Avon 2004 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

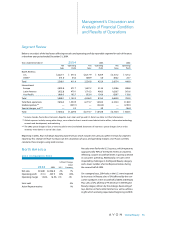

Latin America’s net sales grew 13% in

2004 with increases in nearly all markets

in the region, reflecting growth in units and

active Representatives, partially offset by

the negative impact of foreign exchange.

increase in average order per Representative.

• In Western Europe, net sales in U.S. dollars and local

currencies increased primarily from growth in the

United Kingdom, resulting from new product

launches and consumer motivation programs such

as gift with purchase programs.

• In the second quarter of 2003, Avon began consoli-

dating its Turkish subsidiary which increased net sales

by $47.2 in 2003, and favorably impacted unit growth

in Europe by 2 points (see Note 17, Acquisitions).

The increase in operating margin in 2003 in Europe was

most significantly impacted by the following markets:

• In Central and Eastern Europe, operating margin

improved (which increased segment margin by 1.3

points) driven by an improvement in gross margin in

nearly all markets. In Russia, the gross margin improve-

ment resulted from a change in pricing strategy and

the elimination of sales tax in July 2003. In Poland, the

gross margin improvement was driven by lower con-

sumer motivation programs such as gift with pur-

chase, as well as pricing strategies, and lower

obsolescence expense.

• In Western Europe, operating margin improved (which

increased segment margin by 1.0 point) primarily due

to a higher gross margin. This increase resulted from

lower product costs, due to supply chain benefits

including the closure of a manufacturing facility in the

United Kingdom, price increases in certain markets

and the exit of certain non-core categories.

• In South Africa, operating margin declined (which

decreased segment margin by .6 point) resulting

from inventory adjustments in that market.

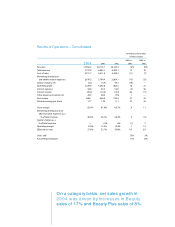

Latin America

2004 Compared to 2003

%/Point Change

Local

2004 2003 US $ Currency

Net sales $1,932.8 $1,716.3 13% 14%

Operating profit 479.1 406.3 18% 21%

Operating margin 24.8% 23.7% 1.1 1.1

Units sold 11%

Active Representatives 11%

Net sales increased in 2004 with increases in nearly all mar-

kets in the region, reflecting growth in units and active

Representatives, partially offset by the negative impact of

foreign exchange, primarily in Venezuela and Mexico.

• In Brazil, net sales increased, primarily reflecting an

increase in units and active Representatives, driven

by field sales incentive programs and new product

launches, as well as favorable foreign exchange.

• In Venezuela, net sales increased significantly, prima-

rily due to growth in units and active Representatives,

partially offset by the negative impact of foreign

exchange. Net sales also benefited from field sales

incentive programs and higher prices.

• In Argentina, net sales increased significantly, driven

by growth in active Representatives and units,

reflecting new product launches and consumer

incentive programs.

• In Mexico, net sales increased, driven by growth in

units and active Representatives, almost entirely off-

set by the negative impact of foreign exchange. Net

sales benefited from new product launches and field

sales incentive programs.

The increase in operating margin in Latin America was

most significantly impacted by the following markets:

• In Venezuela, operating margin increased (which

increased segment margin by .8 point) reflecting a

lower expense ratio resulting from sales growth and

general cost containment initiatives. Operating

margin was also favorably impacted by an improve-

ment in gross margin resulting from higher prices,

as well as supply chain savings mainly due to a

lower cost of materials.

• In Brazil, operating margin increased (which

increased segment margin by .6 point) resulting from

an improvement in gross margin, reflecting savings

associated with supply chain Business Transforma-

tion initiatives and the impact of a sales tax reform in

2004, which allows Avon Brazil to receive tax credits

on inventory purchases.

• In Mexico, operating margin decreased (which

decreased segment margin by .5 point) primarily due

to a lower gross margin reflecting an unfavorable mix

of products sold. Additionally, operating margin was

unfavorably impacted by a higher expense ratio result-

ing from unfavorable comparisons to 2003 (the sec-

ond quarter of 2003 included a gain from the sale of a

warehouse property in Mexico City as the Company

transitioned to a new distribution facility in Celaya).