Avon 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

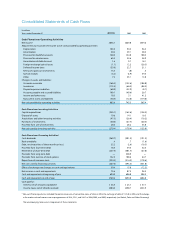

2003

Gross Gross

Unrealized Unrealized Market

Cost Gains Losses Value

Equity securities $44.5 $2.3 $(16.0) $30.8

State and municipal

bonds 21.0 .9 — 21.9

Mortgage backed

securities 1.7 .1 — 1.8

Other 3.6 — (.5) 3.1

Total available-

for-sale

securities 70.8 3.3 (16.5) 57.6

Cash and

equivalents .3 — — .3

Total $71.1 $3.3 $(16.5) $57.9

Payments for the purchases, proceeds and gross realized

gains and losses from the sales of these securities totaled

$27.7, $27.6, $.2 and $.4, respectively, during 2003.

For the years ended December 31, 2004 and 2003,

unrealized losses on available-for-sale securities

impacted accumulated other comprehensive loss

as follows:

2004 2003

Net unrealized losses at

beginning of year, net of taxes $(8.5) $(13.0)

Net unrealized gains, net of taxes 1.4 4.4

Reclassification of net losses

to earnings, net of taxes 9.1 .1

Net unrealized gains (losses)

end of year, net of taxes $ 2.0 $ (8.5)

6Income Taxes

Deferred tax assets (liabilities) resulting from tempo-

rary differences in the recognition of income and

expense for tax and financial reporting purposes at

December 31 consisted of the following:

2004 2003

Deferred tax assets:

Postretirement benefits $ 78.5 $ 74.4

Accrued expenses and

reserves 89.1 74.0

Special and non-recurring

charges 2.1 6.0

Employee benefit plans 124.4 105.0

Foreign operating loss

carryforwards 70.0 51.3

Postemployment benefits 15.8 11.8

Revenue recognition 3.2 2.8

Minimum tax credit

carryforwards 29.5 19.4

Foreign tax credit

carryforwards 8.8 32.7

All other 45.5 31.3

Valuation allowance (70.2) (84.8)

Total deferred tax assets 396.7 323.9

Deferred tax liabilities:

Depreciation (42.1) (44.1)

Prepaid retirement plan costs (9.9) (38.7)

Capitalized interest (4.9) (5.5)

Capitalized software (7.9) (6.5)

Unremitted foreign earnings (5.1) (16.9)

All other (25.5) (24.8)

Total deferred tax liabilities (95.4) (136.5)

Net deferred tax assets $301.3 $ 187.4

Deferred tax assets (liabilities) at December 31 were

classified as follows:

2004 2003

Deferred tax assets:

Prepaid expenses and other $ 95.4 $ 94.1

Other assets 222.9 156.2

Total deferred tax assets 318.3 250.3

Deferred tax liabilities:

Income taxes (4.9) (12.3)

Deferred income taxes (12.1) (50.6)

Total deferred tax liabilities (17.0) (62.9)

Net deferred tax assets $301.3 $187.4