BP 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report

and Accounts

2009

bp.com/annualreport

What’s inside?

3 Business review

4 Chairman’s letter

6 Group chief executive’s review

8 Our performance

10 Group overview

22 Exploration and Production

36 Refi ning and Marketing

42 Other businesses and corporate

44 Research and technology

46 Corporate responsibility

52 Relationships with suppliers and contractor

52 Regulation of the group’s business

52 Organizational structure

53 Financial performance

61 Liquidity and capital resources

s

65 Board performance and biographies

66 Directors and senior management

69 Board performance report

81 Directors’ remuneration report

82 Part 1 Summary

84 Part 2 Executive directors’ remuneration

91 Part 3 Non-executive directors’ remuneration

93 Additional information for

shareholders

94 Critical accounting policies

96 Property, plants and equipment

96 Share ownership

98 Major shareholders and related party transactions

98 Dividends

99 Legal proceedings

100 Share prices and listings

101 Memorandum and Articles of Association

103 Exchange controls

103 Taxation

105 Documents on display

105 Controls and procedures

106 Code of ethics

106 Principal accountants’ fees and services

106 Corporate governance practices

107 Purchases of equity securities by the issuer

and affi liated purchasers

107 Fees and charges payable by a holder of ADSs

108 Fees and payments made by the Depositary

to the issuer

108 Called-up share capital

108 Administration

108 Annual general meeting

109 Financial statements

110 Consolidated fi nancial statements of the BP group

116 Notes on fi nancial statements

179 S upplementary information on oil and

natural gas (unaudited)

193 Parent company fi nancial statements of BP p.l.c.

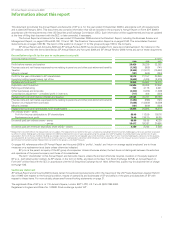

Table of contents

-

Page 1

... Major shareholders and related party transactions Dividends Legal proceedings Share prices and listings Memorandum and Articles of Association Exchange controls Taxation Documents on display Controls and procedures Code of ethics Principal accountants' fees and services Corporate governance... -

Page 2

-

Page 3

... 4-9, references within BP Annual Report and Accounts 2009 to 'profits', 'results' and 'return on average capital employed' are to those measures on a replacement cost basis unless otherwise indicated. BP p.l.c. is the parent company of the BP group of companies. Unless otherwise stated, the text... -

Page 4

...stipulated share of the production remaining after such cost recovery. SEC The United States Securities and Exchange Commission. Subsidiary An entity that is controlled by the BP group. Control is the power to govern the financial and operating policies of an entity so as to obtain the benefits from... -

Page 5

... of the group's business Our performance Business review 52 Organizational structure 10 Group overview 53 Financial performance 22 Exploration and Production 61 Liquidity and capital resources 36 Refining and Marketing 42 Other businesses and corporate 44 Research and technology 46 Corporate... -

Page 6

... Report and Accounts 2009 Business review Chairman's letter I have joined BP at an exciting and testing time for the energy industry and the wider world. Crisis in the global economy has asked tough questions of everyone. Meanwhile, two long-term issues require our continued attention - the high... -

Page 7

...-executive board director for 14 years, Peter steered the group through many challenges. He leaves a strong BP that is well positioned for further success. As a board, we thank him for his exceptional contribution. We also thank those nonexecutives who are to leave after the annual general meeting... -

Page 8

... The return on average capital employed on a replacement basis is the ratio of replacement cost proï¬t before interest expense and minority interest but after tax, to the average of opening and closing capital employed. Capital employed is BP shareholders' interest, plus ï¬nance debt and minority... -

Page 9

... for all new major projects to allow informed investment in fossil fuels and to encourage development of the technology needed to reduce their carbon footprint. And ï¬nally, we are investing in our low-carbon businesses. Since 2005 we have invested more than $4 billion in Alternative Energy, with... -

Page 10

... BP on procedures such as 'integrity management' and 'control of work', which are core elements of BP's operating management system. 500 400 300 200 340 2007 335 2008 234 2009 Number of employeesa Employees include all individuals who have a contract of employment with a BP group entity. In 2009 BP... -

Page 11

... additional shares at the closing price applicable on the ex-dividend date. Total shareholder return scores in 2009 reï¬,ect BP's improving competitive performance as well as a general recovery of global stock markets compared with the low levels seen at the end of 2008. ADS basis Ordinary share... -

Page 12

... is in London. The UK is a centre for trading, legal, finance and other business functions as well as three of BP's major global research and technology groups. We have well-established operations in Europe, the US, Canada, Russia, South America, Australasia, Asia and parts of Africa. Currently... -

Page 13

...America, North Africa and the Middle East. Our Exploration and Production segment also includes gas marketing and trading activities, primarily in Canada, Europe and the US. In Russia, we have an important associate through our 50% shareholding in TNK-BP , a major oil company with exploration assets... -

Page 14

BP Annual Report and Accounts 2009 Business review Crude oil and gas prices, and refining margins ($ per barrel of oil equivalent) Dated Brent oil price Henry Hub gas price (First of Month Index) Global indicator refining margin (GIM)a 150 120 90 60 30 2004 2005 2006 2007 2008 2009 ... -

Page 15

... more than 80% of the world's oil resources are held by Russia, Mexico and members of OPEC - areas where international oil companies are frequently limited or prohibited from applying their technology and expertise to produce additional supply. New partnerships will be required to transform latent... -

Page 16

...in meeting the world's continued need for hydrocarbons, with our Exploration and Production and Refining and Marketing activities remaining at the core of our strategy. We are also creating long-term options for the future in new energy technology and low-carbon energy businesses. Current investment... -

Page 17

BP Annual Report and Accounts 2009 Business review Our performance 2009 has been a successful year for BP, with positive financial and operational momentum despite an extremely turbulent global financial environment. Safety Good progress has been made on underpinning improved safety performance in ... -

Page 18

... footnote (a) on page 53. More information on non-operating items and fair value accounting effects can be found on pages 58-59. Profit attributable to BP shareholders for the year ended 31 December 2008 was $21,157 million, including inventory holding losses, net of tax, of $4,436 million and a net... -

Page 19

... the sale of our ground fuels marketing business in Greece and retail churn in the US, Europe and Australasia. Further proceeds from the sale of LukArco are receivable in the next two years. See Financial statements - Note 3 on page 124. In 2008, we completed an asset exchange with Husky Energy Inc... -

Page 20

... markets, at a time when cash flows from our business operations may be under pressure, our ability to maintain our long-term investment programme may be impacted with a consequent effect on our growth rate, and may impact shareholder returns, including dividends and share buybacks, or share price... -

Page 21

... Accounts 2009 Business review Investment efficiency Our organic growth is dependent on creating a portfolio of quality options and investing in the best options. Ineffective investment selection could lead to loss of value and higher capital expenditure. Reserves replacement Successful execution... -

