Avon 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Section

Table of contents

-

Page 1

Financial Section -

Page 2

...Plus 13% Beauty Plus 25% 27% Europe 31% 30% 18% 69% 21% 62% Beauty Beauty Europe Net Sales Business Unit Operating Profit 2000 2004 Net Sales by Geographic Region $ IN BILLIONS Operating Profit by Geographic Region $ IN MILLIONS Asia Pacific Europe Latin America North America Asia... -

Page 3

...48 Accounting Changes 49 Market For Avon's Common Stock 50 Consolidated Statements of Income 51 Consolidated Balance Sheets 52 Consolidated Statements of Cash Flows 53 Consolidated Statements of Changes in Shareholders' Equity 54 Notes to Consolidated Financial Statements 88 Management 's Report of... -

Page 4

...'s Annual Report on Form 10-K for the year ended December 31, 2004, filed with the U.S. Securities and Exchange Commission. The Company undertakes no obligation to update any such forward-looking statements. Overview Business Avon is a global manufacturer and marketer of beauty and related products... -

Page 5

...number of days of estimated future months'cost of sales covered by the inventory balance at the end of the period. The number of days of preceding months'cost of sales covered by the accounts payable balance at the end of the period. Change in Units Accounts Receivable Days Inventory Days Accounts... -

Page 6

...and Results of Operations Financial Summary In 2004, Avon reported strong growth in net income and earnings per share. Net sales grew in every region supported by growth in active Representatives and the number of units sold. The strength of Avon's business was driven by the exceptional performance... -

Page 7

... between the cost of inventory and the estimated market value. In determining the allowance for estimated obsolescence, Avon classifies inventory into various categories based upon their stage in the product life cycle, future marketing sales plans and the disposition process. Avon assigns a degree... -

Page 8

... to the market price. Net income in each of the years of 2004, 2003 and 2002 would have been lower by $26.3, $28.7 and $30.1, respectively, if Avon had applied the fair value recognition provisions of FAS No. 123, "Accounting for Stock-Based Compensation" (see Note 1, Description of Business and... -

Page 9

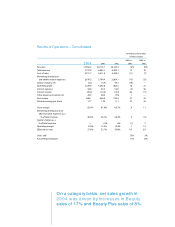

...Change 2004 vs. 2003 vs. 2002 2 004 Net sales Total revenue Cost of sales Marketing, distribution and administrative expenses Special charges, net Operating profit Interest expense Interest income Other expense (income), net Net income Diluted earnings per share Gross margin Marketing, distribution... -

Page 10

Management's Discussion and Analysis of Financial Condition and Results of Operations Net Sales Net sales growth in 2004 was 13%, and was driven by an increase in units and the number of active Representatives, with dollar increases in all regions. Excluding the impact of foreign currency exchange,... -

Page 11

... spending on brochures and Sales Leadership), • an increase in various other marketing expenses (including direct marketing, customer access and promotional literature) of $58.2, • higher customer service costs in the U.S. of approximately $25.0, • merit salary increases of approximately... -

Page 12

... targeted completion dates through 2004. Specifically, the initiatives focused on: simplifying Avon's marketing processes; taking advantage of supply chain opportunities; strengthening Avon's sales model through the Sales Leadership program and the Internet; streamlining the Company's organizational... -

Page 13

... were funded through cash flow from operations. Special Charges - Third Quarter 2 00 2 Special charges of $43.6 pretax, recorded in the third quarter of 2002, primarily related to Avon's Business Transformation initiatives, including supply chain initiatives, workforce reduction programs and sales... -

Page 14

..., costs related to Avon's executive and administrative offices, information technology, research and development, and marketing. *** The 2002 special charges of ($36.3) were included in the Consolidated Statements of Income as special charges ($34.3) and as inventory write-downs in cost of sales... -

Page 15

... to be favorable in 2004 by .8 point). The U.S. business reported a sales increase of 3% in 2003 resulting from a higher number of active Representatives (reflecting growth of the Sales Leadership program), increases in units, and successful new product launches including mark. On a category basis... -

