Avon 2004 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Global Beauty 85

Notes to Consolidated

Financial Statements

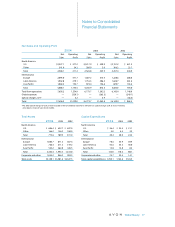

15 Supplemental Income

Statement Information

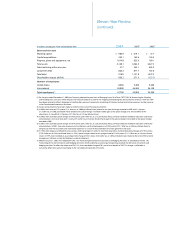

For the years ended December 31, 2004, 2003 and

2002, the components of other expense (income), net

were as follows:

2004 2003 2002

Foreign exchange

losses (gains), net $ 9.5 $15.9 $(16.0)

Losses for other-than-

temporary declines

in market value on

available-for-sale

securities (Note 5) 13.7 — —

Amortization of debt

issue costs and

other financing 7.0 14.1 6.7

Other (1.9) (1.4) (.6)

Other expense

(income), net $28.3 $28.6 $ (9.9)

16 Other Information

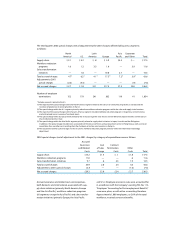

In January 2003, Avon announced that it had agreed

with J.C. Penney to end the business relationship,

which began in 2001, pursuant to which Avon’s

beComing line of products had been carried in approx-

imately 90 J.C. Penney stores. For the year ended

December 31, 2003, costs associated with ending this

business relationship were $18.3, including severance

costs ($4.1), asset and inventory write-downs ($12.1)

and other related expenses ($2.1). These costs, which

were incurred in the first and second quarters, were

included in the Consolidated Statements of Income in

marketing, distribution and administrative expenses

($10.5) and in cost of sales ($7.8).

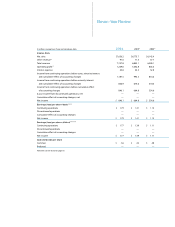

17 Acquisitions

In June 2004, Avon purchased 20% of the outstanding

shares in its two subsidiaries in China from a minority

interest shareholder for $45.6, including transaction

costs. Avon previously owned 73.845% of these sub-

sidiaries and consolidated their results, while recording

minority interest for the portion not owned. As a result

of this transaction, Avon reduced the minority interest

in the net assets of these subsidiaries as of June 30,

2004. The purchase of these shares did not have a

material impact on Avon’s consolidated net income.

Avon China is included in Avon’s Asia Pacific operating

segment. Avon initially allocated approximately $36.0

of the purchase price to goodwill and is in the process

of reviewing the valuation of intangible assets, if any;

thus, the allocation of the purchase price is subject

to adjustment.

In the second quarter of 2003, Avon purchased the out-

standing 50% of shares in its Turkish business, Eczacibasi

Avon Kozmetik (EAK) from its partner, Eczacibasi Group,

for $18.4, including transaction costs. As a result of the

acquisition agreement, Avon consolidated the remain-

ing 50% of its Turkish joint venture business in the

second quarter of 2003. Prior to the second quarter of

2003, the investment was accounted for under the

equity method. The impact on net sales and operating

profit in 2003 was $47.2 and $14.6, respectively. Avon

Turkey is included in Avon’s European operating

segment. Avon allocated approximately $17.0 of the

purchase price to goodwill.