Page 22

... the holistic set of management systems, organizational structures, processes, standards and behaviours that are employed to conduct our business and deliver returns for shareholders. The system is designed to meet the expectations of internal control of the Combined Code in the UK and of COSO... -

Page 23

...average quarterly charge from Other businesses and corporate, costs, foreign exchange and energy costs, capital expenditure, timing and proceeds of divestments, balance of cash inflows and outflows, dividend and optional scrip dividend, cash flows, shareholder distributions, gearing, working capital... -

Page 24

...of technology and strong relationships based on mutual advantage. • Sustainably driving cost and capital efficiency in accessing, finding, developing and producing resources, enabled by deep technical capability and a culture of continuous improvement. Our performance In Exploration and Production... -

Page 25

... table below presents our average sales price per unit of production. $ per unit of productiona Europe North America Rest of Europe Rest of North America South America Africa Asia Australasia Total group average UK US Russia Rest of Asia Average sales priceb 2009 Liquidsc Gas 2008 Liquidsc Gas... -

Page 26

BP Annual Report and Accounts 2009 Business review The table below presents our average production cost per unit of production. $ per unit of productiona Europe North America Rest of Europe Rest of North America South America Africa Asia Australasia Total group average UK US Russia Rest of Asia... -

Page 27

... by the remuneration committee for the purposes of determining compensation bonuses for the executive directors. Other indicators include a number of financial and operational measures. BP's variable pay programme for the other senior managers in the Exploration and Production segment is based... -

Page 28

...show BP's estimated net proved reserves as at 31 December 2009. Estimated net proved reserves of liquids at 31 December 2009a b million barrels Developed Undeveloped Total UK Rest of Europe US Rest of North America South America Africa Rest of Asia Australasia Subsidiaries Equity-accounted entities... -

Page 29

... Annual Report and Accounts 2009 Business review The following tables show BP's net production by major field for 2009, 2008 and 2007. Liquids thousand barrels per day BP net share of productiona Field or area 2009 2008 2007 UKb ETAPc Foinavend Other Various Total UK Norway Total Rest of Europe... -

Page 30

... has a direct interest in the underlying production and the option and ability to make lifting and sales arrangements independently. 2009, BP assumed operatorship of the Mirpurkhas and Khipro blocks in Pakistan, swapped a number of assets with BG Group plc in the UK sector of the North Sea, divested... -

Page 31

... reviews operations in our Exploration and Production business by continent and country, and lists associated significant events that occurred in 2009. Where relevant, BP's percentage working interest in oil and gas assets is shown in brackets. Working interest is the cost-bearing ownership share... -

Page 32

... plant in the UK. Significant events were: • On 31 August 2009, the exchange of assets between BP and BG Group was formally completed. The exchange is expected to strengthen BP's position as a major operator in the southern North Sea and to facilitate development activity and investment in the UK... -

Page 33

... investor in Egypt, with investments close to $15 billion to date. With its partners, BP has produced almost 40% of Egypt's entire oil production and close to 30% of its gas production. The Gulf of Suez Petroleum Company (GUPCO), BP's joint venture with the Egyptian General Petroleum Corporation... -

Page 34

...oil company operating in Russia and the Ukraine. BP's investment in TNK-BP is reported in the Exploration and Production segment. The TNK-BP group's major assets are held in OAO TNK-BP Holding. Other assets include the BP-branded retail sites in the Moscow region and interests in OAO Rusia Petroleum... -

Page 35

...day. BP and CNPC plan to invest approximately $15 billion over the next 20 years to enhance the Rumaila production to a plateau rate of 2.85mmb/d, around 3% of global oil production. BP will hold a 38% working interest, CNPC will hold 37% and the remaining 25% will be held by the State Oil Marketing... -

Page 36

... to development and its impact on local communities. The Tangguh project has five long-term contracts in place to supply LNG to purchasers in China, South Korea, Mexico and Japan. • In Australia, we are one of seven partners in the North West Shelf (NWS) venture. The joint venture operation covers... -

Page 37

... and losses on exchange-traded commodity derivatives are included in sales and other operating revenues for accounting purposes. Spot and term contracts Spot contracts are contracts to purchase or sell a commodity at the market price, typically an index price prevailing on the delivery date when... -

Page 38

... 80 countries. We have significant operations in Europe and North America and also manufacture and market our products across Australasia, in China and other parts of Asia, Africa and Central and South America. Our organization is managed through two main business groupings: fuels value chains (FVCs... -

Page 39

...37 Business review Sales and other operating revenuesa Replacement cost profit before interest and taxb Total assets Capital expenditure and acquisitions 213,050 743 82,224 4,114 320,039 4,176 75,329 6,634 250,221 2,621 95,311 5,495 US Europe Rest of World Total marketing salesa Trading/supply... -

Page 40

... our refineries are focused on securing the safety and reliability of our assets while improving our competitive position. In addition, we continue to invest to develop the capability to produce the cleaner fuels that meet the requirements of our customers and their communities. capital employed is... -

Page 41

... value chain Group interest b % Total BP share Europe Germany New Zealand South Africa Total Rest of World Total a Crude distillation capacity is gross rated capacity, which is defined as b BP share of equity, which is not necessarily the same as BP share of c the highest average sustained unit... -

Page 42

..., southern and eastern Africa. We are developing networks in China in two separate joint ventures, one with Petrochina and the other with China Petroleum and Chemical Corporation (Sinopec). Number of retail sites operated under a BP brand Retail sitesa b 2009 2008 2007 US Europe Rest of World Total... -

Page 43

...investing in its key assets and market positions in order to deliver value to its customers and outperform its competitors. In 2009, the IBs accounted for just under a quarter of the segment's operating capital employeda and just over half the profit, after adjusting for non-operating items and fair... -

Page 44

... and we now supply customers in 64 countries. This has allowed us to reduce working capital and improve returns on operating capital employed. We have annual marketing sales in excess of 25 billion litres. Air BP's strategic aim is to grow its position in the core locations of Europe, the US... -

Page 45

... of energy security and climate change. We have embarked on a focused programme of biofuels development based around the most efficient transformation of sustainable and low-cost sugars into a range of fuel molecules. BP continues to invest throughout the entire biofuels value chain from sustainable... -

Page 46

... to meet group requirements and manages key financial risks including interest rate, foreign exchange, pension and financial institution credit risk. From locations in the UK, the US and the Asia Pacific region, Treasury provides the interface between BP and the international financial markets and... -

Page 47

...a wide range of technologies. The ETI has also developed a model of the UK energy system which projects out to 2050. • In 2009, BP launched the Energy Sustainability Challenge, a threeyear study into how changes in availability of and demand for natural resources and ecosystem services will affect... -

Page 48

... management at our US refineries and our safety management culture. In accordance with those recommendations, we appointed an Independent Expert for a five-year term to monitor their implementation. We again co-operated closely with the Independent Expert in 2009, providing him access to our sites... -

