Avon 2004 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

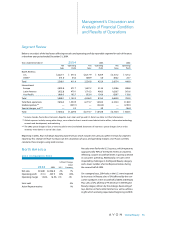

Management’s Discussion and

Analysis of Financial Condition

and Results of Operations

through operational means. Since Avon uses foreign

currency rate-sensitive and interest rate-sensitive instru-

ments to hedge a certain portion of its existing and fore-

casted transactions, Avon expects that any loss in value

for the hedge instruments generally would be offset by

increases in the value of the underlying transactions.

Avon does not enter into derivative financial instru-

ments for trading or speculative purposes, nor is Avon a

party to leveraged derivatives. The master agreements

governing Avon’s derivative contracts generally contain

standard provisions that could trigger early termination

of the contracts in certain circumstances, including if

Avon were to merge with another entity and the credit-

worthiness of the surviving entity were to be “materially

weaker” than that of Avon prior to the merger.

Interest Rate Risk

Avon’s long-term, fixed-rate borrowings are subject to

interest rate risk. Avon uses interest rate swaps, which

effectively convert the fixed rate on the debt to a float-

ing interest rate, to manage its interest rate exposure.

At December 31, 2004 and 2003, Avon held interest rate

swap agreements that effectively converted approxi-

mately 70% and 90%, respectively, of its outstanding

debt of $918.0 and $1,121.8, respectively, to a variable

interest rate based on LIBOR.

Avon’s long-term borrowings and interest rate swaps

were analyzed at year-end to determine their sensitivity

to interest rate changes. Based on the outstanding bal-

ance of all these financial instruments at December 31,

2004, a hypothetical 50 basis point change (either an

increase or a decrease) in interest rates prevailing at that

date, sustained for one year, would not represent a

material potential change in fair value, earnings or cash

flows. This potential change was calculated based on

discounted cash flow analyses using interest rates

comparable to Avon’s current cost of debt.

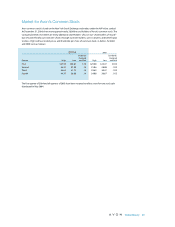

Foreign Currency Risk

Avon operates globally, with manufacturing and distri-

bution facilities in various locations around the world.

For the three years ended 2004, 2003 and 2002, the

Company derived approximately 70% and 90% of its

consolidated net sales and operating profit, respectively,

from operations of subsidiaries outside of the U.S. In

addition, as of December 31, 2004 and 2003, these sub-

sidiaries comprised approximately 60% of the Com-

pany’s consolidated total assets.

Avon is exposed to changes in financial market condi-

tions in the normal course of its operations, primarily

due to international businesses and transactions

denominated in foreign currencies and the use of vari-

ous financial instruments to fund ongoing activities.

Avon’s diversified global portfolio of businesses has

demonstrated that the effects of weak economies and

currency fluctuations in certain countries may be offset

by strong results in others. Fluctuations in the value of

foreign currencies cause U.S. dollar-translated amounts to

change in comparison with previous periods. Accordingly,

Avon cannot project the possible effect of such fluctua-

tions upon translated amounts or future earnings. This

is due to the large number of currencies, intercompany

transactions, hedging-related activities entered into in an

attempt to minimize the impact of exchange rate changes

on financial results, and the fact that all foreign currencies

do not react in the same manner against the U.S. dollar.

Nevertheless, during 2004, the U.S. dollar continued to

weaken against most major currencies. If this trend con-

tinues, it is expected to have a favorable impact on the

translation of the Company’s overseas results.

Avon uses foreign currency forward contracts and

options to hedge portions of its forecasted foreign cur-

rency cash flows resulting from intercompany royalties,

intercompany loans, and other third-party and inter-

company foreign currency transactions where there is

a high probability that anticipated exposures will mate-

rialize. These contracts have been designated as cash

flow hedges. At December 31, 2004, the primary cur-

rencies for which Avon has net underlying foreign cur-

rency exchange rate exposure are the Argentine peso,

Brazilian real, British pound, Chinese renminbi, the

Euro, Japanese yen, Mexican peso, Philippine peso, Pol-

ish zloty, Russian ruble and Venezuelan bolivar.

Avon uses foreign currency forward contracts and for-

eign currency denominated debt to hedge the foreign

currency exposure related to the net assets of certain of

its foreign subsidiaries.

Avon also enters into foreign currency forward contracts

and options to protect against the adverse effects that

exchange rate fluctuations may have on the earnings of

its foreign subsidiaries. These derivatives do not qualify

for hedge accounting and, therefore, the gains and

losses on these derivatives have been recognized in

earnings each reporting period.

Global Beauty 45