Avon 2004 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Special Charges – Fourth Quarter 2001

In the fourth quarter of 2001, Avon recorded special

charges of $97.4 pretax primarily associated with facility

rationalizations and workforce reduction programs related

to implementation of certain Business Transformation

initiatives. Approximately 80% of the charges related to

future cash expenditures. By December 2004, 99% of these

cash expenditures were made. All payments were funded

by cash flow from operations. In the third quarter of 2002,

Avon recorded an adjustment related to the fourth quarter

2001 charge (see Special Charges – Third Quarter 2002

below). Additionally, in the fourth quarters of 2004 and

2003, Avon recorded pretax benefits of $2.5 and $2.1,

respectively, from adjustments to the fourth quarter

2001 charge (see Note 13, Special Charges).

In 2002, 2003, and 2004, actions associated with the

2001 special charges yielded net savings of approxi-

mately $30.0 (net of transitional costs of approximately

$20.0), $60.0 (net of transitional costs of approximately

$10.0), and $85.0 (net of transitional costs of approxi-

mately $5.0), respectively.

The actions associated with the 2001 special charges

resulted in incremental cash outlays of approximately

$32.0 in 2002 and produced incremental cash flow of

$27.0 in 2003 and $40.0 in 2004. Capital expenditures

associated with the 2001 special charges were approxi-

mately $30.0 in 2002 and $5.0 in 2003. The cash outlays

in 2002, and capital expenditures in 2002 and 2003 were

funded through cash flow from operations.

Special Charges – Third Quarter 2002

Special charges of $43.6 pretax, recorded in the third

quarter of 2002, primarily related to Avon’s Business

Transformation initiatives, including supply chain initia-

tives, workforce reduction programs and sales transfor-

mation initiatives. Approximately 90% of the charges

related to future cash expenditures. Approximately

96% of these expenditures were made by December

2004. Avon also recorded in the third quarter of 2002

a pretax benefit of $7.3 from an adjustment to the spe-

cial charges recorded in the fourth quarter of 2001.

The net effect of the special items was a pretax charge

of $36.3. The $36.3 was included in the Consolidated

Statements of Income for 2002 as a special charge

($34.3) and as inventory write-downs, which were

included in cost of sales ($2.0). In the fourth quarters

of 2004 and 2003, Avon recorded pretax benefits of $.7

and $1.8, respectively, from adjustments to the third

quarter 2002 charge (see Note 13, Special Charges).

In 2003 and 2004, actions associated with the 2002 special

charges yielded net savings of approximately $16.0 (net of

transitional costs of approximately $13.0) and $50.0 (net

of transitional costs of approximately $3.0), respectively.

The actions associated with the 2002 special charges

resulted in incremental cash outlays of approximately

$20.0 in 2002 and produced incremental cash flow of $3.0

in 2003 and $25.0 in 2004. Capital expenditures associated

with Business Transformation initiatives included in the

2002 special charges were approximately $17.0 through

2004 and were funded through cash flow from operations.

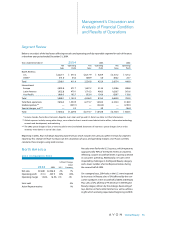

On a category basis, 2004 sales in the U.S.

were impacted by increases in Beauty sales of

3% and Beauty Plus sales of 2%, offset by a

9% decrease in the Beyond Beauty category.