Page 49

... code of conduct. Information on the environmental impact of our operations and our efforts to manage resources responsibly are discussed in our annual BP Sustainability Report which is available on our website at www.bp.com/sustainability. a Technology development BP invests in, or jointly funds... -

Page 50

... the sales of many of our products. US and EU regulations Approximately 60% of our fixed assets are located in the US and the EU. US and EU environment and health and safety regulations significantly affect BP's exploration and production, refining, marketing, transportation and shipping operations... -

Page 51

... refineries producing marine fuel, including costs to dispose of sulphur, as well as increased CO2 emissions and energy costs for additional refining. In the UK, significant health and safety legislation affecting BP includes the Health and Safety at Work Act and regulations and the Control of Major... -

Page 52

... for policy decisions relating to employees. In 2009, this included senior level talent review and succession planning, embedding of D&I plans in the businesses and the structure of long-term incentive plans. We continue to increase the number of local leaders and employees in our operations so... -

Page 53

...-term, solutions. Our investments in education and local enterprise development aim to build local capability as part of our business agenda, either through our local employees or through the provision of goods and services. As a global energy company, BP operates in a diverse range of countries... -

Page 54

... payable in kind. A licence holder is generally required to pay production taxes or royalties, which may be in cash or in kind. Less typically, BP may explore for and exploit hydrocarbons under a service agreement with the host entity in exchange for reimbursement of costs and/or a fee paid in cash... -

Page 55

... 2009 2008 2007 Sales and other operating revenues Profit for the year Profit for the year attributable to BP shareholders Profit attributable to BP shareholders per ordinary share - cents Dividends paid per ordinary share - cents For a discussion of the business environment in 2007-2009, see Group... -

Page 56

... Inventory holding gains (losses) Exploration and Production Refining and Marketing Other businesses and corporate Profit before interest and tax Finance costs Net finance expense (income) relating to pensions and other post-retirement benefits Profit before taxation Replacement cost profit before... -

Page 57

BP Annual Report and Accounts 2009 Business review Exploration and Production For the year ended 31 December 2009 2008 $ million 2007 Sales and other operating revenuesa Replacement cost profit before interest and taxb 57,626 24,800 86,170 38,308 65,740 27,602 million barrels of oil equivalent... -

Page 58

... nine major projects in 2008. $ million 2009 2008 2007 Sales and other operating revenuesa Replacement cost profit before interest and taxb Global indicator refining margin (GIM)c Northwest Europe US Gulf Coast Midwest US West Coast Singapore BP average Refining availabilityd Refinery throughputs... -

Page 59

... comprises the Alternative Energy business, Shipping, the group's aluminium asset, Treasury (which includes interest income on the group's cash, cash equivalents), and corporate activities worldwide. The replacement cost loss before interest and tax for the year ended 31 December 2009 was $2,322... -

Page 60

... of non-operating items is shown in the table below. $ million 2009 2008 2007 Exploration and Production Impairment and gain (loss) on sale of businesses and fixed assets Environmental and other provisions Restructuring, integration and rationalization costs Fair value gain (loss) on embedded... -

Page 61

... upon the effective tax rate on group profit. Reconciliation of non-GAAP information $ million 2009 2008 2007 Exploration and Production Replacement cost profit before interest and tax adjusted for fair value accounting effects Impact of fair value accounting effects Replacement cost profit before... -

Page 62

... the discounted value of the expected future cost of decommissioning the asset. Additionally, we undertake periodic reviews of existing provisions. These reviews take account of revised cost assumptions, changes in decommissioning requirements and any technological developments. The level of... -

Page 63

BP Annual Report and Accounts 2009 Business review Liquidity and capital resources Cash flow The following table summarizes the group's cash flows. $ million 2009 2008 2007 Net cash provided by operating activities Net cash used in investing activities Net cash used in financing activities ... -

Page 64

... average quarterly loss from Other businesses and corporate, effective tax rate, operating and capital expenditure, timing and proceeds of divestments, contractual commitments, balance of cash inflows and outflows and dividend and optional scrip dividend. These forward-looking statements are... -

Page 65

... plant and equipment at 31 December 2009 and the proportion of that expenditure for which contracts have been placed. Capital expenditure is considered to be committed when the project has received the appropriate level of internal management approval. For jointly controlled assets, the net BP share... -

Page 66

BP Annual Report and Accounts 2009 Business review 64 -

Page 67

Board performance and biographies 66 Directors and senior management 69 Board performance report Board performance and biographies -

Page 68

... and Marketing) Executive Director (Managing Director) Executive Director (Chief Financial Officer) Executive Director (Chief Executive, Exploration and Production) Group General Counsel Executive Vice President, Human Resources Executive Vice President (Chairman and President of BP America Inc... -

Page 69

...In 1995, he was appointed group finance director of HSBC Holdings plc and in 2009 his role was broadened to chief financial officer, executive director risk and regulation. He was chairman of the Financial Reporting Council's review of the Turnbull Guidance on Internal Control. Between 2001 and 2004... -

Page 70

... and production business and an executive director in 2007. He is a non-executive director of BAE Systems plc. Senior management R Bondy Rupert Bondy (48) joined BP as group general counsel in May 2008. In 1989, he joined US law firm Morrison & Foerster, working in San Francisco and London. From... -

Page 71

... Washington and will meet at other locations when appropriate. In 2009, the board met in Long Beach, California and used this opportunity to visit the company's businesses in the West Coast fuels value chain and to learn about the research taking place into biofuels. An analysis of the time spent by... -

Page 72

...Board Monitoring, Information and Assurance Ernst & Young Internal audit Finance function Annual plan / Group risks / Strategy Safety & Operations function General counsel Group chief executive Group compliance ofï¬cer External market and reputation research Independent expert Executive management... -

Page 73

...advise the chairman, group chief executive and board of BP plc on strategic and geopolitical issues relating to the long-term development of the company. The international advisory board met twice in 2009. The chairman, senior independent director and non-executive directors Neither the chairman nor... -

Page 74

..., board issues and board committees. • The business environment for BP. • BP's core businesses: Exploration and Production, and Refining and Marketing. • Reviews of Alternative Energy and Group Technology. • Overviews of BP's functions - including Finance, Safety and Operations, HR, Internal... -

Page 75

... the group chief executive, other executive and nonexecutive directors and senior management, the company secretary's office, investor relations and other teams within BP engage with a range of shareholders on issues relating to the group. Presentations given by the group to the investment community... -

Page 76

...the annual plan presented by the group chief executive. A joint meeting of the audit and safety, ethics and environment assurance committees in January 2010 reviewed reports from the general auditor as part of the board's annual review of the system of internal control. The chairman of the board and... -

Page 77

...times in 2009, with an additional joint meeting between the audit committee and the safety, ethics and environment assurance committee (SEEAC) to review the general auditor's report on internal controls and risk management for the previous year. Each meeting was attended by the group chief financial... -

