Avon 2004 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Avon’s diversified global portfolio of markets has

demonstrated that the effects of weak economies

and currency fluctuations in certain countries may

be offset by strong results in others.

Because Avon operates in international regions, fluctu-

ations in the value of foreign currencies cause U.S. dol-

lar-translated amounts to change in comparison with

previous periods. Avon’s diversified global portfolio of

markets has demonstrated that the effects of weak

economies and currency fluctuations in certain coun-

tries may be offset by strong results in others. Actions

which may mitigate currency risk include strategies such

as hedging of certain currencies, and local manufacturing

and sourcing in certain countries to limit risk associated

with possible increases in the cost of imported goods.

Avon cannot, however, project the possible effect of cur-

rency fluctuations upon its results when translated into

U.S. dollars or on its future earnings.

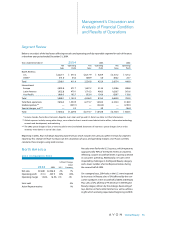

Strategic Initiatives

The Company’s strategic initiatives include a focus on

Beauty brands as a key driver of sales growth, as well as

new product lines such as Health and Wellness prod-

ucts and mark. Growth is also targeted from further

expansion of Sales Leadership, a career opportunity for

Avon Representatives, as well as exploration of geo-

graphic opportunities, in particular, China, Central

and Eastern Europe, Turkey and the Middle East, and the

Andean region of South America. In addition, the Com-

pany expects that its Business Transformation programs

will continue to produce margin expansion, primarily as

a result of savings from supply chain and marketing ini-

tiatives, which will also fuel continued incremental con-

sumer and strategic investments. In 2004, Avon’s Board

approved the development of an integrated global sup-

ply chain strategy, which includes development of a

new common systems platform, known as enterprise

resource planning (“ERP”). The ERP system is expected

to drive global integration of the Company’s operations

and improve the speed,

flexibility and efficiency of its global supply chain. The

global supply chain strategy is essential to the achieve-

ment of Avon’s accelerated growth and operating mar-

gin targets. Implementation is scheduled to start in

Europe in early 2005. Avon anticipates that the ERP

project will be substantially complete in 2008. Capital

investment and expense associated with the imple-

mentation of the ERP project are estimated to be in the

ranges of $125.0 to $135.0 and $75.0 to $90.0, respec-

tively, during the period 2005 through 2008, and will

be subject to further review and approval by Avon’s

Board of Directors.

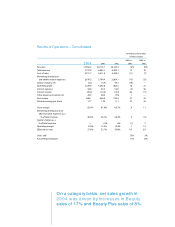

Key Performance Indicators

Within the following discussion and analysis, Avon utilizes the key performance indicators (“KPIs”) defined below to

assist in the evaluation of its business.

KPI Definition

Change in Active Representatives This indicator is based on the number of Representatives submitting

an order in a campaign, totaled for all campaigns in the related

period. This amount is divided by the number of billing days in the

associated period, to exclude the impact of year-to-year changes in

billing days (for example, holiday schedules). To determine the

Change in Active Representatives, this calculation is compared to

the same calculation in the corresponding period of the prior year.

Change in Units The gross number of pieces of merchandise sold during a period, as

compared to the same number in the same period of the prior year.

Units sold include samples sold and product contingent upon the

purchase of another product (for example, gift with purchase or

purchase with purchase), but exclude free samples.

Accounts Receivable Days The number of days of preceding months’net sales covered by the

accounts receivable balance at the end of the period.

Inventory Days The number of days of estimated future months’cost of sales cov-

ered by the inventory balance at the end of the period.

Accounts Payable Days The number of days of preceding months’cost of sales covered by

the accounts payable balance at the end of the period.