BMW 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.31

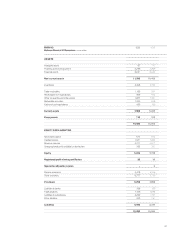

reclassified figures. Further details regarding the

reasons for and the effects of the harmonisation of

the internal and external reporting systems are pro-

vided in Note [7]. Reconciliations are also provided

for each affected item in the income statement.

The BMW Group recorded a net profit of euro

1,947 million for the financial year 2003. The net

profit was therefore 3.6% below the figure for the

previous year. The pre-tax return on sales was 7.7%

(2002: 7.8%) and the post-tax return on sales was

4.7% (2002: 4.8%). The Group generated earnings

per share of common stock of euro 2.89 (2002:

euro 3.00) and earnings per share of preferred stock

of euro 2.91 (2002: euro 3.02).

The low exchange rate of the US dollar im-

pacted the level of reported revenues for the year.

Group revenues fell by 2.1% compared to the pre-

vious year. However, adjusted for changes in ex-

change rates, the Group achieved revenue growth of

4.2%. Revenues from the sale of BMW, MINI and

Rolls-Royce brand cars were at the previous year’s

level despite the currency impact. Revenues from

motorcycle sales fell by 6.6% and revenues from

financial services fell by 9.8%, in both cases due to

currency fluctuations. Revenues generated by other

activities of the Group were 15.5% lower. This re-

duction was mainly attributable to the revenues of

the pressings plant in Swindon and of the Softlab

Group. Revenue increases were registered in almost

all regions. Revenues rose by 1.8% in Germany, by

1.7% for the remainder of Europe and by 12.1% for

the markets in Africa, Asia and Oceania. Revenues

generated in Asia climbed by 12.8%, mainly on the

back of exports to China. The lower US dollar ex-

change rate resulted in a 14.3% drop in revenues for

the Americas region compared to the previous year.

The USA remained, however, the strongest market

in revenue terms for the BMW Group.

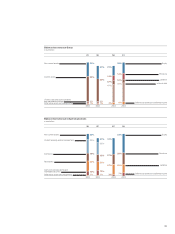

The reduction of cost of sales was 0.1 percent-

age points lower than that of revenues. The gross

profit fell by 2.3% and represented 22.7% (2002:

22.8%) of revenues. The gross profit percentage for

industrial operations fell by 0.6% and that of finan-

cial operations improved by 1.8%. Further details of

the entities consolidated in each of the sub-groups

are provided in Note [1].

Sales and administrative costs increased by only

1.3% despite the expansion of business volumes.

They represent 10.7% (2002: 10.4%) of revenues.

Research and development costs were at a simi-

larly high

level to the previous year.They represent

5.2% (2002: 5.0%) of revenues. Research and de-

velopment costs include depreciation and disposals

of euro 583 million (2002: euro 536 million) related

to development costs recognised as assets. Total

research and development costs, including research

costs and non-capitalised development

costs as

well as investment in capitalised development

costs,

amounted to euro 2,559 million (2002: euro 2,455

million). At this level, the research and development

ratio was 6.2% of revenues (2002: 5.8%).

Depreciation and amortisation included in cost

of sales, sales and administrative costs and research

and development costs amounted to euro 2,370

million (2002: euro 2,143 million).

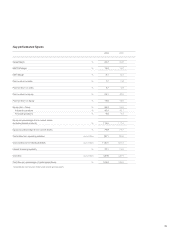

The positive net amount of other operating in-

come and expenses increased by 37.8% compared

to the previous year. Whereas other operating in-

come was marginally higher than in the previous

year, other operating expenses fell by 15.0%. This

was attributable to the lower level of write-downs

and lower allocations to provisions.

The net financial result improved by 28.8%

compared to the previous year. This was attributable

to gains arising on the fair market measurement of

derivative financial instruments. The financial result

All brands with new sales volume records.

Revenue down as a result of exchange rate changes.

Group profit from ordinary activities at previous

year’s level.

Capital expenditure increased again.

Cash flow again above previous year’s level.