Avon 2004 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

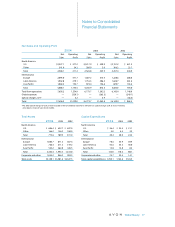

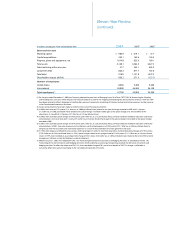

The liability balances and employee terminations by business segment were as follows:

North Latin Asia Corporate

America* U.S. America Europe Pacific and Other Total

Total Accrued charges $ 4.7 $ 6.2 $ 4.1 $ 17.5 $ 7.2 $ 3.9 $ 43.6

Less: Foreign exchange .7 — .2 3.4 .2 — 4.5

Less: Expenses charged (6.0) (5.8) (3.5) (18.6) (6.6) (3.6) (44.1)

Less: Adjustment 2003 .3 (1.0) (.8) .4 (.7) — (1.8)

Less: Adjustment 2004 .3 .7 .3 (1.6) (.1) (.3) (.7)

Balance at

December 31, 2004 $ — $ .1 $ .3(a) $ 1.1(b) $— $— $ 1.5

Number of planned

employee terminations 152 179 241 302 119 41 1,034

Number of employee

terminations remaining — — 38———38

*Excludes amounts related to the U.S.

(a) The majority of the remaining liability relates to workforce reduction programs in Venezuela. The Venezuelan government has prohibited

terminating employees until January 2005; therefore, the remaining terminations have been delayed until 2005.

(b) The majority of the remaining liability relates to employee severance costs associated with sales force reductions in certain

Western European markets.

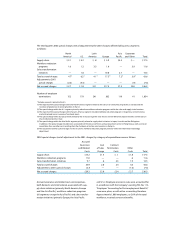

14 Contingencies

Avon has been a defendant in a class action suit com-

menced in 1991 on behalf of certain classes of holders

of Avon’s Preferred Equity-Redemption Cumulative

Stock (“PERCS”). Plaintiffs alleged various contract and

securities law claims related to the PERCS (which were

fully redeemed in 1991) and sought to aggregate dam-

ages of approximately $145.0, plus interest. A trial of

this action took place in the United States District

Court for the Southern District of New York and con-

cluded in November 2001. In March 2004, the court

rendered a decision in favor of Avon and dismissed the

Consolidated Amended Class Action Complaint. The

plaintiffs appealed the court’s decision to the United

States Court of Appeals for the Second Circuit, and in

February 2005, the Court of Appeals affirmed the deci-

sion of the District Court. The plaintiffs have not yet

indicated whether they plan to appeal the decision of

the District Court. While it is not possible to predict the

outcome of litigation, management believes that this

action should not have a material adverse effect on the

Consolidated Financial Statements.

Avon has been defending actions commenced in the

Supreme Court of the State of New York by Sheldon

Solow d/b/a Solow Building Company (“Solow”), the

landlord of the Company’s former headquarters in

New York City. In one action, Plaintiff sought aggregate

damages of approximately $80.0, plus interest, for the

Company’s alleged failure to restore the leasehold

premises at the conclusion of the lease term in 1997.

In May 2004, Avon entered into a settlement with

Solow and paid Solow $6.2 in exchange for a release