Page 78

... management of BP's financial risk) was reported to the committee during the year by the chief financial officer. Internal control and audit The committee holds an annual joint meeting at the start of each year with the safety, ethics and environment assurance committee to review the general auditor... -

Page 79

... their adoption and publication. • Reviewing BP's internal control systems as they relate to nonfinancial risk. • Reviewing reports on the group's compliance with its code of conduct and on the employee concerns programme (OpenTalk) as it relates to non-financial issues. The full list of the... -

Page 80

... and management of the group's security risks and the progress made in HSE at TNK-BP . Internal audit and compliance and ethics The committee received and discussed quarterly reports from the group compliance and ethics officer. Each year we review compliance with the company's code of conduct and... -

Page 81

BP Annual Report and Accounts 2009 Board performance and biographies Remuneration committee report Structure of the committee Members of the remuneration committee during the year were Dr DeAnne Julius (chairman) and Sir Ian Prosser. Sir Tom McKillop stepped down from the committee when he retired ... -

Page 82

...group chief executive. • Reviewing the structure and effectiveness of the business organization of BP . • Reviewing the systems for senior executive development and determining the succession plan for the group chief executive, executive directors and other senior members of executive management... -

Page 83

Directors' remuneration report 82 Part 1 Summary 84 Part 2 Executive directors' remuneration 91 Part 3 Non-executive directors' remuneration Directors' remuneration report -

Page 84

... of Exploration and Production, and 4 times for other executive directors. • Vesting after three years based on performance relative to other oil majors. • Three-year retention period after vesting before release of shares. Pension • Final salary scheme appropriate to home country of executive... -

Page 85

...the number of transatlantic meetings for which an attendance allowance was paid. In 2009 the chairman reviewed non-executive director remuneration taking into account the review completed in 2008. The chairman made a recommendation to the board (which was agreed) to maintain the 2008 structure until... -

Page 86

... policy for executive directors in BP formed the starting point for the review. These include: • A substantial portion of executive remuneration should be linked to success in implementing the company's business strategy to maximize long-term shareholder value. • Executives should develop... -

Page 87

... Report and Accounts 2009 Directors' remuneration report • Salaries should be reviewed annually, in the context of the total quantum of pay, and taking into account both external market and internal company conditions. • The remuneration committee will actively seek to understand shareholder... -

Page 88

...that could become payable under all plans. Other benefits Executive directors are eligible to participate in regular employee benefit plans and in all-employee share saving schemes applying in their home countries. Benefits in kind are not pensionable. BP provides accommodation in London for both Mr... -

Page 89

BP Annual Report and Accounts 2009 Directors' remuneration report Pensionsa thousand Accrued pension entitlement at 31 Dec 2009 Additional pension earned during the year ended 31 Dec 2009b Transfer value of accrued benefitc at 31 Dec 2008 (A) Transfer value of accrued benefitc at 31 Dec 2009 (B) ... -

Page 90

BP Annual Report and Accounts 2009 Directors' remuneration report Performance share element of EDIPa Share element interests Market price of each share at date of award of performance shares £ Potential maximum performance sharesb Number of ordinary shares vestedc Market price of each share at ... -

Page 91

BP Annual Report and Accounts 2009 Directors' remuneration report Share optionsa Option type At 31 Dec 2009 Option price Market price at date of exercise Date from which first exercisable At 1 Jan 2009 Granted Exercised Expiry date Dr A B Hayward I C Conn R W Dudleyb c Dr B E Groteb A G ... -

Page 92

BP Annual Report and Accounts 2009 Directors' remuneration report Service contracts Director Contract date Salary as at 31 Dec 2009 During the year, the fees received by executive directors for external appointments were as follows: Executive director Appointee company Additional position held at ... -

Page 93

... of cash fees, payable monthly. • Non-executive directors should not receive share options from the company. • Non-executive directors are encouraged to establish a holding in BP shares of the equivalent value of one year's base fee. Process BP reviews the quantum and structure of chairman and... -

Page 94

... at 2008 levels, in 2009 actual fees paid to nonexecutive directors were affected by changes in committee membership and the number of transatlantic meetings to which an attendance allowance was paid. No share or share option awards were made to any non-executive director in respect of service to... -

Page 95

... 98 Major shareholders and related party transactions 98 Dividends 99 Legal proceedings 100 Share prices and listings 101 Memorandum and Articles of Association 103 Exchange controls 103 Taxation 105 Documents on display 105 Controls and procedures 106 Code of ethics 106 Principal accountants' fees... -

Page 96

...carrying values of the assets may not be recoverable and, as a result, charges for impairment are recognized in the group's results from time to time. Such indicators include changes in the group's business plans, changes in commodity prices leading to unprofitable performance, low plant utilization... -

Page 97

... the group's post-tax weighted average cost of capital and is adjusted where applicable to take into account any specific risks relating to the country where the cash-generating unit is located, although other rates may be used if appropriate to the specific circumstances. In 2009 the rates ranged... -

Page 98

... Accounting for pensions and other post-retirement benefits involves judgement about uncertain events, including estimated retirement dates, salary levels at retirement, mortality rates, rates of return on plan assets, determination of discount rates for measuring plan obligations, healthcare cost... -

Page 99

... shareholding in the company through savings-related and/or matching share plan arrangements. BP also uses performance plans (see Financial statements - Note 38 on page 172) as elements of remuneration for executive directors and senior employees. Shares acquired through the company's employee share... -

Page 100

... Accounts 2009 Additional information for shareholders Major shareholders and related party transactions Register of members holding BP ordinary shares as at 31 December 2009 Number of ordinary shareholders Percentage of total ordinary shareholders Percentage of total ordinary share capital Range... -

Page 101

BP Annual Report and Accounts 2009 Additional information for shareholders The following table shows dividends announced and paid by the company per ADS for each of the past five years. March June September December Total Dividends per American depositary share 2005 2006 2007 2008 2009 UK ... -

Page 102

... of operations, financial position or liquidity will not be material. For certain information regarding environmental proceedings, see Environment - United States on page 48. Share prices and listings Markets and market prices The primary market for BP's ordinary shares is the London Stock Exchange... -

Page 103

BP Annual Report and Accounts 2009 Additional information for shareholders Pence Dollars American depositary sharesa High Low Ordinary shares High Low Year ended 31 December 2005 2006 2007 2008 2009 Year ended 31 December 2008: First quarter Second quarter Third quarter Fourth quarter 2009: ... -

Page 104

.... It is not the company's intention to change its current policy of paying dividends in US dollars. Apart from shareholders' rights to share in BP's profits by dividend (if any is declared), the Articles of Association provide that the directors may set aside: • A special reserve fund out of the... -

Page 105

... trading in the UK through a permanent establishment generally will not be taxable in the UK on a dividend it receives from the company. A shareholder who is an individual resident for tax purposes in the UK is subject to UK tax but entitled to a tax credit on cash dividends paid on ordinary shares... -