Page 16

... Europe were positively impacted by the successful launch of a new personal care line, Senses, as well as consumer promotion programs. In Russia, sales growth reflected increases in units and active Representatives resulting from expansion into new territories, with penetration and access supported... -

Page 17

...an improvement in gross margin, reflecting savings associated with supply chain Business Transformation initiatives and the impact of a sales tax reform in 2004, which allows Avon Brazil to receive tax credits on inventory purchases. • In Mexico, operating margin decreased (which decreased segment... -

Page 18

... savings associated with supply chain Business Transformation initiatives. • In Venezuela, operating margin increased (which increased segment margin by .1 point) due to an increase in gross margin resulting from pricing strategies, a favorable mix of products sold and supply chain savings related... -

Page 19

... in the number of sales campaigns in the Philippines beginning in the second quarter of 2004, which resulted in additional opportunities to order and increased the active Representative growth rate in the region by 5%. • In China, net sales increased primarily due to growth in units driven by... -

Page 20

... foreign exchange and growth in active Representatives driven largely by an increase in the number of direct mailings to customers. • In Australia, increases in net sales in U.S. dollars were driven by foreign exchange and growth in active Representatives. • In the Philippines, net sales in... -

Page 21

... management. However, the addition or expansion of product lines, which are subject to changing fashion trends and consumer tastes, as well as planned expansion in high growth markets, may cause inventory levels to grow periodically. Balance Sheet Data Cash and cash equivalents Total debt Working... -

Page 22

...through acquisition of stock from employees in connection with tax payments upon vesting of restricted stock. In February 2005, Avon announced that it would begin a new five-year, $1,000.0 share repurchase program upon completion of its current share repurchase program. In January 2004, Avon's Board... -

Page 23

... 31, 2004, Avon had an international committed line of credit of $1.0 of which no amounts were outstanding. The fee on this line is .25% on the unused portion. Risk Management Strategies and Market Rate Sensitive Instruments The overall objective of Avon's financial risk management program is to... -

Page 24

... balance of all these financial instruments at December 31, 2004, a hypothetical 50 basis point change (either an increase or a decrease) in interest rates prevailing at that date, sustained for one year, would not represent a material potential change in fair value, earnings or cash flows... -

Page 25

... plan to appeal the decision of the District Court. While it is not possible to predict the outcome of litigation, management believes that this action should not have a material adverse effect on the Consolidated Financial Statements. Eq uity Price Risk Avon is exposed to equity price fluctuations... -

Page 26

... should not have a material adverse effect on the Consolidated Financial Statements of the Company. Blakem ore, et al. v. Avon Products, Inc., et al. is a purported class action pending in the Superior Court of the State of California on behalf of Avon Sales Representatives who "since March 24... -

Page 27

... Financial Statements. This action will be vigorously contested. Various other lawsuits and claims, arising in the ordinary course of business or related to businesses previously sold, are pending or threatened against Avon. In the opinion of Avon's management, based on its review of the information... -

Page 28

Market for Avon's Common Stock Avon common stock is listed on the New York Stock Exchange and trades under the AVP ticker symbol. At December 31, 2004, there were approximately 20,000 record holders of Avon's common stock. The Company believes that there are many additional shareholders who are not ... -

Page 29

....3 41.5 1,187.5 330.6 856.9 (10.8) $ 846.1 $ $ 1.79 1.77 2003 2002 Net sales Other revenue Total revenue Costs, expenses and other: Cost of sales Marketing, distribution and administrative expenses Special charges, net Operating profit Interest expense Interest income Other expense (income), net... -

Page 30

Consolidated Balance Sheets In millions December 31 2 004 2003 Assets Current assets Cash, including cash equivalents of $401.2 and $373.8 Accounts receivable (less allowances of $101.0 and $81.1) Inventories Prepaid expenses and other Total current assets Property, plant and equipment, at cost:... -

