BP 2009 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP bases its proved reserves estimates on the requirement of

reasonable certainty with rigorous technical and commercial

assessments based on conventional industry practice. BP only applies

technologies that have been field tested and have been demonstrated to

provide reasonably certain results with consistency and repeatability in

the formation being evaluated or in an analogous formation. BP applies

high resolution seismic data for the identification of reservoir extent and

fluid contacts only where there is an overwhelming track record of

success in its local application. In certain deepwater fields, such as fields

in the Gulf of Mexico, BP has booked proved reserves before production

flow tests are conducted, in part because of the significant safety, cost

and environmental implications of conducting these tests. The industry

has made substantial technological improvements in understanding,

measuring and delineating reservoir properties without the need for flow

tests. To determine reasonable certainty of commercial recovery, BP

employs a general method of reserves assessment that relies on the

integration of three types of data: (1) well data used to assess the local

characteristics and conditions of reservoirs and fluids; (2) field scale

seismic data to allow the interpolation and extrapolation of these

characteristics outside the immediate area of the local well control; and

(3) data from relevant analogous fields. Well data includes appraisal wells

or sidetrack holes, full logging suites, core data and fluid samples. BP

considers the integration of this data in certain cases to be superior to a

flow test in providing understanding of overall reservoir performance. The

collection of data from logs, cores, wireline formation testers, pressures

and fluid samples calibrated to each other and to the seismic data can

allow reservoir properties to be determined over a greater volume than

the localized volume of investigation associated with a short-term flow

test. There is a strong track record of proved reserves recorded using

these methods, validated by actual production levels.

Governance

BP’s centrally controlled process for proved reserves estimation approval

forms part of a holistic and integrated system of internal control. It

consists of the following elements:

• Accountabilities of certain officers of the group to ensure that there

is review and approval of proved reserves bookings independent of

the operating business and that there are effective controls in the

approval process and verification that the proved reserves estimates

and the related financial impacts are reported in a timely manner.

• Capital allocation processes, whereby delegated authority is

exercised to commit to capital projects that are consistent with the

delivery of the group’s business plan. A formal review process exists

to ensure that both technical and commercial criteria are met prior to

the commitment of capital to projects.

• Internal Audit, whose role includes systematically examining the

effectiveness of the group’s financial controls designed to assure the

reliability of reporting and safeguarding of assets and examining the

group’s compliance with laws, regulations and internal standards.

• Approval hierarchy, whereby proved reserves changes above certain

threshold volumes require central authorization and periodic reviews.

The frequency of review is determined according to field size and

ensures that more than 80% of the BP proved reserves base

undergoes central review every two years and more than 90% is

reviewed centrally every four years.

BP’s segment resources authority is the petroleum engineer primarily

responsible for overseeing the preparation of the reserves estimate.

He has over 35 years of diversified industry experience with the past 10

spent as the head of the reservoir management function within BP. He is

a member of the Society of Petroleum Engineers (SPE) and the Institute

of Materials, Minerals and Mining. On the retirement of the current

segment resources authority in 2010, his responsibilities for reserves

estimation, governance and compliance will be taken by the current vice

president of segment reserves. The current vice president of segment

reserves has over 25 years of diversified industry experience with the

past seven spent managing the governance and compliance of BP’s

reserves estimation. He is a sitting member of the SPE Oil and Gas

Reserves Committee and the United Nations Economic Commission

for Europe Expert Group on Resource Classification.

For the executive directors and senior management, no specific

portion of compensation bonuses is directly related to proved reserves

targets. Additions to proved reserves is one of several indicators by

which the performance of the Exploration and Production segment is

assessed by the remuneration committee for the purposes of

determining compensation bonuses for the executive directors. Other

indicators include a number of financial and operational measures.

BP’s variable pay programme for the other senior managers in the

Exploration and Production segment is based on individual performance

contracts. Individual performance contracts are based on agreed items

from the business performance plan, one of which, if chosen, could

relate to proved reserves.

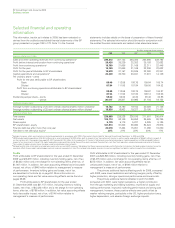

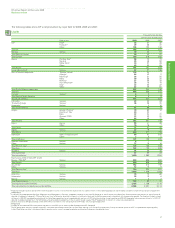

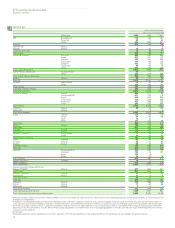

Proved reserves replacement

Total hydrocarbon proved reserves, on an oil equivalent basis including

equity-accounted entities, comprised 18,292mmboe (12,621mmboe for

subsidiaries and 5,671mmboe for equity-accounted entities) at

31 December 2009, an increase of 0.8% (increase of 0.5% for

subsidiaries and increase of 1.5% for equity-accounted entities)

compared with 31 December 2008. Natural gas represents about 43%

(55% for subsidiaries and 14% for equity-accounted entities) of these

reserves. The increase includes a net decrease from acquisitions and

divestments of 282mmboe, (59mmboe net decrease for subsidiaries

and 223mmboe net decrease for equity-accounted entities) largely

comprising a number of assets in Bolivia, Indonesia, Kazakhstan, Pakistan

and the UK.

The proved reserves replacement ratio is the extent to which

production is replaced by proved reserves additions. This ratio is

expressed in oil equivalent terms and includes changes resulting from

revisions to previous estimates, improved recovery and extensions and

discoveries, and may be expressed as a replacement ratio excluding

acquisitions and divestments or as a total replacement ratio including

acquisitions and divestments. For 2009 the proved reserves replacement

ratio excluding acquisitions and divestments was 129% (121% in 2008

and 112% in 2007) for subsidiaries and equity-accounted entities, 112%

for subsidiaries alone and 164% for equity-accounted entities alone.

In 2009, net additions to the group’s proved reserves (excluding

production, sales and purchases of reserves-in-place and equity-

accounted entities) amounted to 1,113mmboe (795mmboe for equity-

accounted entities), principally through improved recovery from, and

extensions to, existing fields and discoveries of new fields. Of our

subsidiary reserves additions through improved recovery from, and

extensions to, existing fields and discoveries of new fields, approximately

55% are associated with new projects and are proved undeveloped

reserves additions. Volumes added in 2009 principally relied on the

application of conventional technologies. The remaining additions are in

existing developments where they represent a mixture of proved

developed and proved undeveloped reserves. The principal reserves

additions in our subsidiaries were in the US (Arkoma, Mad Dog, Prudhoe

Bay, Thunder Horse), the UK (Clair), Trinidad (Kapok), Angola (Pazflor) and

Australia (Jansz-Io). The principal reserves additions in our equity-

accounted entities were in Argentina (Cerro Dragon, Cuenca Marina

Austral) and in Russia (Kamennoye, Samatlor).

25

BP Annual Report and Accounts 2009

Business review

Business review

Business review