Avon 2004 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Global Beauty 79

Notes to Consolidated

Financial Statements

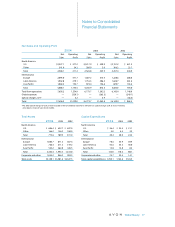

13 Special Charges

In May 2001, Avon announced its new Business Trans-

formation plans, which were designed to significantly

reduce costs and expand profit margins, while continu-

ing to focus on consumer growth strategies. Those

original Business Transformation initiatives include an

end-to-end evaluation of business processes in key

operating areas, with target completion dates through

2004. Specifically, the initiatives focus on simplifying

Avon’s marketing processes, taking advantage of supply

chain opportunities, strengthening Avon’s sales model

through the Sales Leadership program and the Internet,

streamlining the Company’s organizational structure and

integrating certain similar activities across markets to

achieve efficiencies. Avon has realized benefits from

these Business Transformation initiatives during 2002

through 2004.

Special Charges – Fourth Quarter 2001

In the fourth quarter of 2001, Avon recorded special

charges (“2001 Special Charges”) of $97.4 pretax primarily

associated with facility rationalizations and workforce

reduction programs related to implementation of cer-

tain Business Transformation initiatives. Approximately

80% of the charges related to future cash expenditures.

Substantially all of these cash expenditures were made

by December 2004. All payments were funded by cash

flow from operations. While project plans associated

with these initiatives have not changed, the Company

has experienced favorable adjustments to its original

cost estimates. As a result, the Company reversed pretax

amounts totaling $2.5, $2.1 and $7.3 in 2004, 2003 and

2002, respectively. The favorable adjustments primarily

related to certain employees pursuing reassignments

in other Avon locations, lower severance costs resulting

from higher than anticipated lump-sum distributions

(associates who elected lump-sum distributions did

not receive benefits during the severance period) and

favorable contract termination negotiations.

The remaining liability at December 31, 2004 was $.3

and relates to amounts payable under the terms of the

plan to employees already receiving severance.

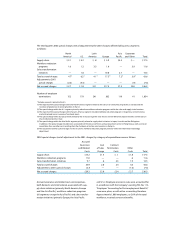

Special Charges – Third Quarter 2002

In September 2002, the Company authorized a plan

related to the implementation of its Business Trans-

formation initiatives. In connection with these initia-

tives, in the third quarter of 2002, Avon recorded

special charges of $43.6 pretax ($30.4). These charges

were primarily associated with the following initiatives:

• Supply chain initiatives, including actions to improve

efficiencies and productivity in manufacturing, logis-

tics, transportation and distribution activities;

• Workforce reduction programs focused on

realigning the organization and leveraging

regional structures; and

• Sales transformation initiatives, including a shift

to a more variable expense base and changes in

the selling structure due to a variety of initiatives

to contemporize the sales model.

Approximately 90% of the charge resulted in future

cash expenditures. Approximately 96% of these cash

expenditures were made by December 31, 2004. All

payments were funded by cash flow from operations.

The third quarter charges (net of the $7.3 adjustment

to the 2001 special charges as previously disclosed)

were included in the Consolidated Statements of

Income as special charges ($34.3) and as inventory

write-downs, which were included in cost of sales ($2.0).