Avon 2004 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and

Analysis of Financial Condition

and Results of Operations

Future effects of pension plans on the operating results

of the Company will depend on economic conditions,

employee demographics, mortality rates, the number of

associates electing to take lump-sum payments, invest-

ment performance and funding decisions, among other

factors. However, given current assumptions (including

those noted above), 2005 pension expense related to

the U.S. plan is expected to increase in the range of

$10.0 to $15.0. The Company does not anticipate that

this incremental expense will affect its ability to meet

its financial targets.

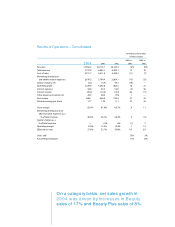

A 50 basis point change (in either direction) on the

expected rate of return on plan assets, the discount rate

or the rate of compensation increases would have had

the following effect on 2004 pension expense:

Increase/(Decrease) in

Pension Expense

50 basis point 50 basis point

Increase Decrease

Rate of return on assets $ (4.5) $ 4.5

Discount rate (10.1) 10.9

Rate of compensation

increase 3.9 (3.6)

Taxes

Avon records a valuation allowance to reduce its

deferred tax assets to the amount that is more likely than

not to be realized. While Avon has considered projected

future taxable income and ongoing tax planning strate-

gies in assessing the need for the valuation allowance, in

the event Avon were to determine that it would be able

to realize a net deferred tax asset in the future, in excess

of the net recorded amount, an adjustment to the

deferred tax asset would increase earnings in the period

such determination was made. Likewise, should Avon

determine that it would not be able to realize all or part

of its net deferred tax asset in the future, an adjustment

to the deferred tax asset would decrease earnings in the

period such determination was made. Avon establishes

additional provisions for income taxes when, despite the

belief that their tax positions are fully supportable, there

remain certain positions that are likely to be challenged

and may or may not be sustained on review by tax

authorities. Avon adjusts these additional accruals in light

of changing facts and circumstances. Avon files income

tax returns in many jurisdictions. In 2005, a number of

income tax returns are scheduled to close by statute and

it is possible that a number of tax examinations may be

completed. If Avon’s filing positions are ultimately

upheld, it is possible that the 2005 provision for income

taxes may reflect adjustments. Depending on the num-

ber of filing positions ultimately upheld, the impact of

adjustments could be significant to 2005 net income.

Stock-based Compensation

Avon applies the recognition and measurement princi-

ples of Accounting Principles Board (“APB”) Opinion 25,

“Accounting for Stock Issued to Employees,” in account-

ing for its long-term stock-based incentive plans. No

compensation cost related to grants of stock options

was reflected in net income, as all options granted

under the plans had an exercise price equal to the mar-

ket price. Net income in each of the years of 2004, 2003

and 2002 would have been lower by $26.3, $28.7 and

$30.1, respectively, if Avon had applied the fair value

recognition provisions of FAS No. 123, “Accounting for

Stock-Based Compensation”(see Note 1, Description

of Business and Summary of Significant Accounting

Policies). In accordance with the recently issued FAS

123(R), Avon will record expense beginning in July 2005

(see Note 2, Accounting Changes). The Company is con-

sidering its choice of implementation methods available

under this pronouncement. Forward-looking guidance

does not include the impact of expensing options.

Contingencies

In accordance with FAS No. 5, “Accounting for Contin-

gencies,”Avon determines whether to disclose and

accrue for loss contingencies based on an assessment

of whether the risk of loss is remote, reasonably possi-

ble or probable. Management’s assessment is devel-

oped in consultation with the Company’s outside

counsel and other advisors and is based on an analysis

of possible outcomes under various strategies. Loss

contingency assumptions involve judgments that are

inherently subjective and can involve matters that are

in litigation, which by its nature is unpredictable. Man-

agement believes that its assessment of the probability

of loss contingencies is reasonable, but because of the

subjectivity involved and the unpredictable nature of

the subject matter at issue, management’s assessment

may prove ultimately to be incorrect, which could

materially impact the Consolidated Financial State-

ments in current or future periods.

Global Beauty 29