BMW 2003 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2003 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.001 BMW Group in figures

004 Report of the Supervisory Board

008 Supervisory Board

011 Board of Management

012 Group Management Report

12 A Review of the Financial Year

29 Outlook

30 Financial Analysis

44 Risk Management

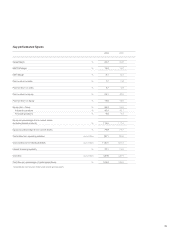

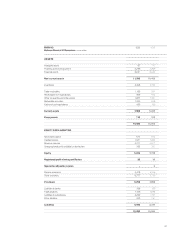

047 BMW Stock

050 Corporate Governance

054 Group Financial Statements

118 BMW AG Principal Subsidiaries

120 BMW Group10-year Comparison

122 BMW Group Locations

124 Glossary, Index

46

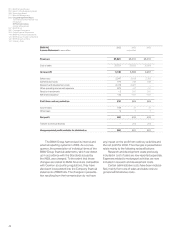

–The financing and lease business is refinanced as

a general rule in each of the markets in the relevant

currency so as to avoid currency risks.

–A major part of financing and lease business within

the Financial Services segment is refinanced on the

capital markets. The excellent credit-standing of

the BMW Group, reflected in the long-standing first-

class short-term ratings issued by Moody’s (P-1) and

Standard & Poor’s (A-1), allows the BMW Group to

obtain competitive conditions.

Risks relating to the measurement of financial

assets

–Fluctuations on the international securities mar-

kets can lead to a lasting decline in value of financial

assets. In this situation, IAS 39 (in conjunction with

IAS 36) requires that impairment losses are recog-

nised with income effect. A review, which also took

account of external analyses, came to the conclu-

sion that no impairment losses were required to be

recognised at 31 December 2003.

Legal risks

– The BMW Group is not involved in any court or

arbitration proceedings which could have a signifi-

cant impact on the economic position of the Group.

–Like all enterprises, the BMW Group is exposed

to the risk of warranty claims. Adequate provisions

have been recognised in the balance sheet to cover

such claims. Part of the risk, especially relating to

the American market, has been insured up to eco-

nomically acceptable levels. The high quality of

BMW

Group products, underpinned by regular quality

audits and on-going improvement measures, helps

to reduce this risk.

Personnel risks

–As an attractive employer, the BMW Group has a

strong position in the intense competition for quali-

fied technical and management staff. Employee

satisfaction and a low level of employee fluctuation

also help to minimise the risk of know-how drift.

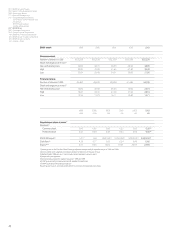

–The general increase in life expectancy and

changes in the age structure of the population at

large also have an affect on the pension obligations

of the BMW Group.

BMW AG recognises full provisions for pension

obligations to employees in Germany based on

actuarial valuations. The funds remain in the com-

pany and thus help to finance on-going operations.

Pension entitlements in the USA and the re-

maining pension obligations in the United Kingdom

are funded mainly by fixed-income securities with a

high level of creditworthiness and, to a minor extent

,

by investment in shares. Overall, this contributes to a

reduction

in the risk of a possible short-fall in coverage

as a result of a poor performance of the stock mar-

kets.The amount of obligations not recognised in

the balance sheet in accordance with the corridor

approach of IAS 19 is minimal. The relevant amounts

are being recognised over period of up to 15 years.

The short-fall in 2003 leads to additional payment

obligations to the pension funds of euro 24.6 million.

IT risks

–In the area of information technology, the BMW

Group undertakes various measures relating to

employees, organisational procedures, applications,

systems and networks in order to protect itself from

unauthorised access or misuse of data.

Internal rules for handling data and for the

safe use of information systems apply throughout

the Group. Internal communications reinforces the

awareness of employees for security issues.

Amongst the technical measures taken are

certain standard activities such as the use of virus

scanners, firewall systems and access controls at

operating system and application level. These

measures serve to protect confidentiality, integrity

and authenticity.