Page 31

... of $48.3 in 2003, the exchange of debt of $125.0 in 2003, and the change in fair market value of interest rate swap agreements of $8.6, $53.1, and $44.7 in 2004, 2003, and 2002, respectively (see Note 4, Debt and Other Financing). The accompanying notes are an integral part of these statements. -

Page 32

... income Dividends - $.56 per share Two-for-one stock split effected in the form of a dividend (Note 9) Exercise of stock options, including tax benefits of $40.3 Repurchase of common stock Grant, cancellation and amortization of restricted stock Balance at December 31, 2004 356.31 $ 89.1 $ 938... -

Page 33

In millions, except per share and share data 1 Description of the Business and Summary of Significant Accounting Policies Business Avon Products, Inc. ("Avon"or the "Company") is a global manufacturer and marketer of beauty and related products. Avon's business is conducted worldwide primarily in... -

Page 34

... in the product life cycle, future marketing sales plans and disposition process. Avon assigns a degree of obsolescence risk to products based on this classification to determine the level of obsolescence provision. Property, Plant and Equipment Property, plant and equipment are stated at cost and... -

Page 35

... restricted stock units is measured as the quoted market price of Avon's stock at the measurement date and is amortized to expense over the vesting period. The effect on net income and earnings per share if Avon had applied the fair value recognition provisions of Statement of Financial Accounting... -

Page 36

... and amounted to $63.8 in 2004 (2003 - $57.6; 2002 - $47.7). Research and development costs include all costs related to the design and development of new products such as salaries and benefits, supplies and materials and facilities costs. Advertising Advertising costs are expensed as incurred and... -

Page 37

... 151"), which requires certain inventory-related costs to be expensed as incurred. FAS 151 is effective January 1, 2006. Avon is currently assessing the effect of FAS 151 on the Consolidated Financial Statements. 2 Accounting Changes Postretirement Benefits In May 2004, the FASB issued FASB Staff... -

Page 38

... longer designated as fair value hedges of $10.3 and $9.3 at December 31, 2004 and 2003, respectively, (see Note 7, Financial Instruments and Risk Management). At December 31, 2004, Avon held interest rate swap contracts, that swap approximately 70% of the Company's debt to variable rates (see Note... -

Page 39

... including financing working capital and capital expenditures and supporting stock repurchase programs. The interest rate on borrowings under the credit facility is based on LIBOR or on the higher of prime or 1â„2% plus the federal funds rate. The credit facility has an annual facility fee, payable... -

Page 40

...-for-sale and recorded at current market value (see Note 10, Employee Benefit Plans). Payments for the purchases, proceeds and gross realized gains and losses from the sales of these securities totaled $20.0, $28.6, $.4 and $13.9, respectively, during 2004. During the fourth quarter of 2004, Avon... -

Page 41

... and expense for tax and financial reporting purposes at December 31 consisted of the following: 2 004 70.8 .3 $71.1 3.3 - (16.5) - 57.6 .3 Deferred tax assets: Postretirement benefits Accrued expenses and reserves Special and non-recurring charges Employee benefit plans Foreign operating loss... -

Page 42

... foreign earnings offshore. Additionally, the effective tax rate was favorably impacted by cash management and tax strategies, which the Company began to implement in the second quarter of 2004. These strategies are a further extension of the Company's Business Transformation efforts and reflect the... -

Page 43

...cash flow impact of this January 2004 payment was partially offset by the tax benefit on the interest portion of the payment. These settlements resulted in a favorable impact on the effective tax rate of 2.5% in 2003. Accounting Policies Derivatives are recognized on the balance sheet at their fair... -

Page 44

...was $11.5. This unrealized gain was recorded in debt and is now being amortized to interest expense over the remaining term of the original related fixed-rate debt. At December 31, 2004 and 2003, Avon had interest rate swaps designated as fair value hedges of fixed-rate debt pursuant to FAS No. 133... -