Page 106

...gain or loss will generally be income or loss from sources within the US for foreign tax credit limitation purposes. The deductibility of capital losses is subject to limitations. We do not believe that ordinary shares or ADSs will be treated as stock of a passive foreign investment company, or PFIC... -

Page 107

... Guidance for Directors on the Combined Code (Turnbull). Based on this assessment, management has determined that BP's internal control over financial reporting as of 31 December 2009 was effective. The company's internal control over financial reporting includes policies and procedures that pertain... -

Page 108

... a code of business conduct and ethics for directors, officers and employees. BP has adopted a code of conduct, which applies to all employees, and has board governance principles which address the conduct of directors. In addition BP has adopted a code of ethics for senior financial officers as... -

Page 109

BP Annual Report and Accounts 2009 Additional information for shareholders Purchases of equity securities by the issuer and affiliated purchasers At the AGM on 16 April 2009, authorization was given to repurchase up to 1.8 billion ordinary shares in the period to the next AGM in 2010 or 15 July ... -

Page 110

..., dividend payments, the dividend reinvestment plan or the ADS direct access plan, or to change the way you receive your company documents (such as the Annual Report and Accounts, Annual Review and Notice of Meeting) please contact the BP Registrar or ADS Depositary. UK - Registrar's Office The BP... -

Page 111

... exchange gains and losses Research and development Operating leases Exploration for and evaluation of oil and natural gas resources Auditor's remuneration Finance costs Taxation Dividends Earnings per ordinary share Property, plant and equipment Goodwill Intangible assets Investments in jointly... -

Page 112

... (IFRS) as issued by the International Accounting Standards Board and IFRS as adopted by the European Union. The directors are required to prepare financial statements for each financial year that present fairly the financial position of the group and the financial performance and cash flows of the... -

Page 113

... the nine provisions of the June 2008 Combined Code specified for our review. Other matter We have reported separately on the parent company financial statements of BP p.l.c. for the year ended 31 December 2009 and on the information in the Directors' remuneration report that is described as having... -

Page 114

BP Annual Report and Accounts 2009 Consolidated financial statements of the BP group Group income statement For the year ended 31 December Note 2009 2008 $ million 2007 Sales and other operating revenues Earnings from jointly controlled entities - after interest and tax Earnings from associates - ... -

Page 115

... ended 31 December Note 2009 2008 $ million 2007 Profit for the year Currency translation differences Exchange gains on translation of foreign operations transferred to gain or loss on sale of businesses and fixed assets Actuarial (loss) gain relating to pensions and other post-retirement benefits... -

Page 116

...Other payables Derivative financial instruments Accruals Finance debt Deferred tax liabilities Provisions Defined benefit pension plan and other post-retirement benefit plan deficits Total liabilities Net assets Equity Share capital Reserves BP shareholders' equity Minority interest Total equity 19... -

Page 117

BP Annual Report and Accounts 2009 Consolidated financial statements of the BP group Group cash flow statement For the year ended 31 December Note 2009 2008 $ million 2007 Operating activities Profit before taxation Adjustments to reconcile profit before taxation to net cash provided by operating ... -

Page 118

... Reporting Standards The consolidated financial statements of the BP group for the year ended 31 December 2009 were approved and signed by the chairman and group chief executive on 26 February 2010 having been duly authorized to do so by the board of directors. BP p.l.c. is a public limited company... -

Page 119

...is stated at the previous carrying amount under UK generally accepted accounting practice. Goodwill may also arise upon investments in jointly controlled entities and associates, being the surplus of the cost of investment over the group's share of the net fair value of the identifiable assets. Such... -

Page 120

...incurred. Costs directly associated with an exploration well are initially capitalized as an intangible asset until the drilling of the well is complete and the results have been evaluated. These costs include employee remuneration, materials and fuel used, rig costs, delay rentals and payments made... -

Page 121

... future cash flows are adjusted for the risks specific to the asset group and are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money. An assessment is made at each reporting date as to whether there is any indication... -

Page 122

BP Annual Report and Accounts 2009 Notes on financial statements 1. Significant accounting policies continued Financial liabilities Financial liabilities are classified as financial liabilities at fair value through profit or loss; derivatives designated as hedging instruments in an effective hedge... -

Page 123

... conditions, other than conditions linked to the price of the shares of the company (market conditions). Non-vesting conditions, such as the condition that employees contribute to a savings-related plan, are taken into account in the grant-date fair value, and failure to meet a non-vesting condition... -

Page 124

... the total for each plan of the present value of the defined benefit obligation (using a discount rate based on high quality corporate bonds), less the fair value of plan assets out of which the obligations are to be settled directly. Fair value is based on market price information and, in the case... -

Page 125

... in equity if there is no change in control. When control is lost, any remaining interest in the entity is remeasured to fair value and a gain or loss recognized in profit or loss. The amendment is effective for annual periods beginning on or after 1 July 2009 and is to be applied retrospectively... -

Page 126

...year (2008 $64 million and 2007 $84 million). $ million 2009 2008 2007 Gains on sale of businesses and fixed assets Exploration and Production Refining and Marketing Other businesses and corporate 1,717 384 72 2,173 34 1,258 61 1,353 954 1,464 69 2,487 $ million 2009 2008 2007 Losses on sale... -

Page 127

... businesses and corporate During 2009, we disposed of our wind energy business in India and contributed our Fowler II wind energy development asset in exchange for a 50% equity interest in a jointly controlled entity, Fowler II Holdings LLC. In addition, there was a return of capital in the jointly... -

Page 128

... the cash generating unit is located, although other rates may be used if appropriate to the specific circumstances. In 2009 the rates ranged from 9% to 13% (2008 11% to 13%). The rate applied in each country is re-assessed each year. In certain circumstances the fair value less costs to sell may... -

Page 129

BP Annual Report and Accounts 2009 Notes on financial statements 4. Segmental analysis continued Other businesses and corporate comprises the Alternative Energy business, Shipping, the group's aluminium asset, Treasury (which in the segmental analysis includes all of the group's cash, cash ... -

Page 130

... and Accounts 2009 Notes on financial statements 4. Segmental analysis continued $ million 2008 Exploration and Production Refining and Marketing Other businesses and corporate Consolidation adjustment and eliminations By business Total group Segment revenues Sales and other operating revenues... -

Page 131

... and Accounts 2009 Notes on financial statements 4. Segmental analysis continued $ million 2007 Exploration and Production Refining and Marketing Other businesses and corporate Consolidation adjustment and eliminations By business Total group Segment revenues Sales and other operating revenues... -

Page 132

BP Annual Report and Accounts 2009 Notes on financial statements 4. Segmental analysis continued $ million 2009 By geographical area US Non-US Total Revenues Third party sales and other operating revenuesa Results Replacement cost profit before interest and taxation Non-current assets Other non-... -

Page 133

... as production taxes. There was no effect on the group profit or the group balance sheet. Financial statements 7. Depreciation, depletion and amortization $ million By business 2009 2008 2007 Exploration and Production US Non-US Refining and Marketing US Non-USa Other businesses and corporate US... -

