Avon 2004 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

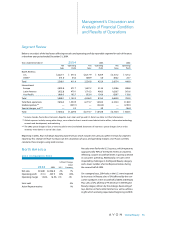

Management’s Discussion and

Analysis of Financial Condition

and Results of Operations

Net Cash Used by Financing Activities

Net cash used by financing activities in 2004 was $71.5

higher than 2003 primarily due to higher dividend

payments, higher net repayments of debt and higher

repurchases of common stock, partially offset by

higher proceeds from stock option exercises.

In September 2000, Avon’s Board approved a share

repurchase program under which the Company may

buy up to $1,000.0 of its outstanding stock over a five-

year period. Avon purchased approximately 5.7 million

shares of Avon common stock for $224.2 during 2004,

compared with $214.3 spent for the repurchase of

approximately 7.0 million shares during 2003. As of

December 31, 2004, the Company had repurchased

approximately 27.5 million shares at a total cost of

approximately $775.8 under this program and

through acquisition of stock from employees in con-

nection with tax payments upon vesting of restricted

stock. In February 2005, Avon announced that it

would begin a new five-year, $1,000.0 share repur-

chase program upon completion of its current share

repurchase program.

In January 2004, Avon’s Board approved an increase in

the quarterly dividend to $.14 per share from $.105.

Dividends of $.56 per share were declared and paid in

2004 as compared to $.42 per share in 2003. In January

2005, Avon’s Board approved an increase in the quar-

terly dividend to $.165 per share.

Global Beauty 43

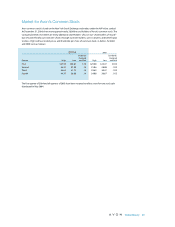

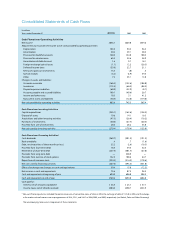

Debt and Contractual Financial Obligations and Commitments

At December 31, 2004, Avon’s debt and contractual financial obligations and commitments by due dates were as follows:

2010 and

2005 2006 2007 2008 2009 Beyond Total

Short-term debt $ 46.0 $ — $ — $ — $ — $ — $ 46.0

Long-term debt(1) — 86.6 100.0 — 300.0 375.0 861.6

Capital lease obligations 5.7 4.9 1.8 0.2 0.1 — 12.7

Total debt 51.7 91.5 101.8 0.2 300.1 375.0 920.3

Operating leases 87.0 65.4 49.6 40.1 34.8 112.4 389.3

Purchase obligations 218.3 115.4 32.5 15.7 15.8 0.6 398.3

Benefit payments 106.9 108.0 114.7 116.7 121.2 608.3 1,175.8

Other long-term obligations 7.5 — — — — — 7.5

Total debt and contractual

financial obligations

and commitments(2) $471.4 $380.3 $298.6 $172.7 $471.9 $1,096.3 $2,891.2

(1) Long-term debt excludes estimated interest payments under these obligations since a significant portion of Avon’s long-term fixed-rate

debt has been swapped to variable rates.

(2) The amount of debt and contractual financial obligations and commitments excludes amounts due pursuant to derivative transac-

tions. The table also excludes information on Avon’s recurring purchases of inventory as these purchase orders are non-binding, are

generally consistent from year to year, and are short-term in nature.

See Note 4, Debt and Other Financing, and Note 12, Leases and Commitments, for further information on Avon’s debt and contractual

financial obligations and commitments.