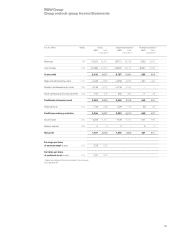

BMW 2003 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2003 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The consolidated financial statements of BMW AG

(“BMW Group financial statements” or “Group finan-

cial statements”) at 31 December 2003 have been

drawn up in accordance with International Financial

Reporting Standards (IFRSs) issued by the Interna-

tional Accounting Standards Board (IASB), London

and valid at the balance sheet date. The designation

“IFRSs” also includes all valid International Account-

ing Standards (IASs). All interpretations of the Inter-

national Financial Reporting Interpretations Com-

mittee (IFRIC), formerly the Standing Interpretations

Committee (SIC), which are mandatory for the finan-

cial year 2003, were also applied.

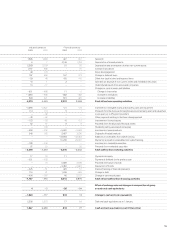

The BMW Group and sub-group income state-

ments and balance sheets correspond to the classi-

fication provisions contained in §298 (in conjunction

with §266 and §275) of the German Commercial

Code (HGB), whereby the income statements are

presented using the cost of sales format. In order to

improve clarity, certain items are aggregated in the

income statement and balance sheet. These items

are disclosed and analysed separately in the Notes.

In order to support the sale of BMW products,

the BMW Group provides various financial services –

mainly loan and lease financing – to its customers.

The inclusion of the financial services activities of

the Group therefore has an impact on the Group

financial statements. In order to provide a better in-

sight into the assets, liabilities, financial position and

performance of the Group, additional information

has been presented in the BMW Group financial

statements on the industrial and the financial opera-

tions. Financial operations include financial services

and the activities of the Group financing companies.

The operating interest income and expense of

financial operations are included in revenues and

cost of sales respectively. The holding companies

BMW (UK) Holdings Ltd., Bracknell, BMW Holding

B.V., The Hague, BMW Österreich Holding GmbH,

Steyr, and BMW (US) Holding Corp., Wilmington,

Del., are allocated to industrial operations. The main

business transactions between the industrial and

financial operations, which are eliminated in the

Group financial statements, are internal sales of

products,the provision of funds for Group companies

and the related interest. These additional disclosures

allow the assets, liabilities, financial position and per-

formance of the industrial and financial operations

to be presented, in accordance with the recognition

and measurement principles stipulated by IFRSs, as

if they were two separate groups. This information,

which has not been audited by the Group auditors,

is provided on a voluntary basis.

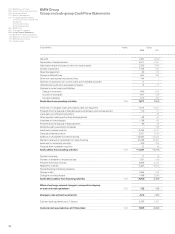

In conjunction with the refinancing of financial

services business, a significant volume of receiv-

ables arising from customer and dealer financing are

sold. Similarly rights and obligations relating to leases

are sold.The sale of receivables is a well established

instrument used by industrial and financial com-

panies. These transactions are usually in the form

of so-called “asset backed financing” transactions.

This involves the sale of a portfolio of receivables to

a trust which, in turn, issues marketable securities

to refinance the purchase price. The BMW Group

continues to “service” the receivables (including

debt collection) and receives an appropriate fee for

these services. In accordance with IAS 27 (Consoli-

dated Financial Statements and Accounting for

Investments in Subsidiaries) and the interpretation

in SIC 12 (Consolidation – Special Purpose Entities),

such assets remain in the Group financial state-

ments although they have been legally sold. Gains

and losses relating to the sale of such assets are not

recognised until the assets are removed from the

Group balance sheet. The balance sheet value of

the assets sold at 31 December 2003 totalled euro

5.0 billion (31.12.2002: euro 4.5 billion). For an addi-

tional understanding of the asset, liability and finan-

cial position of the BMW Group, the Group balance

sheet contains a supplementary disclosure of the

balance sheet total adjusted for assets which have

been sold.

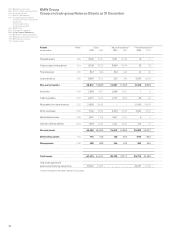

BMW Group

Notes to the Group Financial Statements

Accounting principles and policies

[1]Basis of preparation

61