Avon 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Global Beauty 59

Notes to Consolidated

Financial Statements

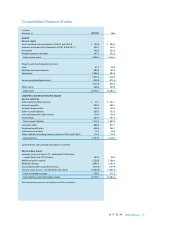

3Inventories

Inventories at December 31 consisted of the following:

2004 2003

Raw materials $183.2 $152.0

Finished goods 557.3 501.4

Total $740.5 $653.4

4Debt and Other Financing

Debt

Debt at December 31 consisted of the following:

2004 2003

Debt maturing within one year:

Notes payable $ 19.1 $ 39.7

Commercial paper 26.9 —

6.90% Notes, due November 2004 — 200.0

Current portion of long-term debt 5.7 4.4

Total $ 51.7 $244.1

Long-term debt:

1.06% Yen Notes, due

September 2006 $ 86.6 $ 84.2

6.55% Notes, due August 2007 100.0 100.0

7.15% Notes, due November 2009 300.0 300.0

4.625% Notes, due May 2013 106.6 105.0

4.20% Notes, due July 2018 248.9 248.8

Other, payable through 2018

with interest from 1% to 22% 12.7 11.8

Total long-term debt 854.8 849.8

Adjustments for debt with

fair value hedges 17.2 32.3

Less current portion (5.7) (4.4)

Total $866.3 $877.7

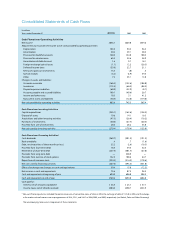

Other long-term debt, payable through 2018, consists

of obligations under capital leases, which primarily

relate to leases of automobiles.

Adjustments for debt with fair value hedges includes

adjustments to reflect net unrealized gains of $6.9 and

$23.0 on debt with fair value hedges at December 31,

2004 and 2003, respectively, and unamortized gains on

terminated swap agreements and swap agreements

no longer designated as fair value hedges of $10.3 and

$9.3 at December 31, 2004 and 2003, respectively, (see

Note 7, Financial Instruments and Risk Management).

At December 31, 2004, Avon held interest rate swap

contracts, that swap approximately 70% of the Com-

pany’s debt to variable rates (see Note 7, Financial

Instruments and Risk Management).

In July 2003, the holders of $48.3 of zero coupon

convertible senior notes due 2020 (the “Convertible

Notes”), which were originally issued in 2000, converted

their notes into approximately 1,502,000 shares of Avon

Common Stock in accordance with the conversion fea-

ture of the Convertible Notes. The conversion reduced

Treasury Stock by $13.7 and increased additional paid-

in capital by $34.6. In July 2003, Avon redeemed the

remaining Convertible Notes by paying $398.9, which

represented the redemption price of $531.74 for each

$1,000 principal amount at maturity of Convertible Notes

that were then outstanding. As a result of the redemp-

tion, deferred issuance costs related to the Convertible

Notes of approximately $6.4 were expensed to Other

expense (income), net and $.7 were reclassified to

additional paid-in capital in 2003.

In June 2003, Avon issued to the public $250.0 principal

amount of registered senior notes (the “4.20% Notes”)

under the Company’s $1,000.0 debt shelf registration

statement. The 4.20% Notes mature on July 15, 2018,

and bear interest at a per annum rate of 4.20%, payable

semi-annually. The net proceeds were used to repay a

portion of Avon’s Convertible Notes, discussed above.

The carrying value of the 4.20% Notes represents the

$250.0 principal amount, net of the unamortized dis-

count to face value of $1.1 and $1.2 at December 31,

2004 and 2003, respectively.