Avon 2004 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Additionally, Avon held assets at December 31, 2004

and 2003, amounting to $34.2 and $22.5, respectively,

that may be used for other benefit payments. At

December 31, 2004 and 2003, the assets consisted of

corporate-owned life insurance policies with cash sur-

render values of $31.9 and $20.3, respectively, and

mutual funds with market values of $2.3 and $2.2,

respectively. The assets are recorded at market value,

with increases or decreases in the corporate-owned

life insurance policies reflected in the Consolidated

Statements of Income.

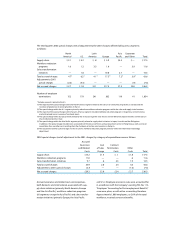

Postretirement Benefits

For 2005, the assumed rate of future increases in the

per capita cost of health care benefits (the health care

cost trend rate) was 10.0% for all claims and will grad-

ually decrease each year thereafter to 5.0% in 2010

and beyond. A one-percentage point change in the

assumed health care cost trend rates would have the

following effects:

1 Percentage 1 Percentage

(In millions) Point Increase Point Decrease

Effect on total

of service and

interest cost

components $ .1 $ (.1)

Effect on

postretirement

benefit obligation 1.7 (1.7)

Postemployment Benefits

Avon provides postemployment benefits, which

include salary continuation, severance benefits, disabil-

ity benefits, continuation of health care benefits and life

insurance coverage to eligible former employees after

employment but before retirement. At December 31,

2004 and 2003, the accrued cost for postemployment

benefits was $45.0 and $42.8, respectively, and was

included in employee benefit plans.

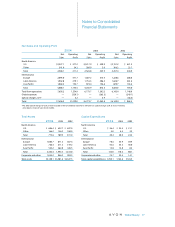

11 Segment Information

The Company’s operating segments, which are its

reportable segments, are based on geographic opera-

tions and include operating business units in North

America, Europe, Latin America, and the Asia Pacific.

The segments have similar business characteristics and

each offers similar products through similar customer

access methods.

The accounting policies of the segments are the same

as those described in Note 1, Description of the Business

and Summary of Significant Accounting Policies. The

Company evaluates the performance of its segments

based on operating profits or losses. Segment revenues

reflect direct sales of products to Representatives

based on the Representative’s geographic location.

Intersegment sales and transfers are not significant. Each

segment records direct expenses related to its employ-

ees and its operations. The Company does not allocate

income taxes, foreign exchange gains or losses, or cor-

porate global expenses to segments. Global expenses

include, among other things, costs related to Avon’s

executive and administrative offices, information tech-

nology, research and development, and marketing.

Summarized financial information concerning Avon’s

reportable segments as of December 31 is shown in

the following tables. North America – Other includes

Canada, Puerto Rico, the Dominican Republic, Avon

Salon and Spa and U.S. Retail.