per year

Acetic

Geographic area PTA PX acid Other O&D Total

US 2,385 2,373 583 151 – 5,492

Europe 1,330 624 532 158 1,629 4,273

Rest of World 3,704 – 1,035 108 3,217 8,064

7,419 2,997 2,150 417 4,846 17,829

aPetrochemicals capacity is the maximum proven sustainable daily rate (msdr) multiplied by the

number of days in the respective period, where msdr is the highest average daily rate ever achieved

over a sustained period.

bIncludes BP share of equity-accounted entities.

Global fuels

The supply of aviation fuels and LPG is run globally in the global fuels SPU.

Air BP is one of the world’s largest and best known aviation fuels

suppliers, serving many of the major commercial airlines as well as the

general aviation and military sectors. During 2009, which was another

tough year for the aviation industry, we continued to simplify our

geographical footprint by exiting non-core countries and we now supply

customers in 64 countries. This has allowed us to reduce working capital

and improve returns on operating capital employed.

We have annual marketing sales in excess of 25 billion litres. Air

BP’s strategic aim is to grow its position in the core locations of Europe,

the US, Australasia and the Middle East, while focusing its portfolio

towards airports that offer long-term competitive advantage.

The LPG business sells bulk, bottled, automotive and wholesale

LPG products to a wide range of customers in 12 countries. During the

past few years, our LPG business has consolidated its position and

introduced new consumer offers in established markets, developed

opportunities in growth markets and pursued new demand such as the

German Autogas market. In 2009, we have divested non-core operations

and focused our asset base around sustainable marketing operations.

Annual sales are in excess of 2 million tonnes per annum.

Other businesses and corporate

Other businesses and corporate comprises the Alternative Energy

business, Shipping, the group’s aluminium asset, Treasury (which

includes interest income on the group’s cash and cash equivalents), and

corporate activities worldwide.

The financial results of Other businesses and corporate are

discussed on page 57.

Key statistics

$ million

2009 2008 2007

Sales and other operating revenuesa2,843 4,634 3,698

Replacement cost profit (loss) before

interest and taxb(2,322) (1,223) (1,209)

Total assets 17,954 19,079 20,595

Capital expenditure and acquisitions 1,299 1,839 939

aIncludes sales between businesses.

bIncludes profit after interest and tax of equity-accounted entities.

Alternative Energy

Alternative Energy comprises BP’s low-carbon businesses and future

growth options outside oil and gas. Alternative Energy is focused on four

key businesses, which we believe have the potential to be a material

source of low-carbon energy and are aligned with BP’s core capabilities.

These are biofuels, wind, solar, and hydrogen power and carbon capture

and storage (CCS).

Our market

It is now well accepted that a more diverse mix of energy will be required

to meet future demand. The International Energy Association (IEA)a

estimates that world energy demand could be 40% higher than at

present by 2030, driven largely by China and India. The IEA also projects

that higher fossil-fuel prices, as well as increasing concerns over energy

security and climate change, could boost the share of wind and solar

electricity generation from 1% in 2007 to 6% in 2030, and the biofuels

share of transport fuels from 1% in 2007 to 4% in 2030b.

Our performance

Alternative Energy made good progress in 2009. Our wind business has

added 279MW of capacity including the construction of two wind farms

in the US – Fowler Ridge II in Indiana and Titan I in South Dakota – taking

the total capacity in commercial operation to 711MW (1,237MW gross)

at the end of 2009. In our solar business, we completed the restructuring

of our manufacturing facilities and increased unit sales 25% over 2008.

Our biofuels business is investing in advanced technologies. We have our

first joint-venture ethanol refinery in Brazil and another joint-venture

facility is under construction in the UK.

Since 2005, we have invested more than $4 billioncin Alternative

Energy, in line with our commitment to invest $8 billion by 2015.

aAdapted from World Energy Outlook 2009. ©OECD/IEA 2009, page 73.

bWorld Energy Outlook 2009. ©OECD/IEA 2009, pages 622-623: ‘Reference Scenario, World’.

cThe majority of costs have been capitalized, some were expensed under IFRS.

2009 2008 2007

Wind – net rated capacity at year-end

(megawatts)a711 432 172

Solar – module sales (megawatts)b203 162 115

aNet wind capacity is the sum of the rated capacities of the assets/turbines that have entered into

commercial operation, including BP’s share of equity-accounted entities. The equivalent capacities

on a gross-JV basis (which includes 100% of the capacity of equity-accounted entities where BP

has partial ownership) were 1,237MW in 2009, 785MW in 2008 and 373MW in 2007. This includes

32MW of capacity in the Netherlands that is managed by our Refining and Marketing segment.

bSolar sales are the total sales of solar modules to third-party customers, expressed in MW.

Previously we reported the theoretical cell production capacity of our in-house solar manufacturing

facilities. Reporting sales volumes operating data brings us into line with the broader solar industry.

42