Avon 2004 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Share Rights Plan

Avon has a Share Rights Plan under which one right

has been declared as a dividend for each outstand-

ing share of its common stock. Each right, which is

redeemable at $.005 at any time at Avon’s option, entitles

the shareholder, among other things, to purchase one

share of Avon common stock at a price equal to one-half

of the then current market price, if certain events have

occurred. The right is exercisable if, among other events,

one party obtains beneficial ownership of 20% or more

of Avon’s voting stock. The description and terms of the

rights are set forth in a Rights Agreement between the

Company and Equiserve Trust Company, N.A., as succes-

sor Rights Agent.

Stock Repurchase Program

In September 2000, Avon’s Board approved a share

repurchase program under which the Company may

buy up to $1,000.0 of its outstanding stock over the

next five years. As of December 31, 2004, the Company

had repurchased approximately 27.5 million shares at a

total cost of approximately $775.8 under this program

and through acquisitions of stock from employees in

connection with tax payments upon vesting of restricted

stock. See Note 19, Subsequent Events, for a discussion

of Avon’s new share repurchase program.

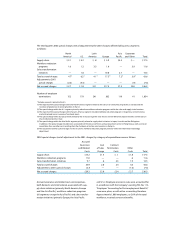

10 Employee Benefit Plans

Savings Plan

The Company offers a qualified defined contribution

plan for U.S.-based employees, the Avon Personal Sav-

ings Account Plan, which allows eligible participants

to contribute up to 25% of eligible compensation

through payroll deductions. Avon has matched

employee contributions dollar for dollar up to the first

3% of eligible compensation and fifty cents for each

dollar contributed from 4% to 6% of eligible compensa-

tion. In February 2005, Avon temporarily suspended the

matching contribution with the intention to resume

no later than 2006. In 2004, 2003 and 2002, matching

contributions approximating $14.6, $14.5 and $14.0,

respectively, were made to this plan in cash, which

was then used by the plan to purchase Avon shares

in the open market.

Retirement Plans

Avon and certain subsidiaries have contributory and

noncontributory retirement plans for substantially all

employees of those subsidiaries. Benefits under these

plans are generally based on an employee’s years of

service and average compensation near retirement. Plans

are funded based on legal requirements and cash flow.

Effective July 1998, the defined benefit retirement plan

covering U.S.-based employees was converted to a cash

balance plan with benefits determined by pay-based

credits related to age and service and interest credits

based on individual account balances and prevailing

interest rates. A 10-year transitional period was estab-

lished for all employees covered under the pre-existing

defined benefit retirement plan. For the period from

July 1, 1998, through June 30, 2008, benefits are calcu-

lated under both the former final average pay formula

and the cash balance formula. Eligible employees who

retire during this period receive whichever benefit yields

the higher amount. For those employees eligible for the

pre-existing plan, the benefit calculated under the for-

mer final average pay formula is frozen at June 30, 2008,

for periods thereafter.

Any pension plan participant who has retired on or

after May 1, 2002, and chooses to receive 20% or more

of their benefit as an annuity at retirement is eligible to

receive a social security supplement payable until the

age of 65, and is eligible to receive retirement medical

coverage for retirements before April 1, 2005.

Postretirement Benefits

Avon provides health care and life insurance benefits

for the majority of employees who retire under Avon’s

retirement plans in the United States and certain for-

eign countries. The cost of such health care benefits is

shared by Avon and its retirees for employees hired on

or before January 1, 2005.