BMW 2003 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2003 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207

|

|

001 BMW Group in figures

004 Report of the Supervisory Board

008 Supervisory Board

011 Board of Management

012 Group Management Report

12 A Review of the Financial Year

29 Outlook

30 Financial Analysis

44 Risk Management

047 BMW Stock

050 Corporate Governance

054 Group Financial Statements

118 BMW AG Principal Subsidiaries

120 BMW Group10-year Comparison

122 BMW Group Locations

124 Glossary, Index

94

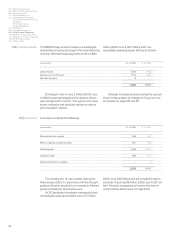

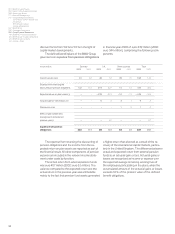

reimbursement or a right to reduce future contribu-

tions,

the surplus amount is recognised in accordance

with IAS 19 as an asset under miscellaneous assets.

A liability is recognised under pension provisions in

the case of funded plans where the pension expense

exceeds the contributions paid to the fund.

Actuarial gains or losses may result from in-

creases or decreases in either the present value of

the defined benefit obligation or in the fair value of

the fund assets. Causes of actuarial gains or losses

include the effect of changes in the measurement

parameters, changes in estimates caused by the

actual development of risks impacting on pension

obligations and differences between the actual and

expected return on plan assets. Past service cost

arises where a BMW Group company introduces a

defined benefit plan or changes the benefits payable

under an existing plan.

Based on the measurement principles contained

in IAS 19, the following funding status applies to

the Group’s pension plans:

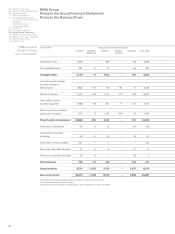

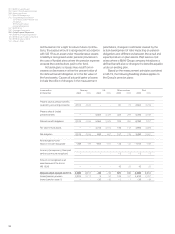

in euro million Germany UK Other countries Total

31 December 2003 2002 2003 2002 2003 2002 2003 2002

Present value of pension benefits

covered by accounting provisions 2,513 2,186 ––91 73 2,604 2,259

Present value of funded

pension benefits – –5,564 5,329 222 209 5,786 5,538

Defined benefit obligations 2,513 2,186 5,564 5,329 313 282 8,390 7,797

Fair value of fund assets – –4,744 4,722 156 144 4,900 4,866

Net obligation 2,513 2,186 820 607 157 138 3,490 2,931

Actuarial gains (+) and

losses (–) not yet recognised – 208 –69 – 852 – 617 –44 –52 –1,104 – 738

Income (+) or expense (–) from past

service cost not yet recognised – ––––2 –3 –2 –3

Amount not recognised as an

asset because of the limit in

IAS 19.58 – –––10 23 10 23

Balance sheet amount at 31.12. 2,305 2,117 –32 –10 121 106 2,394 2,213

thereof pension provision 2,305 2,117 333 122 107 2,430 2,257

thereof pension asset (–) – ––35 –43 –1 –1 –36 –44