Page 45

... are not material to the Consolidated Financial Statements. At December 31, 2004 and 2003, Avon held foreign currency forward contracts and option contracts with fair values totaling $5.0 and $2.6, respectively, recorded in accounts payable. Additionally, certain of Avon's international subsidiaries... -

Page 46

... willing parties, other than in a forced sale or liquidation. The methods and assumptions used to estimate fair value are as follows: Equity and fixed-income securities - The fair values of these investments were based on the quoted market prices for issues listed on securities exchanges. Debt... -

Page 47

... 2002 - 158,600 shares or units valued at $4.2, generally vesting over three years. Compensation expense related to grants of restricted stock or restricted stock units to employees was $8.6 in 2004 (2003 - $6.4; 2002 - $6.6). The unamortized cost of restricted stock and restricted stock units as of... -

Page 48

...-term compensation to executive officers and other key executives driving the Company's Business Transformation initiatives. Under the TLTIP, cash awards were payable if the Company achieved certain financial objectives tied to the transformation objectives during the performance period 2002-2004... -

Page 49

... average compensation near retirement. Plans are funded based on legal requirements and cash flow. Effective July 1998, the defined benefit retirement plan covering U.S.-based employees was converted to a cash balance plan with benefits determined by pay-based credits related to age and service and... -

Page 50

...: Beginning balance Actual return on plan assets Company contributions Plan participant contributions Benefits paid Foreign currency changes Settlements/special termination benefits Ending balance Funded Status: Funded status at end of year Unrecognized actuarial loss Unrecognized prior service cost... -

Page 51

... lump-sum distributions and the amount of their benefits increases. Special termination benefits and settlements or curtailments primarily represent the impact of employee terminations on the Company's benefits plans in the U.S. and certain international locations (see Note 13, Special Charges). -

Page 52

... assumptions used to determine benefit obligations recorded on the Consolidated Balance Sheets as of December 31 were as follows: Pension Benefits U.S. Plans Non-U.S. Plans 2003 6.25% 4.50 8.75 Postretirement Benefits 2 004 Discount rate Rate of compensation increase Rate of return on assets 5.80... -

Page 53

... growth of trust assets. Avon regularly conducts analyses of the plan's current and likely future financial status by forecasting assets, liabilities, benefits and company contributions over time. In so doing, the impact of alternative investment policies upon the plan's financial status is measured... -

Page 54

... be used to pay such benefits with certain exceptions. The assets held in the trust at December 31, 2004, amounting to $81.8 (2003 - $85.7), consisted of a fixed-income portfolio, a managed portfolio of equity securities, corporate-owned life insurance policies and cash and cash equivalents. These... -

Page 55

... Postemployment Benefits Avon provides postemployment benefits, which include salary continuation, severance benefits, disability benefits, continuation of health care benefits and life insurance coverage to eligible former employees after employment but before retirement. At December 31, 2004 and... -

Page 56

... in the Consolidated Statements of Income as special charges ($34.3) and as inventory write-downs in cost of sales ($2.0) in 2002. Total Assets Capital Expenditures 2 004 North America U.S. Other Total International Europe Latin America Asia Pacific Total Corporate and other Total assets 2003... -

Page 57

....8 Sales from Health and Wellness products and m ark. are included in the above categories based on product type. Beauty* Beauty Plus** Beyond Beauty*** Total net sales 2 004 North America U.S. Other Total International Europe Latin America Asia Pacific Total Corporate and other Total depreciation... -

Page 58

...31, 2004 was $.3 and relates to amounts payable under the terms of the plan to employees already receiving severance. Special Charges - Third Quarter 2 00 2 In May 2001, Avon announced its new Business Transformation plans, which were designed to significantly reduce costs and expand profit margins... -

Page 59

... related to supply chain initiatives in Japan, Australia and the Philippines. In addition, the special charge included costs associated with the closure of stores and a procurement center in Hong Kong as well as contract cancellation fees and other costs resulting from the shutdown of certain sales... -

Page 60

... cancellation fees with store owners (Asia Pacific). Other costs primarily represented administrative expenses associated with a facility rationalization, employee and union communication costs, pension termination benefits and legal and professional fees (primarily Europe). While project plans... -

