Avon 2004 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The decrease in operating margin in North America was

most significantly impacted by the following:

• Operating margin in the U.S. declined (which decreased

segment margin by 1.8 points) mainly due to a decline

in gross margin resulting from the following:

• inventory clearance programs in the first quar-

ter of 2004,

• repositioning costs related to Beyond Beauty,

specifically inventory write-offs for toys, and

• higher costs for fuel, warehousing and storage.

The declines were partially offset by higher Repre-

sentative fees and a favorable mix of products

sold. Additionally, operating margin was negatively

impacted by an unfavorable expense ratio, result-

ing from higher pension, bad debt and shipping

expenses.

• Operating margin in the U.S. Retail business in 2003

included costs of $18.3 associated with the reposition-

ing of the beComing line of products (which caused

segment margin to be favorable in 2004 by .8 point).

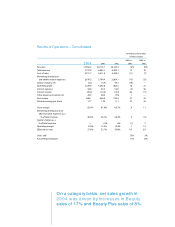

2003 Compared to 2002

%/Point Change

Local

2003 2002 US $ Currency

Net sales $2,526.8 $2,457.4 3% 3%

Operating profit 425.9 444.9 (4)% (4)%

Operating margin 16.5% 17.8% (1.3) (1.3)

Units sold 2%

Active Representatives 3%

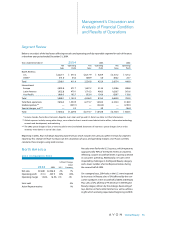

The U.S. business reported a sales increase of 3% in 2003

resulting from a higher number of active Representatives

(reflecting growth of the Sales Leadership program),

increases in units, and successful new product launches

including mark.

On a category basis, the 2003 sales increase in the U.S.

was driven by a 9% increase in Beauty sales (reflecting

strong increases in the skin care and personal care cate-

gories, partially offset by a decline in fragrance). That

increase was largely offset by a 4% decline in Beyond

Beauty sales and a 1% decline in Beauty Plus sales,

reflecting a strategic de-emphasis of toys, severe snow-

storms and the impact of the war in Iraq on consumer

spending in the first half of 2003, as well as a temporary

inability to fill demand for certain holiday non-beauty

products in the fourth quarter of 2003.

The decrease in operating margin in North America in 2003

was most significantly impacted by the following markets:

• In the U.S., operating margin declined (which

decreased segment margin by .6 point) primarily due

to an unfavorable expense ratio. The unfavorable

expense ratio was driven by incremental consumer

and strategic spending in support of mark. as well as

increased advertising. In addition, higher customer

service expenses and higher pension-related costs

were partially offset by lower bonus accruals and

a higher customer order charge. The unfavorable

expense ratio was partially offset by an improvement

in gross margin mainly due to a favorable mix of prod-

ucts sold and savings resulting from supply chain Busi-

ness Transformation initiatives.

• In the Dominican Republic, operating margin declined

(which decreased segment margin by .4 point) as a

result of a sales decline.

Europe’s net sales increased significantly to

surpass $2.0 billion for the first time, driven by

substantial growth in units and the number of

active Representatives, as well as favorable

foreign exchange.