BMW 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.37

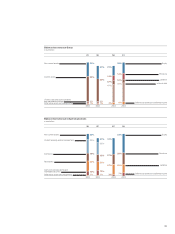

Provisions recognised in the balance sheet

increased by 14.2% to euro 8,751 million. The higher

level of additions to provisions mainly related to

other provisions and was attributable to the increase

in business volume and higher employee-related

obligations. The provision for pension obligations

was 7.7% higher at euro 2,430 million. Total obliga-

tions for pension and similar plans of the BMW

Group amount to euro 8,390 million (2002: euro

7,797 million), of which euro 7,294 million (2002:

euro 7,079 million) are covered by provisions and

fund assets. In the case of defined benefit plans, it

is necessary to recognise in the income statement

the amount of net obligations which exceed 10%

of the relevant obligations, over the remaining aver-

age working life of the employees concerned. At

31 December 2003, the amount still to be recog-

nised was euro 321 million (2002: euro 119 million).

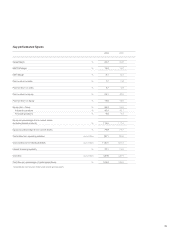

Debt increased by 4.5% to euro 27,449 million.

Within the amount disclosed as debt, bonds in-

creased by 14.9% to euro11,404 million. This in-

crease resulted from amounts added to the Medium

Term Note Program and the issue of an exchange-

able bond on the Group’s shares in the engine

manufacturer, Rolls-Royce plc, London. Liabilities

from customer deposits also rose sharply to euro

3,865 million, an increase of 23.2%. Other debt in-

creased by 7.9% to euro 5,695 million, whereas lia-

bilities to banks and commercial paper liabilities

were reduced in total by euro 1,435 million.

At euro 3,143 million, trade payables were at a

similar level to the previous year.

Other liabilities increased by 5.9% to euro

2,634 million.

The favourable development of the fair values

of derivative financial instruments and the reduced

availability of offsettable deferred tax assets were

the main reasons for the sharp increase in deferred

tax liabilities. These increased by 67.6% to total

euro 2,501 million at the end of 2003.

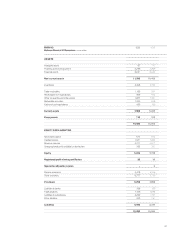

Value added statement

The value added statement shows the value of work

performed less the value of work bought in by the

BMW Group during the financial year. Depreciation,

cost of materials and other expenses are treated as

bought-in costs in the net added value calculation.

The allocation statement applies added value to

each of the participants involved in the added value

process. It should be noted that the gross added

value treats depreciation as a component of added

value which, in the allocation statement, is treated as

internal financing.

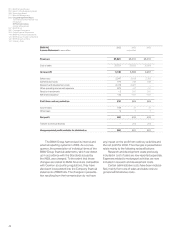

In 2003, the net added value generated by the

BMW Group, of euro 11,550 million (2002: euro

11,705 million) was 1.3% lower than in the previous

year. This reduction was due to the (exchange rate

induced) lower level of revenues compared to the

previous year and the higher level of depreciation.

By contrast, the gross added value, of euro 14,805

million (2002: euro14,607 million) climbed by 1.4%,

since depreciation, which was higher than in the

previous year, is not included.

The bulk of the net added value (61.2%) is

applied to employees, 4.9 percentage points more

than in the previous year. The proportion applied to

providers of finance fell by 4.6 percentage points

to 9.3%. The government/public sector (including

deferred tax liabilities of the Group) accounted for

12.6%, roughly the same proportion as in the pre-

vious year. As a result of the proposed increased

dividend, the proportion applied to shareholders in-

creased by 0.4 percentage points to 3.4%. The

remaining proportion of net added value (13.5%) will

be retained in the Group to finance future operations.

This represents a reduction of 0.8 percentage

points.