Page 134

...the cash-generating unit is located. The rate to be applied to each country is reassessed each year. A discount rate of 11% has been used for all goodwill impairment calculations performed in 2009 (2008 11%). The business segment plans, which are approved on an annual basis by senior management, are... -

Page 135

... sources. Cash flows beyond the five-year plan period are extrapolated using a 2.4% growth rate (2008 cash flows beyond the three-year plan period were extrapolated using a 1.2% growth rate). 2009 Financial statements Sensitivity analysis Sensitivity of value in use to a change in refinery margins... -

Page 136

... (201) Excludes exchange gains and losses arising on financial instruments measured at fair value through profit or loss. 11. Research and development $ million 2009 2008 2007 Expenditure on research and development 587 595 566 12. Operating leases The presentation of operating lease expense... -

Page 137

...and Production segment. $ million 2009 2008 2007 Financial statements Exploration and evaluation costs Exploration expenditure written off Other exploration costs Exploration expense for the yeara Intangible assets - exploration expenditure Net assets Capital expenditure Net cash used in operating... -

Page 138

BP Annual Report and Accounts 2009 Notes on financial statements 14. Auditor's remuneration $ million Fees - Ernst & Young 2009 2008 2007 Fees payable to the company's auditors for the audit of the company's accountsa Fees payable to the company's auditors and its associates for other services ... -

Page 139

... of the effective tax rate The following table provides a reconciliation of the UK statutory corporation tax rate to the effective tax rate of the group on profit before taxation. $ million 2009 2008 2007 Financial statements Profit before taxation Tax on profit Effective tax rate 25,124... -

Page 140

BP Annual Report and Accounts 2009 Notes on financial statements 16. Taxation continued Deferred tax $ million Income statement 2009 2008 2007 2009 Balance sheet 2008 Deferred tax liability Depreciation Pension plan surpluses Other taxable temporary differences Deferred tax asset Petroleum revenue... -

Page 141

... in connection with employee share-based payment plans using the treasury stock method. Financial statements $ million 2009 2008 2007 Profit attributable to BP shareholders Less dividend requirements on preference shares Diluted profit for the year attributable to BP ordinary shareholders 16,578... -

Page 142

BP Annual Report and Accounts 2009 Notes on financial statements 19. Property, plant and equipment $ million Land and land improvements Plant, machinery and equipment Fixtures, fittings and office equipment Oil depots, storage tanks and service stations Oil and gas properties Buildings ... -

Page 143

BP Annual Report and Accounts 2009 Notes on financial statements 20. Goodwill $ million 2009 2008 Cost At 1 January Exchange adjustments Acquisitions Additions Deletions At 31 December Impairment losses At 1 January Impairment losses for the year At 31 December Net book amount at 31 December 9,... -

Page 144

...Note 43. Summarized financial information for the group's share of jointly controlled entities is shown below. $ million 2009 TNK-BP Other 2008 Total TNK-BP Other 2007 Total Sales and other operating revenues Profit before interest and taxation Finance costs Profit before taxation Taxation Minority... -

Page 145

... TNK-BP . Summarized financial information for the group's share of associates is set out below. $ million 2009 TNK-BP Other Total 2008 2007 Sales and other operating revenues Profit before interest and taxation Finance costs Profit before taxation Taxation Minority interest Profit for the year Non... -

Page 146

...fair value. Financial risk factors The group is exposed to a number of different financial risks arising from natural business exposures as well as its use of financial instruments including: market risks relating to commodity prices, foreign currency exchange rates, interest rates and equity prices... -

Page 147

...per month if the portfolio were left unchanged. $ million Financial statements Value at risk for 1 day at 95% confidence interval High Low Average 2009 Year end High Low Average 2008 Year end Group trading Oil price trading Natural gas price trading Power price trading Currency trading Interest... -

Page 148

... as interest rate trading in the value-at-risk table above. BP is also exposed to interest rate risk from the possibility that changes in interest rates will affect future cash flows or the fair values of its financial instruments, principally finance debt. While the group issues debt in a variety... -

Page 149

... increase in interest rates. (iv) Equity price risk The group holds equity investments, typically made for strategic purposes, that are classified as non-current available-for-sale financial assets and are measured initially at fair value with changes in fair value recognized in other comprehensive... -

Page 150

... positions. In managing its liquidity risk, the group has access to a wide range of funding at competitive rates through capital markets and banks. The group's treasury function centrally co-ordinates relationships with banks, borrowing requirements, foreign exchange requirements and cash management... -

Page 151

... is applied for loans associated with long-term gas supply contracts totalling $1,622 million (2008 $1,806 million) that mature within eight years. The table also shows the timing of cash outflows relating to trade and other payables and accruals. $ million 2009 Trade and other payables Finance debt... -

Page 152

... investments that have no fixed maturity date or coupon rate. These investments are classified as available-forsale financial assets and as such are recorded at fair value with the gain or loss arising as a result of changes in fair value recorded directly in equity. Accumulated fair value changes... -

Page 153

...margins on trading exchanges. See Note 24 for further information. 29. Valuation and qualifying accounts $ million Doubtful debts 2009 Fixed assets - investments Doubtful debts 2008 Fixed assets - investments 2007 Doubtful Fixed assets - debts investments At 1 January Charged to costs and expenses... -

Page 154

... hedge accounting, whether as a cash flow or fair value hedge or a hedge of a net investment in a foreign operation, and requires that any derivative that does not meet these criteria should be classified as held for trading and fair valued, with gains and losses recognized in the income statement... -

Page 155

... following table shows the changes in the day-one profits and losses deferred on the balance sheet. $ million 2009 Oil price Natural gas price Oil price 2008 Natural gas price Fair value of contracts not recognized through the income statement at 1 January Fair value of new contracts at inception... -

Page 156

... market data such as prices based on internal models or other valuation methods. This information is presented on a gross basis, that is, before netting by counterparty. $ million 2009 Less than 1 year 1-2 years 2-3 years 3-4 years 4-5 years Over 5 years Total Fair value of derivative assets Level... -

Page 157

... information. Additionally, where limited data exists for certain products, prices are interpolated using historic and long-term pricing relationships. Embedded derivative assets have the following fair values and maturities. $ million 2009 Less than 1 year 1-2 years 2-3 years 3-4 years 4-5 years... -

Page 158

BP Annual Report and Accounts 2009 Notes on financial statements 31. Derivative financial instruments continued Embedded derivative liabilities have the following fair values and maturities. $ million 2009 Less than 1 year 1-2 years 2-3 years 3-4 years 4-5 years Over 5 years Total Commodity price ... -

Page 159

...as fair value hedges of the interest rate risk on fixed rate debt issued by the group. The effectiveness of each hedge relationship is quantitatively assessed and demonstrated to continue to be highly effective. The loss on the hedging derivative instruments taken to the income statement in 2009 was... -

