Avon 2004 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Global Beauty 69

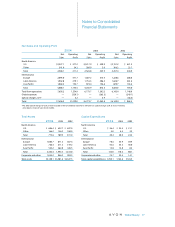

Notes to Consolidated

Financial Statements

Transformation Long-Term Incentive Plan

In 2002, the Compensation Committee of the Board

of Directors approved a Transformation Long-Term

Incentive Plan (“TLTIP”), which was designed to provide

additional long-term compensation to executive offi-

cers and other key executives driving the Company’s

Business Transformation initiatives. Under the TLTIP,

cash awards were payable if the Company achieved

certain financial objectives tied to the transformation

objectives during the performance period 2002-2004.

As of December 31, 2004, the Company achieved a sig-

nificant portion, but not all, of the performance goals

established by the plan. As a result, the Compensation

Committee used its discretion and determined that a

partial payout from the TLTIP of approximately $6.0,

which was equal to 12.5% of the TLTIP targets, was

appropriate to be paid under the plan. No payout was

made to the Chairman and Chief Executive Officer,

who declined to be considered for any payout under

the plan.

Board of Directors Remuneration

Each non-management director is annually granted

options to purchase 8,000 shares of common stock, at

an exercise price based on the market price of the stock

on the date of grant. Each grant of options becomes

fully exercisable one year after the date of grant and

expires ten years after the date of grant. The aggregate

annual grant made to all non-management directors in

2004 and 2003 consisted of 72,000 options in each year

with an exercise price of $36.43 and $26.40, respectively.

Effective January 1, 2004, the annual retainer paid to

non-management directors consists of $35,000 in cash

($30,000 prior to January 1, 2004) plus an annual grant

of restricted stock having a value of $35,000 ($30,000

prior to January 1, 2004) based on the average mean

price of the stock for the 10 days preceding the date of

grant. These shares are restricted as to transfer until the

director retires from the Board. The aggregate annual

grant of restricted stock made to all non-management

directors in 2004 and 2003 consisted of 6,896 and 9,360

shares, respectively. Compensation expense related to

grants of restricted stock to non-management direc-

tors was $.2 in 2004, 2003 and 2002.

In addition to the annual retainer, effective January 1,

2004, non-management directors are paid a $10,000

retainer for membership on the Audit Committee and

$5,000 for membership on each other committee of

the Board of Directors on which he or she serves. Non-

management directors appointed to chair a committee

are paid an additional $10,000 for the Audit Committee

and $5,000 for all other committees.

9Shareholders’ Equity

Stock Split and Dividends

At the May 6, 2004 Annual Meeting, the shareholders

approved an amendment to the Company’s Restated

Certificate of Incorporation to increase the number of

shares of authorized common stock from 800 million to

1.5 billion. Conditioned on such approval, the Board of

Directors in February 2004 had declared a two-for-one

stock split in the form of a 100% stock dividend, payable

May 28, 2004, to shareholders of record on May 17, 2004.

The stock split has been recognized by reclassifying the

$.25 par value of the additional shares resulting from

the split from retained earnings to common stock. The

effect of this stock split was not retroactively reflected

in the Consolidated Statements of Changes in Share-

holders’Equity for periods prior to the split; therefore, in

2004, shares issued for option exercises which occurred

prior to the stock split have not been adjusted for the

stock split. The effect of the stock split on such option

exercises of approximately 1.7 million shares is included

in the line two-for-one stock split effected in the form

of a dividend on the Consolidated Statements of

Changes in Shareholders’Equity. All references to the

number of shares and per share amounts elsewhere

in the financial statements and related footnotes have

been restated to reflect the effect of the split for all

periods presented.