BMW 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.33

mobiles segment increased by 0.4% despite the

lower exchange rate of the US dollar. Expenditure for

the product and market offensive meant that the

segment’s profit from ordinary activities was 4.2%

lower than in the previous year.

Revenues of the Motorcycles segment fell by

6.6% as a result of the exchange rate impact. The

segment result fell by 16.7%, which was attributable,

amongst other factors, to up-front expenditure for

new models which will come onto the market from

the beginning of the financial year 2004.

The BMW Group expanded the activities of its

Financial Services segment and continued its growth

course in 2003. Revenues fell by 9.1% mainly as

aresult of exchange rate changes. The segment

result

advanced by 7.1%, another very satisfying per-

formance.

This improvement was largely attributable

to higher business volumes and continuously falling

financing costs.

As in the previous year, reconciliations to the

Group profit from ordinary activities were negative

overall, whereby the amount was 14.7% lower

than in the previous year. This was due to the over-

all improved results of the Group’s financing com-

panies and financial holding companies, which

more than offset the higher eliminations of inter-

segment profit on leased assets relating to financial

services.

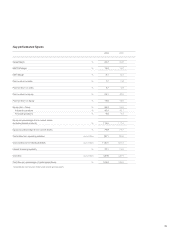

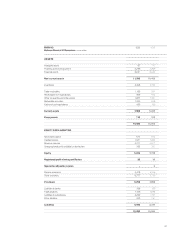

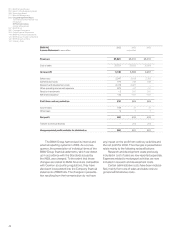

Financial position

The cash flow statements of the BMW Group and

its sub-groups show the sources and applications

of cash flows for the financial years 2003 and 2002,

classified into cash flows from operating, investing

and financing activities.

Based on the net profit for the year, the cash

flows from operating activities are derived using the

indirect method. Cash flows from investing and fi-

nancing activities are based on actual cash pay-

ments and receipts. Cash and cash equivalents in

the cash flow statement correspond to those dis-

closed in the balance sheet.

Operating activities of the BMW Group during

the financial year 2003 generated a positive cash

flow of euro 7,871 million (2002: euro 7,250 million).

In computing this figure, cash outflows relating to

the Rover disengagement amounting to euro 49 mil-

lion (2002: euro174 million) were allocated to in-

vesting activities.

The cash outflow from investing activities

amounted to euro 11,231 million, an increase of

euro 1,516 million compared to the previous year.

This higher cash outflow resulted mainly from the

sharp increase in the net investment in financial

services business. On a net basis, this was euro

910 million higher than in the previous year. Capital

expenditure on intangible assets and property, plant

and equipment resulted in an additional cash out-

flow of euro 164 million. Cash outflow for invest-

ments in marketable securities, which are held as

a liquidity reserve, amounted to euro 700 million, an

increase of euro 366 million compared to the pre-

vious year. 70.1% (2002: 74.6%) of the cash out-

flow from investing activities was covered by the cash

inflow from operating activities.

The cash flow statement for industrial operations

shows, as in the previous year, that the cash inflow

from operating activities exceeded the cash outflow

from investing activities by 2.6% (2002: 7.2%).

The cash flow from financing activities of the

BMW Group gave rise to a cash inflow of euro

2,768 million which was earmarked to refinance

sales financing activities.

After adjustment for the effects of exchange

rate fluctuations and changes in the composition

of the BMW Group, totalling a negative amount

of euro 82 million (2002: negative amount of euro

99 million), the various cash flows resulted in a de-

crease in cash and cash equivalents of euro 674 mil-

lion (2002: decrease of euro 104 million).