BMW 2003 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2003 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.107

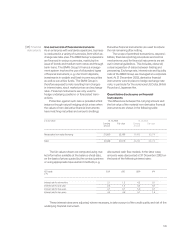

(2002: euro 314 million). During the year under

report, positive changes in fair value measurement

amounting to euro 845 million (2002: euro 1,528

million) were recognised directly in equity. Of this

amount, euro 677 million (2002: euro 1,727 million)

relate to positive effects from cash flow hedges and

euro 168 million (2002: euro 199 million negative)

relate to positive effects from available-for-sale se-

curities.

The fair values of financial instruments relating

to hedged forecasted transactions are recognised

directly in accumulated other equity. In the financial

year under report, positive fair value measurement

changes of euro 602 million (2002: euro 161 million)

were removed from accumulated other equity and

realised during the year. As a result of the situation

on the capital markets, write-downs of euro1 million

(2002: euro 22 million) on available-for-sale securi-

ties were recognised as expenses and reversals of

write-downs on current marketable securities of

euro 3 million (2002: euro – million) were recognised

as income. In 2003, losses of euro 20.6 million

(2002: euro 33.3 million) were realised on the dis-

posal of available-for-sale securities and the equiva-

lent

amount removed from accumulated other equity

and recognised in the income statement.

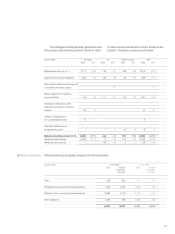

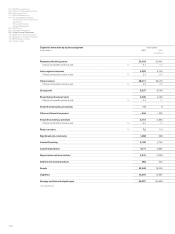

The cash flow statements shows how the cash and

cash equivalents of the BMW Group, industrial oper-

ations and financial operations have changed in the

course of the year as a result of cash inflows and

cash outflows. In accordance with IAS 7 (Cash Flow

Statements), cash flows are classified into cash flows

from operating, investing and financing activities.

The cash flow statements of the BMW Group are

presented on pages 58 and 59.

Cash and cash equivalents included in the cash

flow statement comprise cash on hand, cheques,

deposits at the Federal Bank and cash at bank in-

cluded in the balance sheet, to the extent that they

are available within three months from the balance

sheet date. The negative impact of changes in cash

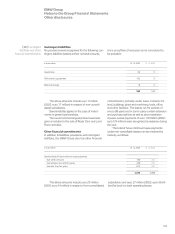

Credit risk

Financial assets are recognised in the balance sheet

net of write-downs for the risk that counter-parties

are unable to fulfil their contractual obligations, irre-

spective of the value of collateral received. In the

case of all performance relationships which underlie

non-derivative financial instruments, collateral is

required, information on the credit-standing of the

counter-party obtained or historical data based on

the existing business relationship (i.e. payment

patterns to date) reviewed in order to minimise the

credit risk. The nature and extent depends on the

type and amount of the relevant transaction. Write-

downs are recorded as soon as credit risks are iden-

tified on individual financial assets. In the case of

derivative financial instruments, the Group is also

exposed to a credit risk which results from the non-

performance of contractual agreements on the part

of the contracting party. This credit risk is minimised

by the fact that the Group only enters into such

contracts with parties of first-class credit standing.

The general credit risk on derivative financial instru-

ments utilised by the BMW Group is therefore not

considered to be significant. A concentration of

credit risk with particular borrowers or groups of bor-

rowers has not been identified.

and cash equivalents due to the effect of exchange

rate fluctuations was, as in the previous year, euro

109 million.

The cash flows from investing and financial

activities are based on actual payments and receipts.

The cash flow from operating activities is computed

using the indirect method, starting from the net

profit of the Group. Under this method, changes in

assets and liabilities relating to operating activities

are adjusted for currency translation effects and

changes in the composition of the Group. The

changes in balance sheet positions shown in the

cash flow statement do not therefore agree directly

with the amounts shown in the Group and sub-

group balance sheets.

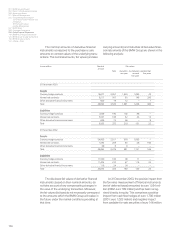

[38]Explanatory notes

to the cash flow

statements