Page 160

... long-term funding when internally assessing the maturity profile of its finance debt. Similar treatment is applied for loans associated with long-term gas supply contracts totalling $1,622 million (2008 $1,806 million) that mature within eight years. The following table shows, by major currency... -

Page 161

...quoted prices or, where these are not available, discounted cash flow analyses based on the group's current incremental borrowing rates for similar types and maturities of borrowing. $ million 2009 Fair value Carrying amount Fair value 2008 Carrying amount Short-term borrowings Long-term borrowings... -

Page 162

...production facilities and pipelines at the end of their economic lives has been estimated using existing technology, at current prices or long-term assumptions, depending on the expected timing of the activity, and discounted using a real discount rate of 1.75% (2008 2.0%). These costs are generally... -

Page 163

... of service. The plans are funded to a limited extent. The obligation and cost of providing pensions and other post-retirement benefits is assessed annually using the projected unit credit method. The date of the most recent actuarial review was 31 December 2009. The group's principal plans are... -

Page 164

...follows: Policy range Asset category % Total equity Bonds/cash Property/real estate 45-75 17.5-50 0-10 Some of the group's pension plans use derivative financial instruments as part of their asset mix and to manage the level of risk. The group's main pension plans do not invest directly in either... -

Page 165

... Annual Report and Accounts 2009 Notes on financial statements 35. Pensions and other post-retirement benefits continued The expected long-term rates of return and market values of the various categories of asset held by the defined benefit plans at 31 December are set out below. The market values... -

Page 166

BP Annual Report and Accounts 2009 Notes on financial statements 35. Pensions and other post-retirement benefits continued $ million 2009 UK pension plans US other postUS retirement pension benefit plans plans Other plans Total Analysis of the amount charged to profit before interest and ... -

Page 167

BP Annual Report and Accounts 2009 Notes on financial statements 35. Pensions and other post-retirement benefits continued $ million 2008 UK pension plans US other postUS retirement pension benefit plans plans Other plans Total Analysis of the amount charged to profit before interest and ... -

Page 168

BP Annual Report and Accounts 2009 Notes on financial statements 35. Pensions and other post-retirement benefits continued $ million 2007 US other postretirement benefit plans UK pension plans US pension plans Other plans Total Analysis of the amount charged to profit before interest and ... -

Page 169

BP Annual Report and Accounts 2009 Notes on financial statements 36. Called-up share capital The allotted, called-up and fully paid share capital at 31 December was as follows: 2009 Issued Shares (thousand) $ million Shares (thousand) 2008 $ million Shares (thousand) 2007 $ million 8% cumulative ... -

Page 170

... to pensions and other post-retirement benefits Available-for-sale investments (including recycling) Cash flow hedges (including recycling) Profit for the year Total comprehensive income Dividends Share-based paymentsa Changes in associates' equity Minority interest buyout At 31 December 2009 5,176... -

Page 171

BP Annual Report and Accounts 2009 Notes on financial statements $ million Foreign currency translation reserve Availablefor-sale investments Sharebased payment reserve Profit and loss account BP shareholders' equity Merger reserve Other reserve Own shares Treasury shares Cash flow hedges ... -

Page 172

BP Annual Report and Accounts 2009 Notes on financial statements 37. Capital and reserves continued Share capital The balance on the share capital account represents the aggregate nominal value of all ordinary and preference shares in issue, including treasury shares. Share premium account The ... -

Page 173

... in the table below. $ million 2009 Pre-tax Tax Net of tax Currency translation differences (including recycling) Actuarial loss relating to pensions and other post-retirement benefits Available-for-sale investments (including recycling) Cash flow hedges (including recycling) Other comprehensive... -

Page 174

...Annual Report and Accounts 2009 Notes on financial statements 38. Share-based payments Effect of share-based payment transactions on the group's result and financial position $ million 2009 2008 2007 Total expense recognized for equity-settled share-based payment transactions Total expense (credit... -

Page 175

... Accounts 2009 Notes on financial statements 38. Share-based payments continued BP ShareMatch Plans These are matching share plans under which BP matches employees' own contributions of shares up to a predetermined limit. The plans are run in the UK and in more than 70 other countries. The UK plan... -

Page 176

... security costs Share-based payments Pension and other post-retirement benefit costs 9,702 780 521 1,213 12,216 2009 10,388 805 508 579 12,280 2008 9,808 771 428 504 11,511 2007 Number of employees at 31 December Exploration and Production Refining and Marketingb Other businesses and corporate... -

Page 177

...report on pages 81 to 92. Remuneration of directors and senior management $ million 2009 2008 2007 Total for all senior management Short-term employee benefits Post-retirement benefits Share-based payments 36 3 20 34 4 20 35 6 22 Financial statements Senior management, in addition to executive... -

Page 178

... the amount and timing of these costs, given the long-term nature of these obligations. BP believes that the impact of any reasonably foreseeable changes to these provisions on the group's results of operations, financial position or liquidity will not be material. The group generally restricts its... -

Page 179

...31 December 2009 and the group percentage of ordinary share capital or joint venture interest (to nearest whole number) are set out below. The principal country of operation is generally indicated by the company's country of incorporation or by its name. Those held directly by the parent company are... -

Page 180

BP Annual Report and Accounts 2009 Notes on financial statements 43. Subsidiaries, jointly controlled entities and associates continued Jointly controlled entities % Country of incorporation or registration Principal activities Angola LNG Supply Services Atlantic 4 Holdings Atlantic LNG 2/3 ... -

Page 181

...compliance and governance processes, see pages 24 to 26. Oil and natural gas exploration and production activities $ million 2009 Europe North America Rest of Europe Rest of North America South America Africa Asia Australasia Total UK US Russia Rest of Asia Subsidiariesa Capitalized costs at 31... -

Page 182

...) Oil and natural gas exploration and production activities continued $ million 2009 Europe North America Rest of North America South America Africa Asia Australasia Total UK Rest of Europe US Russia Rest of Asia Equity-accounted entities (BP share)a Capitalized costs at 31 Decemberb Gross... -

Page 183

BP Annual Report and Accounts 2009 Supplementary information on oil and natural gas (unaudited) Oil and natural gas exploration and production activities continued $ million 2008 Europe North America Rest of Europe Rest of North America South America Africa Asia Australasia Total UK US Russia ... -

Page 184

BP Annual Report and Accounts 2009 Supplementary information on oil and natural gas (unaudited) Oil and natural gas exploration and production activities continued $ million 2007 Europe North America Rest of Europe Rest of North America South America Africa Asia Australasia Total UK US Russia ... -

Page 185

BP Annual Report and Accounts 2009 Supplementary information on oil and natural gas (unaudited) Movements in estimated net proved reserves million barrels Crude oila Europe North America Rest of North America South America Africa Asia Australasia 2009 Total UK Rest of Europe USe Russia Rest of... -

