Avon 2004 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

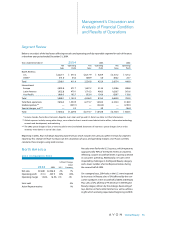

Management’s Discussion and

Analysis of Financial Condition

and Results of Operations

Other expense (income), net was lower in 2004 than in

2003, primarily due to favorable foreign exchange of $6.4

and a favorable comparison to 2003, which included the

write-off of deferred debt issue costs of $6.4 related to

Avon’s convertible notes (see Note 4, Debt and Other

Financing). This favorability was substantially offset by a

write-down of $13.7 in 2004 resulting from declines in

the fair values of investments in equity securities below

their cost bases. These declines were judged to be other-

than-temporary based on various factors, including an

analysis of the duration and the extent to which market

values were below cost. These equity securities are avail-

able to fund select benefit plan obligations.

Other expense (income) net was higher in 2003 than in

2002, primarily due to unfavorable foreign exchange of

$31.9 and the write-off of deferred debt issue costs of

$6.4 in the third quarter of 2003 related to Avon’s con-

vertible notes which were retired in July 2003 (see Note

4, Debt and Other Financing). The foreign exchange

variance was mainly due to gains of $27.8 in 2002 on

net U.S. dollar denominated assets, primarily in

Argentina, Venezuela, Brazil and Mexico.

Effective Tax Rate

The effective tax rate for 2004 was favorably impacted by

ongoing audit settlements, amended filings, tax refunds,

and foreign tax credits, which reduced the rate by 2.8

points. The tax rate was also reduced by approximately

1.7 points as a result of one-time reversals in the second

and fourth quarters of 2004 of previously recorded

deferred taxes in connection with the decision to perma-

nently reinvest a significant portion of foreign earnings

offshore. Additionally, the effective tax rate was favorably

impacted by cash management and tax strategies, which

the Company began to implement in the second quarter

of 2004. These strategies are a further extension of the

Company’s Business Transformation efforts and reflect

the permanent reinvestment of a greater portion of for-

eign earnings offshore. These strategies further reduced

the effective tax rate by approximately .5 point. The 2004

rate was also impacted favorably by changes in the earn-

ings mix and tax rates of international subsidiaries.

The cash management and tax strategies, which the

Company began implementing during the second quar-

ter of 2004, are expected to result in cash management

efficiencies and ongoing tax savings. The Company esti-

mates the potential effective tax rate for 2005 to be in

the range of 31%.

The effective tax rate was lower in 2003 than in 2002

primarily due to tax audit settlements and an interest

refund from the IRS, which, collectively, reduced the

effective rate by approximately 2.5 points. Additionally,

the 2003 rate was impacted favorably by changes in the

earnings mix and tax rates of international subsidiaries.

Special Charges

Business Transformation

In May 2001, Avon announced its Business Transformation

plans, which were designed to significantly reduce costs

and expand profit margins, while continuing to focus on

consumer growth strategies. Those original Business

Transformation initiatives included an end-to-end evalu-

ation of business processes in key operating areas, with

targeted completion dates through 2004. Specifically,

the initiatives focused on: simplifying Avon’s marketing

processes; taking advantage of supply chain opportuni-

ties; strengthening Avon’s sales model through the Sales

Leadership program and the Internet; streamlining the

Company’s organizational structure; and integrating cer-

tain similar activities across markets to achieve efficien-

cies. Avon realized significant benefits from these Business

Transformation initiatives from 2002 through 2004. The

savings from these initiatives provided additional financial

flexibility to achieve profit targets, while enabling further

investment in consumer growth strategies. Management

believes that initiatives associated with the 2001 and 2002

special charges discussed below have helped the Com-

pany achieve its operating margin targets.

In the first quarter of 2003 and in late 2004, Avon

announced additional Business Transformation initia-

tives that are expected to promote continued sales and

earnings growth, as well as provide for further margin

expansion through 2007; however, the scope and

complexity of these initiatives necessarily continue to

involve planning and execution risk. No special charges

are anticipated with these additional Business Transfor-

mation initiatives.

Global Beauty 33