BMW 2003 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2003 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

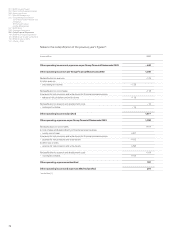

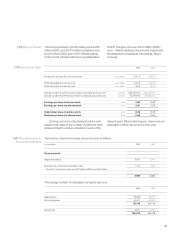

The tax expense/benefits for prior years include

in 2002 a corporation tax reduction of euro 50 million

relating to the dividend payments of BMW AG. In

the year under report, there was no similar reduction.

As a consequence of the Tax Preference Reduction

Act enacted on 16 May 2003, the claims for the cor-

poration tax reduction on the payment of dividends

by BMW AG in 2003 were suspended. Other vari-

ances include a reversal of the valuation allowance

(euro 40 million) on deferred tax assets relating to

tax losses available for carry forward in the United

Kingdom.

001 BMW Group in figures

004 Report of the Supervisory Board

008 Supervisory Board

011 Board of Management

012 Group Management Report

12 A Review of the Financial Year

29 Outlook

30 Financial Analysis

44 Risk Management

047 BMW Stock

050 Corporate Governance

054 Group Financial Statements

118 BMW AG Principal Subsidiaries

120 BMW Group10-year Comparison

122 BMW Group Locations

124 Glossary, Index

82

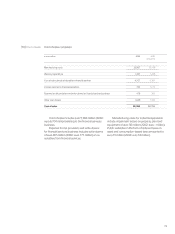

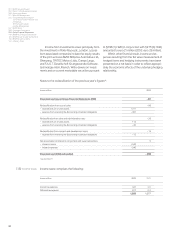

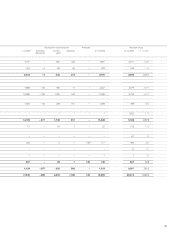

Deferred tax assets on tax loss carryforwards

decreased by euro 439 million compared to the

previous year. This was due to the further utilisation

of tax losses, in particular by BMW AG. A valuation

allowance is recognised on deferred tax assets when

recoverability is uncertain. In determining the level

of the valuation allowance, all positive and negative

factors concerning the likely existence of sufficient

taxable profits in the future are taken into

account.

These estimates can change depending on

the

actual course of events. The valuation allowance in-

cludes euro 226 million (2002: euro 293 million)

on

tax loss carryforwards and euro 440 million (2002:

euro 489 million) on losses on disposals (so called

“capital losses”) in the United Kingdom, which can

only be offset against capital gains, but not against

operating profits. In addition, there is a valuation

allowance of euro 435 million (2002: euro 523 mil-

lion) on deferred tax assets relating to capital

allowances in the United Kingdom which is shown

above in intangible assets and property, plant and

equipment. The valuation allowance decreased

in total by euro 204 million. This includes euro

129 million resulting from the translation of foreign

currency financial statements and which are recog-

nised directly in equity, the deferred tax expense

being therefore only reduced by euro 75 million.

Equity is reduced at the balance sheet date by

deferred tax liabilities of euro 474 million (2002: euro

1,042 million) recognised directly in equity. As in

the previous year, this was the result of the positive

market value changes of interest and currency de-

rivatives recognised directly in equity.

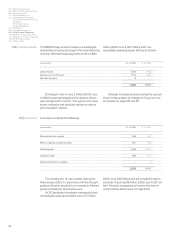

The actual tax expense for the financial year

2003 of euro1,258 million (2002: euro 1,277 million)

is euro 31 million lower (2002: euro 6 million) than

the expected tax expense of euro 1,289 million

(2002: euro 1,283 million) which would theoretically

arise if the tax rate of 40.21% (2001: 38.9%), appli-

cable for German companies, was applied across

the Group. The difference between the expected

and actual tax expense is attributable to the following:

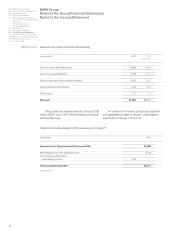

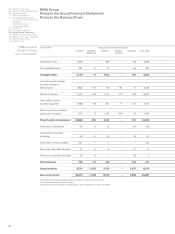

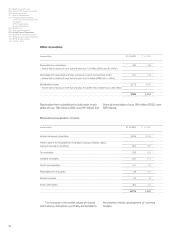

in euro million 2003 2002

Expected tax expense 1,289 1,283

Variances due to different tax rates – 101 –98

Ta x reductions (–)/tax increases (+) as a result of non-taxable income and

non-deductible expenses 36 65

Ta x expense (+)/benefits (–) for prior periods 102 32

Other variances –68 –5

Actual tax expense 1,258 1,277