BMW 2003 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2003 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.67

impairment loss no longer exists, the impairment

loss is reversed up to the level of its rolled-forward

depreciated or amortised cost.

Financial assets are accounted for on the

basis of the settlement date. On initial recognition,

they are measured at acquisition cost, including

transaction costs.

Subsequent to initial recognition, available-

for-sale and held-for-trading financial assets are

measured at fair value. When market prices are not

available,

the fair value of available-for-sale financial

assets is measured using appropriate valuation tech-

niques e.g. discounted cash flow analysis based on

market information available at the balance sheet

date.

Loans and receivables which are not held by the

Group for trading (originated loans and receivables),

held-to-maturity financial investments and all finan-

cial assets for which published price quotations in an

active market are not available and whose fair value

cannot be determined reliably, are measured, to the

extent that they have a fixed term, at amortised cost,

using the effective interest rate method. When the

financial assets do not have a fixed term, they are

measured at acquisition cost.

In accordance with

IAS

39 (Financial Instruments:

Recognition and Measurement), assessments are

made regularly whether there is any objective evi-

dence that a financial asset or group of assets may

be impaired. If any such evidence exists, an impair-

ment loss is included in net profit or loss for the

period. Gains and losses on available-for-sale finan-

cial assets are recognised directly in equity until the

financial asset is disposed of or is determined to

be impaired, at which time the cumulative loss pre-

viously recognised in equity is included in net profit

or loss for the period.

Investments in non-consolidated group com-

panies reported in non-current financial assets

are measured at cost, since published price quota-

tions in an active market are not available and their

fair value cannot be reliably determined.

Associated companies are consolidated using

the equity method, whereby the investment is

measured at the Group’s share of the equity of the

company.

Investments in other companies are measured

at their quoted market price or fair value. When

these values are not available or cannot be reliably

determined, investments in other companies are

measured at cost.

Non-current marketable securities and loans

are measured according to the category of financial

asset to which they are classified. No held-for-trad-

ing financial assets are included under this heading.

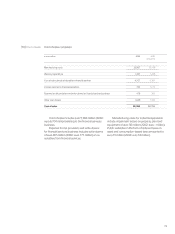

Inventories of raw materials, supplies and

goods for resale are stated at the lower of average

acquisition cost and net realisable value.

Work in progress and finished goods are stated

at the lower of manufacturing cost and net realisable

value. Manufacturing cost comprises all costs which

are directly attributable to the manufacturing

process and an appropriate proportion of produc-

tion-related overheads. This includes production-

related depreciation and an appropriate proportion

of administrative and social costs.

Financing costs are not included in acquisition

or manufacturing cost.

With the exception of derivative financial instru-

ments, all receivables and other current assets

are items originated by the Group and are not held

for trading. They are measured at amortised cost.

Receivables with maturities of over one year which

bear no or lower than market interest rate are dis-

counted. Allowances are recognised to take account

of all identifiable risks.

Receivables from sales financing comprise re-

ceivables from customer, dealer and lease financing.