Avon 2004 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1Description of the Business

and Summary of Significant

Accounting Policies

Business

Avon Products, Inc. (“Avon” or the “Company”) is a global

manufacturer and marketer of beauty and related prod-

ucts. Avon’s business is conducted worldwide primarily

in one channel, direct selling. The Company’s reportable

segments are based on geographic operations in four

regions: North America, Europe, Latin America and Asia

Pacific. Sales are made to the ultimate customers princi-

pally by independent Avon Representatives. The product

categories include Beauty, which consists of cosmetics,

fragrance, skin care and toiletries (“CFT”); Beauty Plus,

which consists of fashion jewelry, watches, apparel and

accessories; and Beyond Beauty, which consists of home

products, gift and decorative products, candles and toys.

Sales from Health and Wellness and mark. are included

among these three categories based on product type.

Significant Accounting Policies

Principles of Consolidation

The consolidated financial statements include the

accounts of Avon and its majority and wholly-owned

subsidiaries. Intercompany balances and transactions

are eliminated. The accounts of Avon’s variable interest

entity, as defined by the Financial Accounting Standards

Board’s (“FASB”) Interpretation No. 46, “Consolidation of

Variable Interest Entities” (“FIN 46"), are included in the

Consolidated Financial Statements. Avon has a 40% inter-

est in Mirabella Realty Company, (“Mirabella”), a Philippine

company formed to purchase land in the Philippines. The

remaining 60% interest is held by Company-sponsored

retirement plans. Prior to July 1, 2003, the investment was

accounted for under the equity method. Avon holds a

variable interest in Mirabella because Avon guarantees

$2.2 of Mirabella’s third-party borrowings. As a result,

Mirabella was consolidated beginning July 1, 2003.

Mirabella’s net assets totaled $.7 at December 31,

2004, and consisted primarily of land of $3.8 and

debt of $2.2.

Use of Estimates

The preparation of financial statements in conformity

with generally accepted accounting principles in the U.S.

requires management to make estimates and assump-

tions that affect the reported amounts of assets and lia-

bilities, the disclosure of contingent assets and liabilities

at the date of the financial statements and the reported

amounts of revenues and expenses during the reporting

period. Actual results could differ materially from those

estimates and assumptions. On an ongoing basis, man-

agement reviews its estimates, including those related to

allowances for doubtful accounts receivable, allowances

for sales returns, provisions for inventory obsolescence,

income taxes and tax valuation reserves, stock-based

compensation, loss contingencies, and the determina-

tion of discount rate and other actuarial assumptions

for pension, postretirement and postemployment

benefit expenses.

Foreign Currency

Financial statements of foreign subsidiaries operating in

other than highly inflationary economies are translated

at year-end exchange rates for assets and liabilities and

average exchange rates during the year for income and

expense accounts. The resulting translation adjustments

are recorded within accumulated other comprehensive

loss. Financial statements of subsidiaries operating in

highly inflationary economies are translated using a com-

bination of current and historical exchange rates and any

translation adjustments are included in earnings.

Financial statement translation of subsidiaries operating

in highly inflationary economies and foreign currency

transactions resulted in net losses (gains) of $9.5, $15.9

and ($16.0) in 2004, 2003 and 2002, respectively, which

are included in other expense (income), net. Included

in these amounts are transaction losses (gains) of $2.6,

$2.8 and ($27.8) in 2004, 2003 and 2002, respectively,

related to U.S. dollar-denominated assets (see Note 7,

Financial Instruments and Risk). In addition, cost of

sales and marketing, distribution and administrative

expenses included the (favorable) unfavorable impact

of the translation of inventories and prepaid expenses

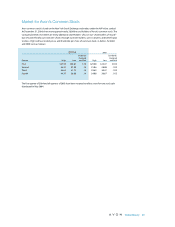

Avon’s reportable segments are based

on geographic operations in four regions:

North America, Europe, Latin America

and Asia Pacific.

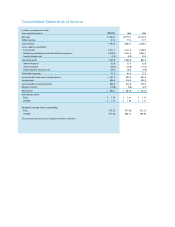

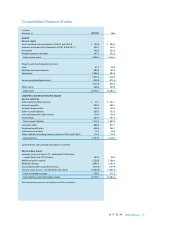

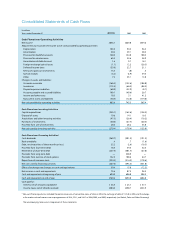

In millions, except per share and share data