Avon 2004 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Investments in Debt and Equity Securities

Debt and equity securities that have a readily deter-

minable fair value and that management does not

intend to hold to maturity are classified as available-

for-sale and carried at fair value. Unrealized holding

gains and losses, net of applicable taxes, are recorded

as a separate component of shareholders’ equity, net

of deferred taxes. Realized gains and losses from the

sale of available-for-sale securities are calculated on a

specific identification basis. Declines in the fair values

of investments below their cost basis that are judged

to be other-than-temporary are recorded in other

expense (income), net. In determining whether an other-

than-temporary decline in market value has occurred,

Avon considers various factors, including the duration

and the extent to which market value is below cost.

Goodwill and Intangible Assets

Goodwill and intangible assets with indefinite lives are

not amortized, but rather are assessed for impairment

annually and upon the occurrence of an event that indi-

cates impairment may have occurred. Intangible assets

with estimable useful lives are amortized using a straight-

line method over the estimated useful lives of the assets.

Avon completed its annual goodwill impairment assess-

ment and no adjustments to goodwill were necessary.

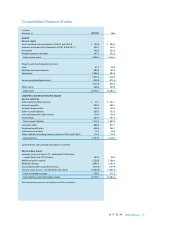

Goodwill totaled $82.2 and $45.2 at December 31, 2004

and 2003, respectively. The change in carrying value of

goodwill for the year ended December 31, 2004 is due

to the acquisition of additional shares in Avon’s two

subsidiaries in China (see Note 17, Acquisition). Intangible

assets totaled $.6 and $1.0 at December 31, 2004 and

2003, respectively.

Stock Awards

Avon applies the recognition and measurement princi-

ples of Accounting Principles Board (“APB”) Opinion 25,

“Accounting for Stock Issued to Employees,” and related

interpretations in accounting for its long-term stock-

based incentive plans, which are described in Note 8,

Long-Term Incentive Plans. No compensation cost related

to grants of stock options was reflected in net income, as

all options granted under the plans had an exercise price

equal to the market value of the underlying common

stock on the date of grant. Compensation cost related to

grants of restricted stock and restricted stock units is

measured as the quoted market price of Avon’s stock at

the measurement date and is amortized to expense over

the vesting period. The effect on net income and earn-

ings per share if Avon had applied the fair value recogni-

tion provisions of Statement of Financial Accounting

Standards (“FAS”) No. 123, “Accounting for Stock-Based

Compensation,”to stock-based compensation for the

years ended December 31 was as follows:

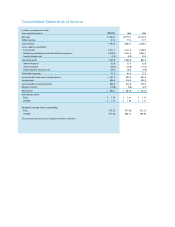

2004 2003 2002

Net income, as reported $846.1 $664.8 $534.6

Add: compensation

expense recognized for

restricted stock and

restricted stock units,

net of taxes 5.7 4.3 4.4

Less: stock-based

compensation expense

determined under

FAS No. 123, net of taxes (32.0) (33.0) (34.5)

Pro forma net income $819.8 $636.1 $504.5

Earnings per share:

Basic – as reported $ 1.79 $ 1.41 $ 1.13

Basic – pro forma 1.74 1.35 1.07

Diluted – as reported 1.77 1.39 1.11

Diluted – pro forma 1.72 1.33 1.05

The fair value for these options granted to employees

was estimated at the grant date using a Black-Scholes

option pricing model with the following weighted-

average assumptions:

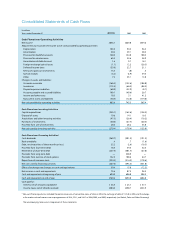

2004 2003 2002

Risk-free interest rate 2.4% 2.4% 4.6%

Expected life 4 years 4 years 4 years

Expected volatility 30% 45% 45%

Expected dividend yield 1.5% 1.6% 1.5%

The weighted-average grant date fair values per share

of options granted during 2004, 2003 and 2002 were

$8.54, $8.83, and $9.55, respectively.