Avon 2004 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

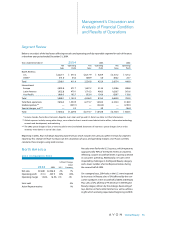

Management’s Discussion and

Analysis of Financial Condition

and Results of Operations

Net Sales

Net sales growth in 2004 was 13%, and was driven by an

increase in units and the number of active Representatives,

with dollar increases in all regions. Excluding the impact

of foreign currency exchange, consolidated net sales

increased 10%, with increases in all regions.

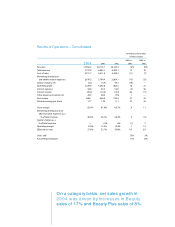

On a category basis, net sales growth in 2004 was driven

by increases in Beauty sales of 17% (with strong increases

in all categories) and Beauty Plus sales of 8%. Beyond

Beauty sales were flat.

Net sales growth in 2003 in dollars and local currency

was 10%, and was driven by an increase in the number

of active Representatives and, to a lesser extent, growth

in units, with increases in all regions. In the second quar-

ter of 2003, Avon began consolidating its Turkish sub-

sidiary which increased sales by $47.2 in 2003.

On a category basis, the 2003 net sales increase was driven

by a 15% increase in Beauty sales (with strong increases in

all categories) and, to a lesser extent, increases in Beyond

Beauty sales of 3% (including a strong increase in Health

and Wellness sales within this category) and Beauty Plus

sales of 2%.

Other Revenue

Other revenue primarily includes shipping and handling

fees billed to Representatives which totaled $91.6, $71.4

and $57.7 in 2004, 2003 and 2002, respectively.

Gross Margin

Gross margin improved .6 point in 2004 due to increases

in Latin America (1.1 points, which increased consoli-

dated gross margin by .3 point), Europe (.7 point, which

increased consolidated gross margin by .2 point) and Asia

Pacific (1.0 points which increased consolidated gross

margin by .2 point), partially offset by a decline in North

America (.8 point, which decreased consolidated gross

margin by .3 point). Additionally, gross margin benefited

from greater contributions from countries with higher

gross margins (which increased consolidated gross mar-

gin by .2 point). The gross margin improvement discussed

previously included incremental net savings associated

primarily with supply chain Business Transformation ini-

tiatives, which favorably impacted consolidated gross

margin by .2 point.

Gross margin improved 1.1 points in 2003, as compared to

2002, due to increases in all regions as follows: Europe

(1.6 points, which increased consolidated gross margin

by .4 point), Latin America (1.1 points which increased

consolidated gross margin by .3 point), Asia Pacific (2.1

points, which increased consolidated gross margin by .3

point) and North America (.1 point, which increased con-

solidated gross margin by less than .1 point). Additionally,

gross margin benefited from greater contributions from

countries with higher gross margins (which increased

consolidated gross margin by .1 point). The gross margin

improvements discussed previously included incremen-

tal net savings associated with supply chain Business

Transformation initiatives across all segments, which

favorably impacted consolidated gross margin by

1.3 points.

See the “Segment Review”section of Management’s Dis-

cussion and Analysis of Financial Condition and Results

of Operations for additional information related to

changes in gross margin by segment.

Marketing, Distribution and Administrative

Expenses

Marketing, distribution and administrative expenses

increased $415.9 in 2004 primarily due to the following:

• a 13% sales increase (which resulted in an increase

in expenses of approximately $228.0),

• an increase in consumer and strategic investments

of $104.0 (including Sales Leadership and spending

on brochures),

• an increase in various other marketing expenses of

approximately $56.0 (including public relations,

direct marketing and promotional material),

• merit salary increases of approximately $26.0 for

certain marketing, distribution and administrative

personnel around the world, and

• an increase in U.S. and non-U.S. pension expense

of $10.9.

These increases in expenses were partially offset by incre-

mental net savings from workforce reduction programs

associated with Avon’s Business Transformation initiatives

of approximately $45.0 in 2004 and a favorable compari-

son to 2003, which included costs from severance and

asset write-downs associated with the repositioning of

the beComing line of products of $10.5 in 2003.

As a percentage of total revenue, marketing, distribution

and administrative expenses decreased in 2004 due to

lower expense ratios in Europe (2.3 points, which low-

ered the consolidated ratio by .7 point), and Asia Pacific

(.2 point, which lowered the consolidated ratio by .1

point), partially offset by higher global expenses (which

increased the consolidated ratio by .4 point) and a

higher expense ratio in North America (.1 point, which

Global Beauty 31