Page 186

BP Annual Report and Accounts 2009 Supplementary information on oil and natural gas (unaudited) Movements in estimated net proved reserves continued billion cubic feet Natural gasa Europe North America Rest of North America South America Africa Asia Australasia 2009 Total UK Rest of Europe US ... -

Page 187

BP Annual Report and Accounts 2009 Supplementary information on oil and natural gas (unaudited) Movements in estimated net proved reserves continued million barrels Crude oila Europe North America Rest of Europe Rest of North America South America Africa Asia Australasia 2008 Total UK USe Russia... -

Page 188

BP Annual Report and Accounts 2009 Supplementary information on oil and natural gas (unaudited) Movements in estimated net proved reserves continued billion cubic feet Natural gasa Europe North America Rest of Europe Rest of North America South America Africa Asia Australasia 2008 Total UK US ... -

Page 189

BP Annual Report and Accounts 2009 Supplementary information on oil and natural gas (unaudited) Movements in estimated net proved reserves continued million barrels Crude oila Europe North America Rest of Europe Rest of North America South America Africa Asia Australasia 2007 Total UK USf Russia... -

Page 190

BP Annual Report and Accounts 2009 Supplementary information on oil and natural gas (unaudited) Movements in estimated net proved reserves continued billion cubic feet Natural gasa Europe North America Rest of Europe Rest of North America South America Africa Asia Australasia 2007 Total UK US ... -

Page 191

... conditions change. BP cautions against relying on the information presented because of the highly arbitrary nature of the assumptions on which it is based and its lack of comparability with the historical cost information presented in the financial statements. $ million 2009 Europe North America... -

Page 192

BP Annual Report and Accounts 2009 Supplementary information on oil and natural gas (unaudited) Standardized measure of discounted future net cash flows and changes therein relating to proved oil and gas reserves continued $ million Europe North America Rest of Europe Rest of North America South ... -

Page 193

...2008 and 2007. Production for the yeara Europe North America Rest of Europe Rest of North America South America Africa Asia Australasia Total UK US Russia Rest of Asia thousand barrels per day Subsidiaries Crude oilb 2009 2008 2007 Natural gasc 2009 2008 2007 Equity-accounted entities (BP share... -

Page 194

... North America Rest of North America South America Africa Asia Australasia Total UK Rest of Europe US Russia Rest of Asia 2009 Exploratory Productive Dry Development Productive Dry 2008 Exploratory Productive Dry Development Productive Dry 2007 Exploratory Productive Dry Development Productive... -

Page 195

BP Annual Report and Accounts 2009 Parent company financial statements of BP p.l.c. Statement of directors' responsibilities in respect of the parent company financial statements The directors are responsible for preparing the financial statements in accordance with applicable United Kingdom law ... -

Page 196

...Report and Accounts 2009 Parent company financial statements of BP p.l.c. Independent auditor's report to the members of BP p.l.c. We have audited the parent company financial statements of BP p.l.c. for the year ended 31 December 2009 which comprise the company balance sheet, the company cash flow... -

Page 197

... and deficit Defined benefit pension plan surplus Defined benefit pension plan deficit Net assets Represented by Capital and reserves Called-up share capital Share premium account Capital redemption reserve Merger reserve Own shares Treasury shares Share-based payment reserve Profit and loss account... -

Page 198

... and Accounts 2009 Parent company financial statements of BP p.l.c. Company cash flow statement For the year ended 31 December Note 2009 2008 $ million 2007 Net cash (outflow) inflow from operating activities Servicing of finance and returns on investments Interest received Interest paid Dividends... -

Page 199

...of the year of long-term market returns on plan assets, adjusted for the effect on the fair value of plan assets of contributions received and benefits paid during the year. The difference between the expected return on plan assets and the interest cost is recognized in the income statement as other... -

Page 200

... the total for each plan of the present value of the defined benefit obligation (using a discount rate based on high quality corporate bonds), less the fair value of plan assets out of which the obligations are to be settled directly. Fair value is based on market price information and, in the case... -

Page 201

... to the company's annual return made to the Registrar of Companies. Country of incorporation Financial statements Subsidiary undertakings % Principal activities International BP Global Investments BP International BP Holdings North America BP Shipping BP Corporate Holdings Burmah Castrol... -

Page 202

... are used to determine the pension liabilities at that date and the pension cost for 2010. Financial assumptions 2009 2008 % 2007 Expected long-term rate of return Discount rate for plan liabilities Rate of increase in salaries Rate of increase for pensions in payment Rate of increase in deferred... -

Page 203

... changes in exchange rates (increasing the reported value of investments on consolidation when expressed in US dollars). Movements in the value of plan assets during the year are shown in detail below. $ million 2009 Expected long-term rate of return % Market value $ million Expected long-term rate... -

Page 204

BP Annual Report and Accounts 2009 Parent company financial statements of BP p.l.c. 6. Pensions continued $ million 2009 2008 Represented by Asset recognized Liability recognized The surplus (deficit) may be analysed between funded and unfunded plans as follows Funded Unfunded The defined benefit ... -

Page 205

...% of the capital paid up on the preference shares and (ii) the excess of the average market price of such shares on the London Stock Exchange during the previous six months over par value. Repurchase of ordinary share capital The company did not purchase any ordinary shares in 2009 (2008 269,757,188... -

Page 206

...as an appropriation of profit in the year ended 31 December 2010. Managing Capital The company defines capital as the total equity of the company. The company's objective for managing capital is to deliver competitive, secure and sustainable returns to maximize long-term shareholder value. BP is not... -

Page 207

BP Annual Report and Accounts 2009 Parent company financial statements of BP p.l.c. 11. Share-based payments Effect of share-based payment transactions on the company's result and financial position $ million 2009 2008 2007 Total expense recognized for equity-settled share-based payment ... -

Page 208

BP Annual Report and Accounts 2009 Parent company financial statements of BP p.l.c. 11. Share-based payments continued Savings and matching plans BP ShareSave Plan This is a savings-related share option plan under which employees save on a monthly basis, over a three-or five-year period, towards ... -

Page 209

... Annual Report and Accounts 2009 Parent company financial statements of BP p.l.c. 11. Share-based payments continued Fair values and associated details for options and shares granted 2009 ShareSave 3 year ShareSave 5 year ShareSave 3 year 2008 ShareSave 5 year ShareSave 3 year 2007 ShareSave 5 year... -

Page 210

... chairman and the non-executive directors and, for executive directors, salary and benefits earned during the relevant financial year, plus bonuses awarded for the year. Ex gratia superannuation payments of $3 million were included in 2007. Compensation for loss of office was $1 million in 2008... -

Page 211

[email protected] BP's reports and publications are available to view online or download from www.bp.com/annualreport. Annual Review Read a summary of our ï¬nancial and operating performance in BP Annual Review 2009 in print or online. www.bp.com/annualreview Sustainability Review Read the summary BP... -

Page 212

beyond petroleum®