BP 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

BP Annual Report and Accounts 2009

Business review

Business review

Business review

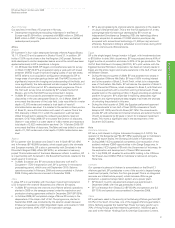

Kazakhstan

• On 11 December 2009, BP announced that it has divested its interest

in Kazakhstan’s Tengiz oil field and the Caspian Pipeline Consortium

(CPC) pipeline, carrying oil between Kazakhstan and Russia, by selling

its 46% stake in LukArco to Russia’s Lukoil. Lukoil, which already

owns 54% of LukArco, will pay $1.6 billion in cash in three

instalments over two years from December 2009.

Middle East and Pakistan

Production in the Middle East consists principally of the production

entitlement of associates in Abu Dhabi, where we have equity interests

of 9.5% and 14.67% in onshore and offshore concessions respectively.

• In Sharjah, the joint agreement between BP, the Government of

Sharjah, Itochu and Tokyo Beki, for the operation and maintenance of

LPG facilities and the production and marketing of LPG products,

expired on 22 March 2009 after a period of 25 years. BP relinquished

its 25% ownership, in accordance with the joint venture agreement,

and negotiated terms that retain BP as the operator of the facilities

through an operating fee structure.

• In Block 61 in Oman, the challenges posed by the world’s largest

onshore wide-azimuth 3D seismic survey led the BP Oman team to

use a ground-breaking new technique known as distance separated

simultaneous sweeping (DS3). BP’s appraisal programme continues

to make good progress evaluating the resources in place in the

Khazzan/Makarem gas fields. Five appraisal wells have been drilled

in 2009. Fracture stimulation and testing of these wells continues.

Infrastructure to facilitate long-term wells tests is under construction

and expected to be ready for service in the second half of 2010.

• On 3 January 2010, we received approval from the Government of

Jordan to join the state-owned National Petroleum Company to

exploit the onshore Risha concession in the north-east of the country.

• With effect from 1 January 2009 BP assumed operatorship of the

Mirpurkhas and Khipro onshore blocks in the southern Sindh province

of Pakistan.

• In the third quarter of 2009, BP won bids for two new exploration

blocks, Digri and Sanghar South, in Pakistan. These blocks are

adjacent to BP’s Mirpurkhas and Khipro concession areas and add

another 5,000 square kilometres to the group’s existing portfolio of

5,300 square kilometres. BP has committed to invest approximately

$30 million in these blocks for seismic and wells over the next three

years.

Iraq

• In November 2009, BP and China National Petroleum Company

(CNPC) entered into a contract with the state-owned Southern Oil

Company of Iraq to expand production from the Rumaila oilfield near

Basra in southern Iraq. This followed a successful bid for the contract

in Baghdad in June 2009. The Rumaila field currently produces

approximately one million barrels of oil per day. BP and CNPC plan to

invest approximately $15 billion over the next 20 years to enhance the

Rumaila production to a plateau rate of 2.85mmb/d, around 3% of

global oil production. BP will hold a 38% working interest, CNPC will

hold 37% and the remaining 25% will be held by the State Oil

Marketing Organisation (SOMO) representing the Iraqi government.

Australasia

Australia

BP is one of seven partners in the North West Shelf (NWS) venture. Six

partners (including BP) hold an equal 16.67% interest in the infrastructure

and oil reserves and an equal 15.78% interest in the gas and condensate

reserves, with a seventh partner owning the remaining 5.32% of gas and

condensate reserves. The NWS venture is currently the principal supplier

to the domestic market in Western Australia and one of the largest LNG

export projects in Asia with five LNG trains in operation.

• The North Rankin 2 project linking a second platform to the existing

North Rankin A platform sanctioned in 2008, is on schedule. On

completion, the North Rankin A and North Rankin B platforms will

operate as a single integrated facility and recover low pressure gas

from the North Rankin and Perseus gas fields.

• The joint venture partners (Chevron, ExxonMobil and Shell) approved

the Greater Gorgon project on 14 September 2009 with the Australian

Government also awarding production licences for the Jansz-Io field

(BP 5.375%). The Jansz-Io field will be developed as part of the

Greater Gorgon project, which will comprise three LNG trains, each

with a capacity of 5 million tonnes per annum (mtpa), on Barrow

Island with first gas expected in 2014. As part of this, a unitization

and unit operating agreement has been executed with the joint

venture partners and sales and purchase agreements for the wellhead

sale of raw gas and repurchase of LNG ex-Barrow Island have been

executed between BP and Shell.

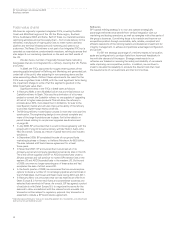

Midstream activities

Oil and natural gas transportation

The group has direct or indirect interests in certain crude oil and natural

gas transportation systems. The following narrative details the significant

events that occurred during 2009 by country.

BP’s onshore US crude oil and product pipelines and related

transportation assets are included under Refining and Marketing (see

page 36).

Alaska

BP owns a 46.9% interest in the Trans-Alaska Pipeline System (TAPS),

with the balance owned by four other companies. BP also owns a 50%

interest in a joint venture company called ‘Denali – The Alaska Gas

Pipeline’ (Denali). Denali has begun work on an Alaska gas pipeline

project, consisting of a gas treatment plant on Alaska’s North Slope,

a large diameter pipeline that is intended to pass through Alaska into

Canada, and should it be required, a large-diameter pipeline from Alberta

to the Lower 48 states. When completed, the pipeline is expected to

transport approximately 4 billion cubic feet of natural gas per day to

market. Following a successful open season, Denali will seek certification

from the Federal Energy Regulatory Commission (FERC) of the US and

the National Energy Board (NEB) of Canada to move forward with project

construction. Denali will manage the project, and will own and operate

the pipeline when completed. BP may consider other equity partners,

including pipeline companies, who can add value to the project and help

manage the risks involved.

Significant events were:

• Work on the strategic reconfiguration project to upgrade and

automate four TAPS pump stations continued to progress in 2009.

This project involves installing electrically driven pumps at four critical

pump stations, along with increased automation and upgraded

control systems. Two of the reconfigured pump stations came online

during 2007 and a third reconfigured pump station came online in

May 2009. Reconfiguration of the remaining pump station in the

programme plan will commence in 2010, with installation currently

planned for 2012.