Avon 2004 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

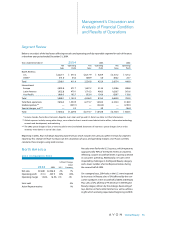

Provisions for Inventory Obsolescence

Avon records an allowance for estimated obsolescence

equal to the difference between the cost of inventory

and the estimated market value. In determining the

allowance for estimated obsolescence, Avon classifies

inventory into various categories based upon their stage

in the product life cycle, future marketing sales plans and

the disposition process. Avon assigns a degree of obso-

lescence risk to products based on this classification to

determine the level of obsolescence provision. If actual

sales are less favorable than those projected by manage-

ment, additional inventory allowances may need to be

recorded for such additional obsolescence. Over the past

three years, annual obsolescence expense has been in

the range of $55.0 to $65.0.

Pension, Postretirement and

Postemployment Expense

The Company maintains qualified defined benefit pen-

sion plans, which cover substantially all employees in the

U.S. and in certain international locations. Additionally,

the Company has unfunded supplemental pension ben-

efit plans for certain current and retired executives (see

Note 10, Employee Benefit Plans).

Avon’s calculations of pension, postretirement and

postemployment costs are dependent upon the use of

assumptions, including discount rates, expected return

on plan assets, interest cost, health care cost trend rates,

benefits earned, mortality rates, the number of associate

retirements, the number of associates electing to take

lump-sum payments and other factors. Actual results

that differ from assumptions are accumulated and amor-

tized over future periods and, therefore, generally affect

recognized expense and the recorded obligation in

future periods. At December 31, 2004, the Company had

unrecognized actuarial losses of $476.3 and $213.6 for the

U.S. and non-U.S. plans, respectively. While management

believes that the assumptions used are reasonable, differ-

ences in actual experience or changes in assumptions

may materially affect Avon’s pension, postretirement

and postemployment obligations and future expense.

For the year ended December 31, 2004, the weighted

average assumed rate of return on all plan assets, includ-

ing the U.S. and non-U.S. plans, was 8.21%. In determin-

ing the long-term rates of return, the Company considers

the nature of the plans’ investments, an expectation for

the plans’ investment strategies, historical rates of return

and current economic forecasts. The Company evaluates

the expected long-term rate of return annually and

adjusts as necessary. As a result of current economic

forecasts, the Company will lower the expected rate of

return for the U.S. plan from 8.75% for 2004 to 8.00%

for 2005, resulting in a weighted average assumed rate

of return on plan assets for the U.S. and non-U.S. plans

of 7.67% for 2005.

The majority of the Company’s pension plan assets relate

to the U.S. pension plan. The assumed rate of return for

2004 for the U.S. plan was 8.75%, which was based on an

asset allocation of approximately 35% in corporate and

government bonds and mortgage-backed securities

(which are expected to earn approximately 5% to 7% in

the long term) and 65% in equity securities (which are

expected to earn approximately 8% to 10% in the long

term). Historical rates of return on the assets of the U.S.

plan for the most recent 10-year and 20-year periods

were 9.4% and 10.8%, respectively. In the U.S. plan, the

Company’s asset allocation policy has favored U.S. equity

securities, which have returned 11.2% and 13.1%, respec-

tively, over the 10-year and 20-year periods. The actual

rate of return on plan assets in the U.S. was approxi-

mately 12% and 21% in 2004 and 2003, respectively.

The discount rate used for determining future pension

obligations for each individual plan is based on a

review of long-term bonds that receive a high rating

from a recognized rating agency. The discount rate at

December 31, 2004 for the U.S. plan was 5.80%, which

was based on the internal rate of return for a portfolio

of Moody’s Aa-rated high quality bonds with maturities

that are consistent with the projected future benefit

payment obligations of the plan. The weighted average

discount rate for U.S. and non-U.S. plans determined on

this basis has decreased to 5.65% at December 31, 2004,

from 6.03% at December 31, 2003.

Avon will record expense related to

grants of stock options beginning

in July 2005.