BMW 2003 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2003 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

where,

deferred tax expense was reduced by euro

11 million. In the previous year, the deferred tax

expense was increased by euro 7 million as a result

of changes in tax rates.

No taxes arose in conjunction with extraordinary

items or from the discontinuation of operations in

the year under report. The income tax expense does

not include any amounts relating to changes in ac-

counting policies.

Deferred taxes were not recognised on retained

profits of euro 9,419 million (2002: euro 8,973 mil-

lion), as it is intended to invest these profits to main-

tain and expand the business volume of the relevant

companies. A computation was not made of the

potential impact of income taxes on the grounds of

disproportionate expense.

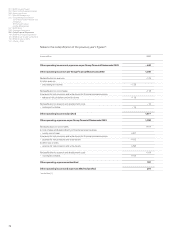

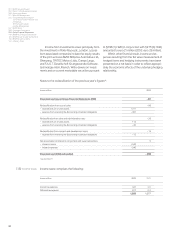

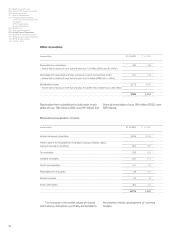

Deferred tax assets and liabilities at 31 December

were attributable to the positions, as shown below. For

the year under report, deferred tax assets and liabilities

relating to provisions were offset against

each other

within the appropriate position, whereas in the

pre-

vious year, the offsetting effect was shown on the line

“netting”. Comparative figures have been reclassified.

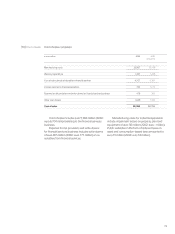

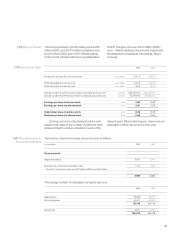

The increase in current taxes is mainly attribut-

able to the fact that tax losses arising in the USA in

conjunction with the Worker Assistance and Job

Creation Act could not, unlike the previous year, be

fully offset against taxable income.

The reduction in the deferred tax expense

relates to the first-time recognition of deferred tax

assets of euro192 million on the tax losses which

cannot be carried back in the USA.

Deferred taxes are computed using tax rates

based on laws already enacted in the various tax

jurisdictions or using rates that are expected to apply

at the date when the amounts are paid or recovered.

In Germany, on the basis of the one-off effect of

the Flood Victims Solidarity Act applicable for 2003,

a corporation tax rate of 26.5% applies. After taking

account of the average multiplier rate (Hebesatz)

of 410% for municipal trade tax and the solidarity

charge of 5.5%, the overall tax rate for BMW com-

panies in Germany is 40.21% (2002: 38.9%). The

tax rates for companies outside Germany range

from 10.0% to 41.7% (2002: 10.0% to 42.0%).

As a result of changed tax rates in Germany and else-

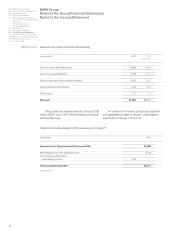

in euro million Deferred tax assets Deferred tax liabilities

2003 2002 2003 2002

Intangible assets and property, plant and equipment 1,304 1,424 4,003 3,732

Financial assets 1 122

Current assets 867 601 4,130 3,687

Ta x loss carryforwards 1,117 1,556 ––

Provisions 721 729 23 56

Liabilities 2,419 2,592 543 400

Consolidations 1,186 1,099 139 120

7,615 8,002 8,840 7,997

Valuation allowance – 1,101 –1,305 ––

Netting – 6,339 – 6,505 – 6,339 – 6,505

175 192 2,501 1,492