BMW 2003 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2003 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.69

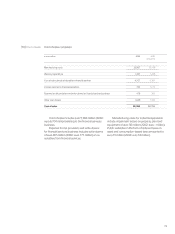

Other provisions are recognised when the

Group has an obligation to a third party, an outflow of

resources is probable and a reliable estimate can be

made of the amount of the obligation. The measure-

ment of other provisions – in particular in the case

of warranty obligations and expected losses on

onerous contracts – takes account of all cost

com-

ponents which are included in the inventory valuation.

Non-current provisions with a remaining period of

more than one year are discounted to the present

value of the expenditures expected to settle the

obligation at the balance sheet date.

Financial liabilities are measured on first-

time recognition at cost, which is equivalent to the

fair value of the consideration given. Transaction

costs are included in this initial measurement.

Subsequent to initial recognition, liabilities are, with

the exception of derivative financial instruments,

measured at amortised cost. The BMW Group has

no liabilities which are held for trading. Liabilities

from finance leases are stated at the present value

of the future lease payments and disclosed under

debt.

The preparation of the Group financial state-

ments in accordance with standards issued by the

IASB requires management to make certain

assump-

tions and estimates that affect the reported amounts

of assets and liabilities, revenues and expenses and

contingent liabilities.The assumptions and estimates

relate principally to the group-wide determination of

useful economic lives, the recognition and measure-

ment of provisions and the recoverability of future

tax benefits. Actual amounts could in certain cases

differ from those assumptions and estimates. Where

new information becomes available, differences are

reflected in the income statement.

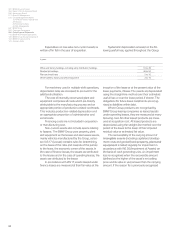

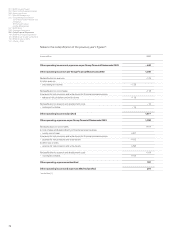

[7]Reclassifications of

the Group financial

statements at

31 December 2002

Following the conversion from German accounting

rules to International Accounting Standards, now

International Financial Reporting Standards, at

31 December 2001for group reporting purposes, the

BMW Group harmonised, in line with international

practice, its internal and external financial reporting

systems during the financial year 2003.The greater

emphasis placed by international accounting stan-

dards on reflecting economic reality in the financial

statements, enables the BMW Group to discontinue

the use of different methods for presenting results

for internal and external purposes, a time-consuming

approach often applied in Germany. The objective

of international accounting standards is to provide

information to users that is relevant for their economic

decision-making

processes. This is consistent with

the requirements placed on an efficient internal

financial reporting system. Information collated by

the harmonised internal and external reporting sys-

tems, which is considered useful and relevant for

the purposes of managing the business, is reflected,

in aggregated form, through external reporting. This

permits a common language to be used within the

Group and for communications with the capital mar-

kets. Harmonised reporting structures also improve

the efficiency of the accounting and reporting sys-

tems. The changes in presentation caused by the

harmonisation did not have any impact on the profit

from ordinary activities and net profit.