Avon 2004 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

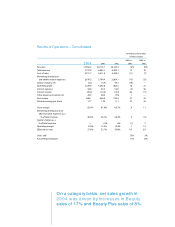

increased the consolidated ratio by .1 point). The expense

ratio in Latin America was flat. Additionally, the consoli-

dated expense ratio was negatively impacted by greater

contributions from markets with higher expense ratios

(which increased the consolidated ratio by .1 point).

Marketing, distribution and administrative expenses

increased $330.3 in 2003 primarily due to the following:

• a 10% sales increase (which resulted in an increase in

expenses of approximately $162.0),

• an increase in consumer and strategic investments of

$94.0 (including spending on brochures and Sales

Leadership),

• an increase in various other marketing expenses

(including direct marketing, customer access and

promotional literature) of $58.2,

• higher customer service costs in the U.S. of approxi-

mately $25.0,

• merit salary increases of approximately $24.0 for

certain marketing, distribution and administrative

personnel around the world,

• an increase in domestic pension expense of approxi-

mately $23.0,

• expenses of $19.5 related to Avon’s Turkish subsidiary

which was consolidated beginning in the second

quarter of 2003 (see Note 17, Acquisitions), and

• costs of $10.5 (severance and asset write-downs)

associated with the repositioning of the beComing

line of products (see Note 16, Other Information).

These increases in expenses were partially offset by

incremental net savings from workforce reduction pro-

grams associated with Avon’s Business Transformation

initiatives of approximately $85.0 and lower bonus

accruals of approximately $32.0.

As a percentage of total revenue, marketing, distribution

and administrative expenses increased in 2003 due to

higher expense ratios in North America (1.4 points,

which increased the consolidated ratio by .6 point) and

the Asia Pacific (1.2 points, which increased the consoli-

dated ratio by .2 point), partially offset by lower expense

ratios in Europe (.9 point, which reduced the consoli-

dated ratio by .2 point) and Latin America (.3 point,

which reduced the consolidated ratio by .1 point).

See the “Segment Review”section of Management’s Dis-

cussion and Analysis of Financial Condition and Results

of Operations for additional information related to

changes in expense ratios by segment.

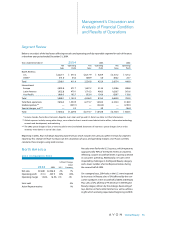

Other Expenses

Interest expense increased slightly in 2004 as a result of

interest on a tax-related liability in Latin America, partially

offset by a decrease in debt-related interest. The decrease

in debt-related interest was primarily due to the retire-

ment of $447.2 of convertible notes in July 2003, par-

tially offset by the issuance of $250.0 of fixed-rate debt

that was later swapped to a floating interest rate. As of

December 31, 2004, Avon had converted approximately

70% of its debt to a floating rate based on LIBOR (see

Note 7, Financial Instruments and Risk Management).

Interest expense decreased in 2003 primarily as a result

of Avon having interest rate swaps at December 31, 2003,

that converted approximately 90% of its debt to a floating

rate based on LIBOR (see Note 7, Financial Instruments

and Risk Management) during a period of declining rates.

In 2003, the lower interest expense was also driven by

lower average debt balances than in 2002.

Interest income increased in 2004, primarily due to

higher average cash and cash equivalents balances

invested offshore at higher interest rates during 2004.

Interest income decreased in 2003, primarily due to

lower average cash and cash equivalents balances dur-

ing 2003 than 2002.

The cash management and tax strategies,

which Avon began implementing during the

second quarter of 2004, are expected to

result in cash management efficiencies and

ongoing tax savings. Avon estimates the

potential effective tax rate for 2005 to be

in the range of 31%.