Avon 2004 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

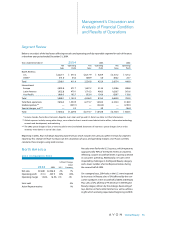

Management’s Discussion and

Analysis of Financial Condition

and Results of Operations

Financial Summary

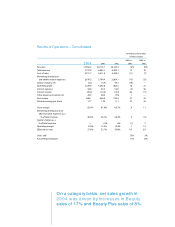

In 2004, Avon reported strong growth in net income

and earnings per share. Net sales grew in every region

supported by growth in active Representatives and the

number of units sold. The strength of Avon’s business

was driven by the exceptional performance of Avon’s

three international regions of Europe, Latin America and

Asia Pacific, which comprised 27%, 25% and 14% of 2004

consolidated net sales, respectively. Each international

region delivered double-digit growth in dollar and local

currency sales, operating profit, active Representatives,

and units. The strength in Avon’s international opera-

tions more than offset the weakness in Avon U.S., where

net sales were flat and operating profit declined. The U.S.

business was impacted by a slower second half driven in

part by a decline in consumer spending. Additionally,

net sales were impacted by challenges in the Beyond

Beauty category. Avon has developed plans to restore

the U.S. business to profitable growth by 2006, follow-

ing the repositioning of the toy and gift segments in the

Beyond Beauty category. Plans include discontinuing

sales of toys in the second quarter of 2005 and a staged

withdrawal of certain other Beyond Beauty product lines

over the next two years. In 2005, the Company expects

U.S. revenue to decline slightly and U.S. operating profit

to decrease in the mid-single digits.

Beauty sales, which accounted for approximately 69%

of total sales in 2004, outpaced overall growth. Beauty

sales increased 17% versus 2003, reflecting Avon’s

strategic focus on driving growth in higher-margin

Beauty products.

Operating profit increased 18% and operating margin

improved .7 points versus 2003, after an incremental

$104.0 in consumer and strategic investments. Avon’s

Business Transformation initiatives have allowed Avon to

improve its operating margin substantially over the past

three years. Avon has achieved almost $270.0 in cumu-

lative transformation savings over the past three years.

Net income in 2004 benefited from a lower effective tax

rate due to benefits realized from Avon’s tax and cash

management strategies, which the Company began to

implement in the second quarter of 2004. These strate-

gies are a further extension of the Company’s Business

Transformation efforts and reflect the permanent rein-

vestment of a greater portion of foreign earnings offshore.

Operating cash flows were $882.6, an 18% increase over

2003, driven by higher net income and favorable work-

ing capital in accounts payable and accrued expenses.

Critical Accounting Estimates

Avon believes the accounting policies described below

represent its critical accounting policies due to the estima-

tion processes involved in each. See Note 1, Description of

the Business and Summary of Significant Accounting

Policies, for a detailed discussion of the application of

these and other accounting policies.

Allowances for Doubtful Accounts Receivable

Representatives contact their customers, selling primarily

through the use of brochures for each sales campaign.

Sales campaigns are generally for a two-week duration in

the U.S. and two- to four-week duration outside the U.S.

The Representative purchases products directly from

Avon and may or may not sell them to an end user. In

general, the Representative, an independent contractor,

remits a payment to Avon each sales campaign, which

relates to the prior campaign cycle. The Representative

is generally precluded from submitting an order for the

current sales campaign until the accounts receivable bal-

ance for the prior campaign is paid; however, there are

circumstances where the Representative fails to make the

required payment. The Company records an estimate

of an allowance for doubtful accounts on receivable bal-

ances based on an analysis of historical data and current

circumstances. Over the past three years, annual bad

debt expense has been approximately $110.0 to $140.0,

or approximately 1.8% of total revenue. The Company

generally has no detailed information concerning, or

any communication with, any end user of its products

beyond the Representative. Avon has no legal recourse

against the end user for the collectibility of any accounts

receivable balances due from the Representative to

Avon. If the financial condition of Avon’s Representatives

were to deteriorate, resulting in an impairment of their

ability to make payments, additional allowances may

be required.

Allowances for Sales Returns

Avon records a provision for estimated sales returns

based on historical experience with product returns. Over

the past three years, sales returns have been in the range

of $265.0 to $290.0, or approximately 4% of total rev-

enue. If the historical data Avon uses to calculate these

estimates does not properly reflect future returns, due to

changes in marketing or promotional strategies or for

other reasons, additional allowances may be required.

Global Beauty 27