BMW 2003 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2003 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

001 BMW Group in figures

004 Report of the Supervisory Board

008 Supervisory Board

011 Board of Management

012 Group Management Report

12 A Review of the Financial Year

29 Outlook

30 Financial Analysis

44 Risk Management

047 BMW Stock

050 Corporate Governance

054 Group Financial Statements

118 BMW AG Principal Subsidiaries

120 BMW Group10-year Comparison

122 BMW Group Locations

124 Glossary, Index

106

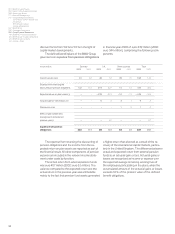

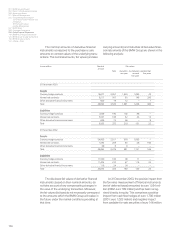

The nominal amounts of derivative financial

instruments correspond to the purchase or sale

amounts or contract values of the underlying trans-

actions. The nominal amounts, fair values (and also

The disclosed fair values of derivative financial

instruments, based on their nominal amounts, do

not take account of any compensating changes in

the value of the underlying transaction. Moreover,

the fair values disclosed do not necessarily correspond

to the amounts which the BMW Group will realise in

the future under the market conditions prevailing at

that time.

carrying amounts) and maturities of derivative finan-

cial instruments of the BMW Group are shown in the

following analysis:

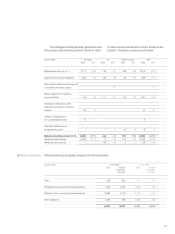

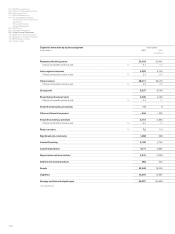

At 31 December 2003, the positive impact from

the fair value measurement of financial instruments

(net of deferred taxes) amounted to euro 1,554 mil-

lion (2002: euro 709 million) and has been recog-

nised directly in equity. This comprises a positive

impact from cash flow hedges of euro 1,700 million

(2001: euro 1,023 million) and negative impact

from available-for-sale securities of euro 146 million

in euro million Nominal Fair values

amount

To t a l

due within due between due later than

one year one and five years

five years

31 December 2003

Assets

Currency hedge contracts 16,877 2,957 1,824 1,090 43

Interest rate contracts 9,217 567 65 146 356

Other derivative financial instruments 600 19 12 – 7

To tal 26,694 3,543 1,901 1,236 406

Liabilities

Currency hedge contracts 3,169 190 102 88 –

Interest rate contracts 5,527 108 52 43 13

Other derivative financial instruments 639 74 65 – 9

To tal 9,335 372 219 131 22

31 December 2002

Assets

Currency hedge contracts 24,063 2,011 918 1,093 –

Interest rate contracts 5,184 259 65 28 166

Other derivative financial instruments 38 8 8 – –

To tal 29,285 2,278 991 1,121 166

Liabilities

Currency hedge contracts 11,530 100 89 11 –

Interest rate contracts 11,404 210 67 119 24

Other derivative financial instruments 118 24 24 – –

To tal 23,052 334 180 130 24