Page 61

... balances and employee terminations by business segment were as follows: North America* Total Accrued charges Less: Foreign exchange Less: Expenses charged Less: Adjustment 2003 Less: Adjustment 2004 Balance at December 31, 2004 Number of planned employee terminations Number of employee terminations... -

Page 62

... proceedings should not have a material adverse effect on the Consolidated Financial Statements of the Company. Blakemore,et al.v.Avon Products,Inc.,et al. is a purported class action pending in the Superior Court of the State of California on behalf of Avon Sales Representatives who, "since March... -

Page 63

... Financial Statements. This action will be vigorously contested. Various other lawsuits and claims, arising in the ordinary course of business or related to businesses previously sold, are pending or threatened against Avon. In the opinion of Avon's management, based on its review of the information... -

Page 64

...investment was accounted for under the equity method. The impact on net sales and operating profit in 2003 was $47.2 and $14.6, respectively. Avon Turkey is included in Avon's European operating segment. Avon allocated approximately $17.0 of the purchase price to goodwill. 16 Other Information In... -

Page 65

... quarter of 2004, Avon recorded a write-down of $13.7 ($12.2 after tax) resulting from declines in the fair values of investments in equity securities below their cost bases that were judged to be other-than-temporary. These equity securities are available to fund select benefit plan obligations. -

Page 66

...shareholders of record on February 14, 2005. With this increase, the indicated annual dividend rate is $.66 per share. At that same time, Avon also announced that it would begin a new five-year, $1,000.0 share repurchase program upon completion of its current share repurchase program. Global Beauty... -

Page 67

... the policies or procedures may deteriorate. Under the supervision and with the participation of Avon's management, including its principal executive and principal financial officers, Avon assessed as of December 31, 2004, the effectiveness of Avon's internal control over financial reporting. This... -

Page 68

... Statements In our opinion, the accompanying consolidated balance sheets and the related consolidated statements of income, cash flows and changes in shareholders'equity present fairly, in all material respects, the financial position of Avon Products, Inc. and its subsidiaries at December 31, 2004... -

Page 69

... 1.13 - - 1.13 1.11 - - 1.11 .40 - Income Data Net sales Other revenue(1) Total revenue Operating profit (2) Interest expense Income from continuing operations before taxes, minority interest and cumulative effect of accounting changes Income from continuing operations before minority interest and... -

Page 70

2001(5) $5,957.8 42.5 6,000.3 763.2 71.1 689.7 449.4 444.9 - (.3)(7) $ 444.6 $ .94 - $ $ - .94 .92 - $ $ - .92 .38 - $ $ $ $ 2000 $5,681.7 40.9 5,722.6 789.9 84.7 692.2 490.0 485.8 - (6.7)(8) $ 479.1 $ 1.02 - (.01) 1.01 1.01 - (.01) 1.00 .37 - $ $ $ $ 1999(6) $5,289.1 38.8 5,327.9 523.1 43.2 480.3... -

Page 71

...after tax, or $.06 per diluted share) to compensate Avon for lost profits and incremental expenses as a result of the cancellation of a retail agreement with Sears. (6) In 1998, Avon began a worldwide business process redesign program in order to streamline operations and recorded special charges of... -

Page 72

... "Employers' Accounting for Postretirement Benefits Other Than Pensions," for its foreign benefit plans. Effective January 1, 1993, Avon adopted FAS No. 106 for its U.S. retiree health care and life insurance benefit plans and FAS No. 109, "Accounting for Income Taxes." (10) Two-for-one stock splits... -

Page 73

Corporate Information -

Page 74

... Avon Representative or purchasing Avon products, please call 1-800-FOR-AVON. Visit Avon's Web site at: www.avon.com Annual Report Design by Avon Corporate Identity Department New York, NY Avon's 2004 Annual Report on Form 10-K includes as exhibits the certifications of the Chief Executive Officer...