Avon 2004 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

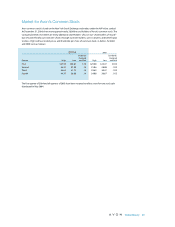

For each of the three years ended December 31, the

components of basic and diluted earnings per share

were as follows:

Shares in millions 2004 2003 2002

Numerator:

Net income $846.1 $664.8 $534.6

Interest expense on

convertible notes,

net of taxes — 5.7 10.4

Net income for purposes

of computing

diluted EPS $846.1 $670.5 $545.0

Denominator:

Basic EPS weighted-

average shares

outstanding 472.35 471.08 472.12

Diluted effect of:

Stock options 5.61 4.73 4.90

Convertible notes — 7.32 13.92

Diluted EPS adjusted

weighted-average

shares outstanding 477.96 483.13 490.94

EPS:

Basic $ 1.79 $ 1.41 $ 1.13

Diluted $ 1.77 $ 1.39 $ 1.11

At December 31, 2004 and 2002, stock options to

purchase .2 million shares and 5.6 million shares,

respectively, were not included in the diluted EPS cal-

culation since their impact was anti-dilutive. There

were no anti-dilutive shares at December 31, 2003.

2Accounting Changes

Postretirement Benefits

In May 2004, the FASB issued FASB Staff Position (“FSP”)

No. 106-2, “Accounting and Disclosure Requirements

Related to the Medicare Prescription Drug, Improvement

and Modernization Act of 2003“ (the “Act”). FSP No. 106-2

provides guidance on accounting for the effects of the

new Medicare prescription drug legislation by employers

whose prescription drug benefits are actuarially equiv-

alent to the drug benefit under Medicare Part D. Among

other things, the new law will expand Medicare to include

an outpatient prescription drug benefit beginning in

2006, as well as a federal subsidy for sponsors of retiree

health care benefit plans that provide a benefit that is

at least actuarially equivalent to the new Medicare drug

benefits. This new FSP was effective July 1, 2004. Avon

concluded that its U.S. post-retirement medical plan

provides a benefit that is actuarially equivalent to the

drug benefit provided in Medicare Part D coverage and

recognized the Act’s financial effect retrospectively to

the date of enactment beginning in the third quarter

of 2004. The adoption of FSP 106-2 was not material to

the Consolidated Financial Statements.

Stock-Based Compensation

In December 2004, the FASB issued FASB Statement

No. 123(R) (revised December 2004), Share-Based Pay-

ments (“FAS 123(R)”), which requires companies

to expense the value of employee and director stock

options and similar awards. FAS 123(R) is effective July 1,

2005, for Avon. The Company is considering its choice of

implementation methods under this pronouncement.

Net income in each of the years of 2004, 2003 and 2002,

would have been lower by $26.3, $28.7 and $30.1, respec-

tively, if Avon had applied the fair value recognition provi-

sions of FAS No. 123. (See Note 1, Description of Business

and Summary of Significant Accounting Policies).

Inventory

In November 2004, the FASB issued FASB Statement

No. 151, Inventory Costs (“FAS 151”), which requires

certain inventory-related costs to be expensed as

incurred. FAS 151 is effective January 1, 2006. Avon is

currently assessing the effect of FAS 151 on the Consol-

idated Financial Statements.