BP 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2009

Business review

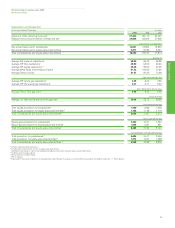

Finance costs and net finance expense relating to pensions and

other post-retirement benefits

Finance costs comprise interest payable less amounts capitalized, and

interest accretion on provisions and long-term other payables. Finance

costs in 2009 were $1,110 million compared with $1,547 million in 2008

and $1,393 million in 2007. The decrease in 2009, when compared with

2008, is largely attributable to the reduction in interest rates. The increase

in 2008, when compared with 2007, is largely the outcome of reductions

in capitalized interest as capital construction projects concluded.

Net finance expense relating to pensions and other post-

retirement benefits in 2009 was $192 million compared with net finance

income of $591 million and $652 million in 2008 and 2007 respectively.

The expected return on assets decreased significantly in 2009 as the

pension asset base reduced, consistent with falls in equity markets

during 2008.

Taxation

The charge for corporate taxes in 2009 was $8,365 million, compared

with $12,617 million in 2008 and $10,442 million in 2007. The effective

tax rate was 33% in 2009, 37% in 2008 and 33% in 2007. The group

earns income in many countries and, on average, pays taxes at rates

higher than the UK statutory rate of 28%. The decrease in the effective

tax rate in 2009 compared with 2008 primarily reflects a higher

proportion of income from associates and jointly controlled entities

where tax is included in the pre-tax operating result, foreign exchange

effects and changes to the geographical mix of the group’s income.

The increase in the effective rate in 2008 compared with 2007 primarily

reflects the change in the country mix of the group’s income, resulting

in a higher overall tax burden.

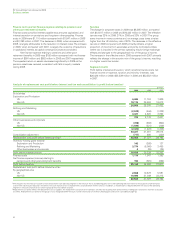

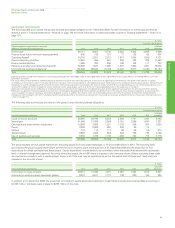

Segment results

Profit before interest and taxation, which is before finance costs, net

finance income or expense, taxation and minority interests, was

$26,426 million in 2009, $35,239 million in 2008 and $32,352 million

in 2007.

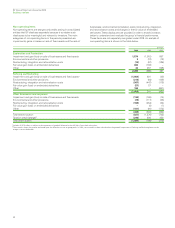

Analysis of replacement cost profit before interest and tax and reconciliation to profit before taxationa

$ million

2009 2008 2007

By business

Exploration and Production

US 6,685 11,724 7,929

Non-US 18,115 26,584 19,673

24,800 38,308 27,602

Refining and Marketing

US (2,578) (644) (1,232)

Non-US 3,321 4,820 3,853

743 4,176 2,621

Other businesses and corporate

US (728) (902) (960)

Non-US (1,594) (321) (249)

(2,322) (1,223) (1,209)

23,221 41,261 29,014

Consolidation adjustment (717) 466 (220)

Replacement cost profit before interest and taxb22,504 41,727 28,794

Inventory holding gains (losses)

Exploration and Production 142 (393) 127

Refining and Marketing 3,774 (6,060) 3,455

Other businesses and corporate 6(35) (24)

Profit before interest and tax 26,426 35,239 32,352

Finance costs 1,110 1,547 1,393

Net finance expense (income) relating to

pensions and other post-retirement benefits 192 (591) (652)

Profit before taxation 25,124 34,283 31,611

Replacement cost profit before interest and tax

By geographical area

US 2,806 10,678 5,581

Non-US 19,698 31,049 23,213

22,504 41,727 28,794

aIFRS requires that the measure of profit or loss disclosed for each operating segment is the measure that is provided regularly to the chief operating decision maker for the purposes of performance

assessment and resource allocation. For BP, this measure of profit or loss is replacement cost profit before interest and tax. In addition, a reconciliation is required between the total of the operating

segments’ measures of profit or loss and the group profit or loss before taxation.

bReplacement cost profit reflects the replacement cost of supplies. The replacement cost profit for the period is arrived at by excluding from profit inventory holding gains and losses and their associated

tax effect. Replacement cost profit for the group is not a recognized GAAP measure. Further information on inventory holding gains and losses is provided on page 53.

54